- United States

- /

- Capital Markets

- /

- NYSE:DBRG

DigitalBridge Group (NYSE:DBRG): Exploring Valuation as It Expands AI and Cloud Ties with KT Corporation

Reviewed by Simply Wall St

DigitalBridge Group (NYSE:DBRG) has taken a significant step in its global expansion by signing a Memorandum of Understanding with KT Corporation, a leading Korean telecom operator. This strategic alliance paves the way for joint development of large-scale AI and cloud infrastructure projects in Korea.

See our latest analysis for DigitalBridge Group.

DigitalBridge Group's collaboration with KT comes on the heels of some big moves across its global data center portfolio, but the market has not quite rewarded that ambition yet. Despite the forward-looking momentum in international expansion and AI, the stock's 1-year total shareholder return sits at -26.8%, with the share price down 14.2% year-to-date and closing lately at $9.52. Recent news may be setting the tone for a potential sentiment shift, yet investors have felt the sting of fading momentum.

If you're tracking digital infrastructure stocks building tomorrow's networks, the next step is discovering See the full list for free.

With shares still trading 18% below the average analyst price target and strong revenue growth outpacing the sector, the real question is whether this is a discounted entry for investors, or if the market has already accounted for every catalyst on the horizon.

Most Popular Narrative: 42.3% Undervalued

DigitalBridge Group's consensus narrative sees a fair value far above its latest close of $9.52, suggesting significant upside if forecasted growth holds true. This valuation exceeds prevailing share prices, presenting an ambitious outlook driven by expected earnings gains and global expansion.

The explosion in AI workloads and hyperscale/cloud CapEx is driving unprecedented demand for data centers and power, fueling a substantial multi-year leasing and development pipeline for DigitalBridge. This supports long-term revenue, FEEUM, and EBITDA growth as the company monetizes these trends through new asset deployment and leasing.

Curious how this valuation takes the leap? The outlook relies on future profit margins typically reserved for industry giants, along with bold assumptions about growth. Ready to uncover which forecasts are influencing this stock’s current valuation? The full narrative reveals the precise numbers the market is now weighing.

Result: Fair Value of $16.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition and new technology risks could pressure margins and disrupt DigitalBridge’s projected earnings trajectory. This could challenge the current bullish valuation outlook.

Find out about the key risks to this DigitalBridge Group narrative.

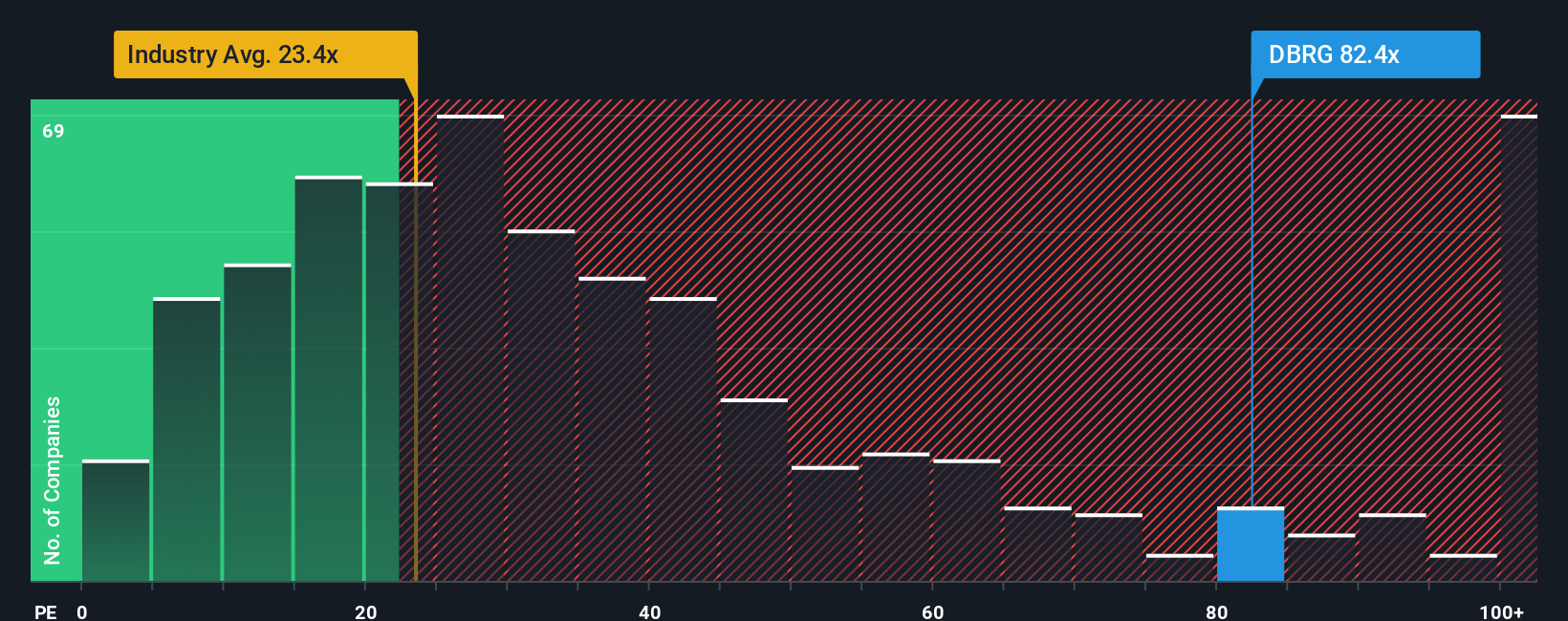

Another View: High Multiple Raises Questions

Looking beyond growth projections, DigitalBridge Group trades at 85.3 times earnings, which is far higher than its US Capital Markets peers at 15.6 times and the estimated fair ratio of 26.4 times. Such a premium signals that the market is already betting on major success. The question is whether this creates valuation risk if those expectations are not met.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DigitalBridge Group Narrative

If you see the numbers differently or want to dig deeper, crafting your own take on DigitalBridge Group only takes a few minutes. Do it your way

A great starting point for your DigitalBridge Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that opportunity knocks in unexpected places. Let Simply Wall Street’s screeners uncover stocks that fit your style so you never miss the next potential winner.

- Supercharge your search for future tech leaders by checking out these 25 AI penny stocks, which are making waves in artificial intelligence across various industries.

- Spot hidden bargains with these 929 undervalued stocks based on cash flows, which are outpacing expectations and could offer compelling value for savvy investors.

- Boost your income potential and minimize portfolio risk with these 15 dividend stocks with yields > 3%, which offer solid yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DBRG

DigitalBridge Group

DigitalBridge (NYSE: DBRG) is a leading global alternative asset manager dedicated to investing in digital infrastructure.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success