- United States

- /

- Diversified Financial

- /

- NYSE:CRBG

Corebridge Financial (CRBG) Turns Profitable, Rapid Earnings Growth Boosts Value Narrative

Reviewed by Simply Wall St

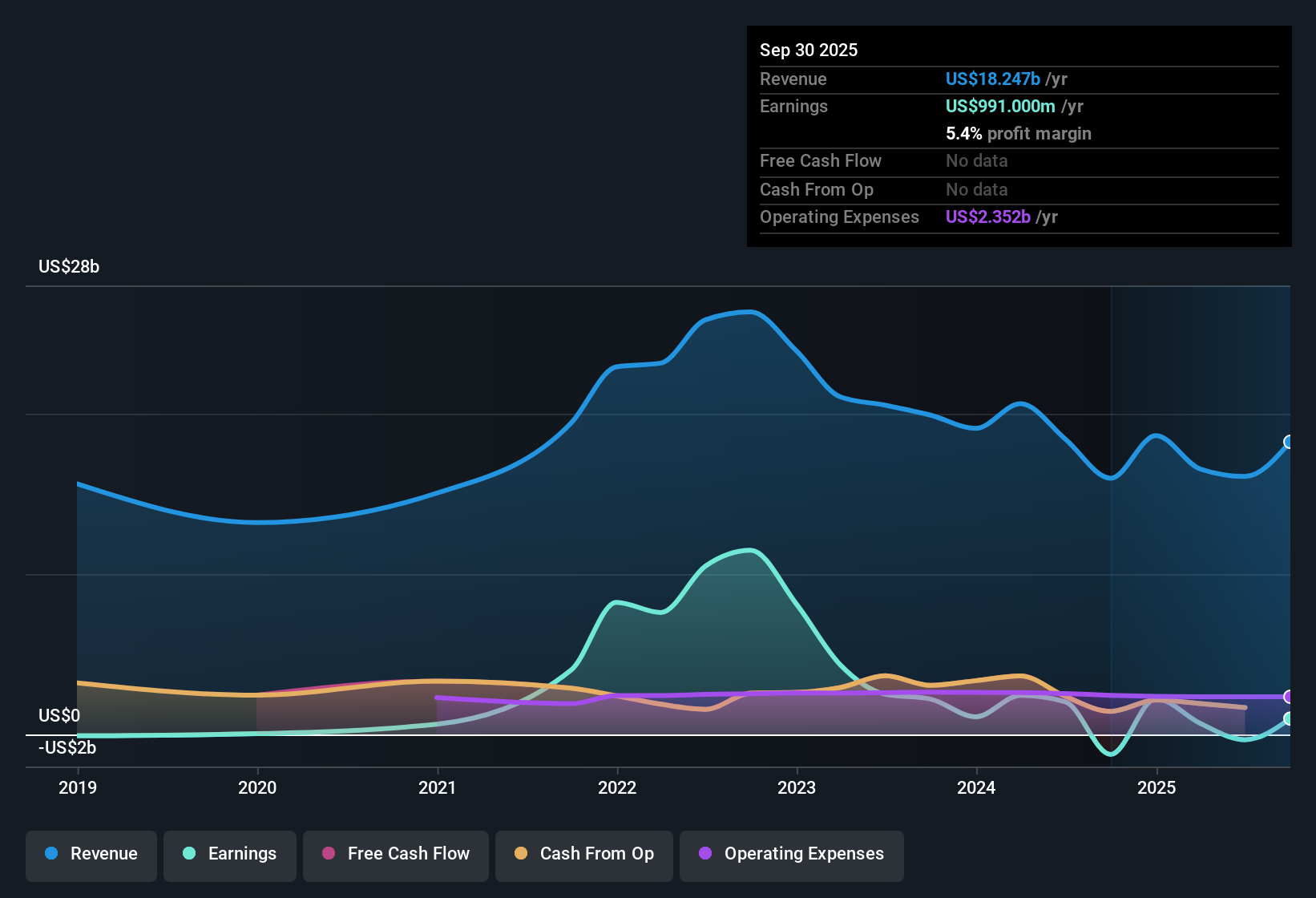

Corebridge Financial (CRBG) has turned the corner to profitability over the last year, with forecasts now calling for earnings growth of 51.05% per year. That is more than triple the broader US market average of 16%. Revenue is set to grow at a slower pace of 7.6% per year, which trails the US market’s 10.5% growth. Margins have also rebounded as the company moved from losses into positive territory, drawing attention as a potential turnaround story this earnings season.

See our full analysis for Corebridge Financial.Next up, we will see how these latest financial results measure up against the prevailing narratives, whether the numbers back up sentiment or tell a different story entirely.

See what the community is saying about Corebridge Financial

Margins Swing From -2.1% to 13.3% Target

- Analysts model that profit margins could shift from -2.1% today to 13.3% over the next three years, a dramatic turnaround that would put Corebridge ahead of many industry peers in operational efficiency.

- According to analysts' consensus view, this margin expansion is anchored in several drivers:

- Ongoing digital modernization and risk reduction strategies have already trimmed general operating expenses by 14% since the IPO, pushing expense ratios down and improving shareholder returns.

- The exit from legacy variable annuity risk, along with a capital-light business model, is expected to free up significant capital for buybacks and support steadier net margins in the years ahead.

- Rising demand for guaranteed income solutions is forecast to deliver long-term annuity sales growth, underpinning sustained revenue expansion alongside these improved margins.

Analysts see these efficiency gains as pivotal to the future and are watching to confirm margin improvements translate to earnings. Read the full consensus narrative for the complete picture. 📊 Read the full Corebridge Financial Consensus Narrative.

5.3% Annual Decline in Share Count Expected

- Forecasts show Corebridge's shares outstanding are projected to shrink by 5.31% per year for the next three years, signaling a steady pace of buybacks that could meaningfully boost earnings per share growth over time.

- Analysts' consensus view points out two main effects of this strategy:

- Share repurchases, made possible by capital freed up from divesting variable annuity risks, are expected to accelerate both EPS growth and return on equity.

- This declining share count is seen as a key catalyst for Corebridge meeting its ambitious 2028 earnings target of $3.0 billion even if outright revenue growth is more modest.

18.7% Gap to Analyst Price Target

- Corebridge trades at $31.26 per share, a notable 18.7% below the consensus analyst price target of $39.85, reflecting optimism from the market’s expectations for improved margins and buyback-driven EPS growth.

- Analysts' consensus narrative highlights that this target price rests on the company achieving $22.3 billion in revenue, $3.0 billion in earnings, and an 8.2x PE by 2028:

- The stock’s current PE of 16.8x is viewed as attractive relative to its peer average of 20.7x, but slightly elevated versus the industry’s 15x. This feeds into the belief that Corebridge is modestly undervalued compared to direct peers but commands a premium to the sector for its turnaround and capital return prospects.

- However, for the price target to be realized, Corebridge will need sustained profit margin expansion and consistent execution on buybacks, both drivers that will be closely watched by investors from here.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Corebridge Financial on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you have a unique take on the numbers? Turn your insight into a personal narrative in just a few minutes with Do it your way.

A great starting point for your Corebridge Financial research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While Corebridge Financial’s revenue growth and current profit margins still trail market averages, consistent execution will be crucial for sustained progress.

If you want steadier performance, focus on companies that consistently deliver solid results through market cycles by starting with stable growth stocks screener (2077 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRBG

Corebridge Financial

Provides retirement solutions and insurance products in the United States.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives