- United States

- /

- Capital Markets

- /

- NYSE:DBRG

DigitalBridge Group (DBRG): Valuation Insight Following Alaska’s Independent Investment Review

Reviewed by Simply Wall St

Alaska Governor Mike Dunleavy’s move to launch an independent legal review into the state’s $50 million investment in DigitalBridge Group (DBRG) has drawn attention from the market. The review is driven by concerns over the state’s use of its rainy day fund and could impact investor expectations around future institutional commitments and regulatory scrutiny.

See our latest analysis for DigitalBridge Group.

After a challenging 12 months that saw DigitalBridge Group deliver a 1-year total shareholder return of -25.8%, shares have shown signs of recovery, climbing 13.7% over the past 90 days as investor sentiment reacts to high-profile developments like the Alaska legal review. Momentum has returned in the short run, but it remains to be seen whether renewed institutional scrutiny will translate into sustained gains or simply more volatility.

If recent headlines have you rethinking your watchlist, this could be an excellent time to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading at a considerable discount to analyst price targets, even after the recent rebound, investors may wonder whether the risk is now priced in or if there is genuine upside left to capture.

Most Popular Narrative: 24.5% Undervalued

DigitalBridge Group’s current share price sits well below the most popular narrative’s fair value estimate. This suggests the market may be overlooking major transformation potential compared to recent close levels. The scene is set for a debate about whether rapid industry shifts can carry the company to new heights.

"The explosion in AI workloads and hyperscale/cloud CapEx is driving unprecedented demand for data centers and power. This is fueling a substantial multi-year leasing and development pipeline for DigitalBridge and supports long-term revenue, FEEUM, and EBITDA growth as the company monetizes these trends through new asset deployment and leasing."

Curious how sky-high expectations for recurring growth and margin expansion shape this bold fair value? The real story lies in ambitious growth targets few investors would predict. See which breakthrough financial drivers are at the heart of this narrative and why DigitalBridge’s future could look radically different than its past.

Result: Fair Value of $16.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competition and the risk of technological shifts in AI infrastructure remain potential catalysts that could challenge the optimistic outlook for DigitalBridge.

Find out about the key risks to this DigitalBridge Group narrative.

Another View: What Do Valuation Ratios Suggest?

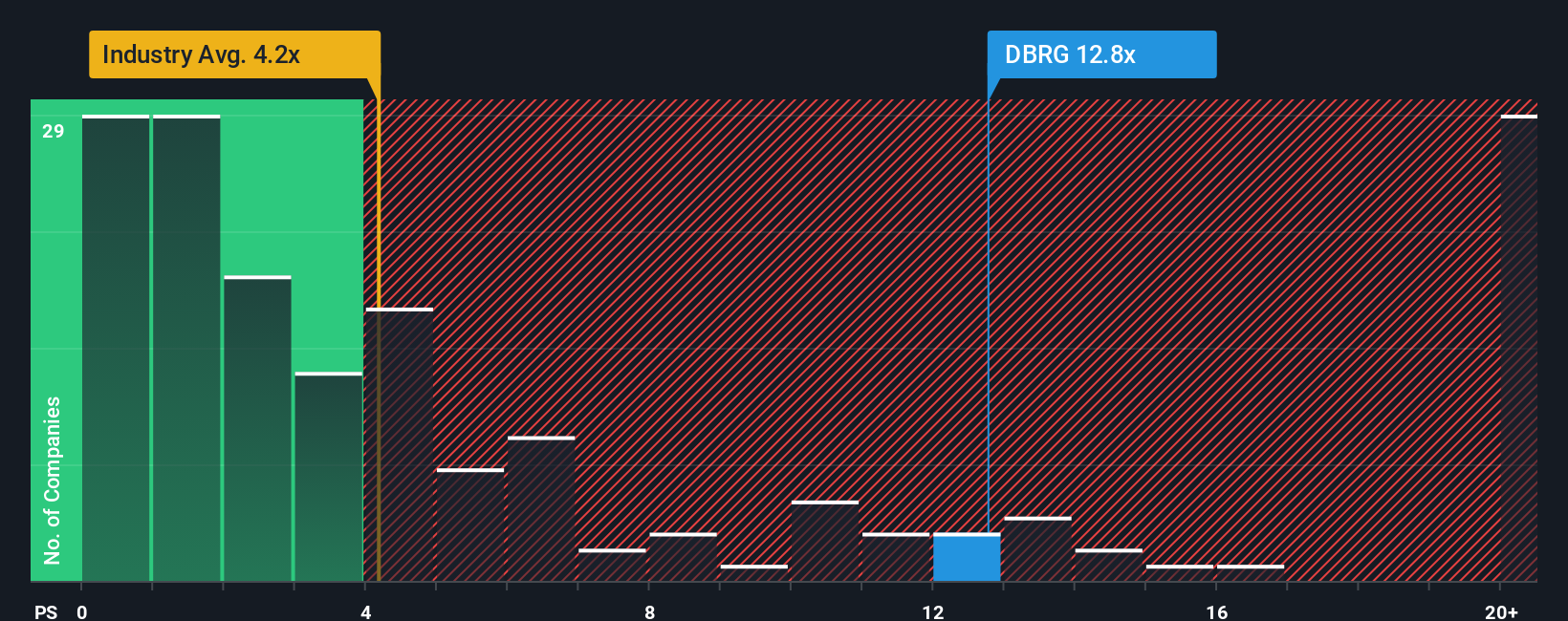

Looking at valuation multiples, DigitalBridge trades at a price-to-sales ratio of 13.1x, which is much higher than the US Capital Markets industry average of 3.9x and the peer average of 3.4x. Even compared to its estimated fair ratio of 4.3x, the stock appears expensive. This premium highlights a valuation risk if market expectations cool. But could strong future growth change the story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DigitalBridge Group Narrative

If you have your own perspective or want to dive deeper into the numbers yourself, crafting a personal view takes just a few minutes. Why not Do it your way?

A great starting point for your DigitalBridge Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't let potential opportunities pass you by. The Simply Wall Street Screener is your shortcut to finding exceptional stocks matched to your exact criteria. Give these a try today:

- Tap into long-term wealth with generous yields by scanning these 17 dividend stocks with yields > 3% that consistently reward investors.

- Spot the breakthroughs shaping tomorrow, starting with these 27 AI penny stocks leading the AI transformation across industries right now.

- Maximize value by seeking out these 877 undervalued stocks based on cash flows still flying under the radar and trading at a discount to intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DBRG

DigitalBridge Group

DigitalBridge (NYSE: DBRG) is a leading global alternative asset manager dedicated to investing in digital infrastructure.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives