- United States

- /

- Diversified Financial

- /

- NYSE:CPAY

Will Corpay's (CPAY) NHL Partnership Sharpen Its Competitive Edge in Cross-Border Payments?

Reviewed by Sasha Jovanovic

- On November 4, 2025, the NHL announced a multiyear North American partnership designating Corpay's Cross-Border business as the Official Foreign Exchange Provider of the league, providing solutions for FX exposure and global payment management.

- This partnership gives Corpay significant brand visibility through prominent in-venue and digital NHL event exposure, while also showcasing its platform’s real-world enterprise capabilities.

- We'll explore how becoming the NHL's official FX provider could elevate Corpay's market presence and influence its investment outlook.

Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

Corpay Investment Narrative Recap

For Corpay shareholders, the core investment thesis centers on the company’s ability to turn major partnerships and platform expansion into sustained transaction growth and stickier enterprise relationships. The recent NHL agreement could accelerate Corpay’s push into mainstream awareness, but in the near term, the primary catalyst remains broad adoption of digital and automated payment workflows. The partnership does not materially change the most pressing risk: intensifying competition from fintechs and vertically integrated rivals that could compress margins if differentiation falters.

Among Corpay’s recent initiatives, the October partnership with Mastercard, which expands near real-time payment accessibility to 22 new markets, stands out. This move is especially relevant as it extends the reach of Corpay’s platform and reinforces the company’s drive toward higher transaction volumes, a central driver for organic revenue growth highlighted by the new NHL collaboration.

By contrast, investors should be aware that despite brand wins, increasing competition in B2B payments continues to...

Read the full narrative on Corpay (it's free!)

Corpay's outlook anticipates $5.7 billion in revenue and $1.8 billion in earnings by 2028. Achieving this will require annual revenue growth of 10.9% and an $0.8 billion increase in earnings from the current $1.0 billion.

Uncover how Corpay's forecasts yield a $368.50 fair value, a 40% upside to its current price.

Exploring Other Perspectives

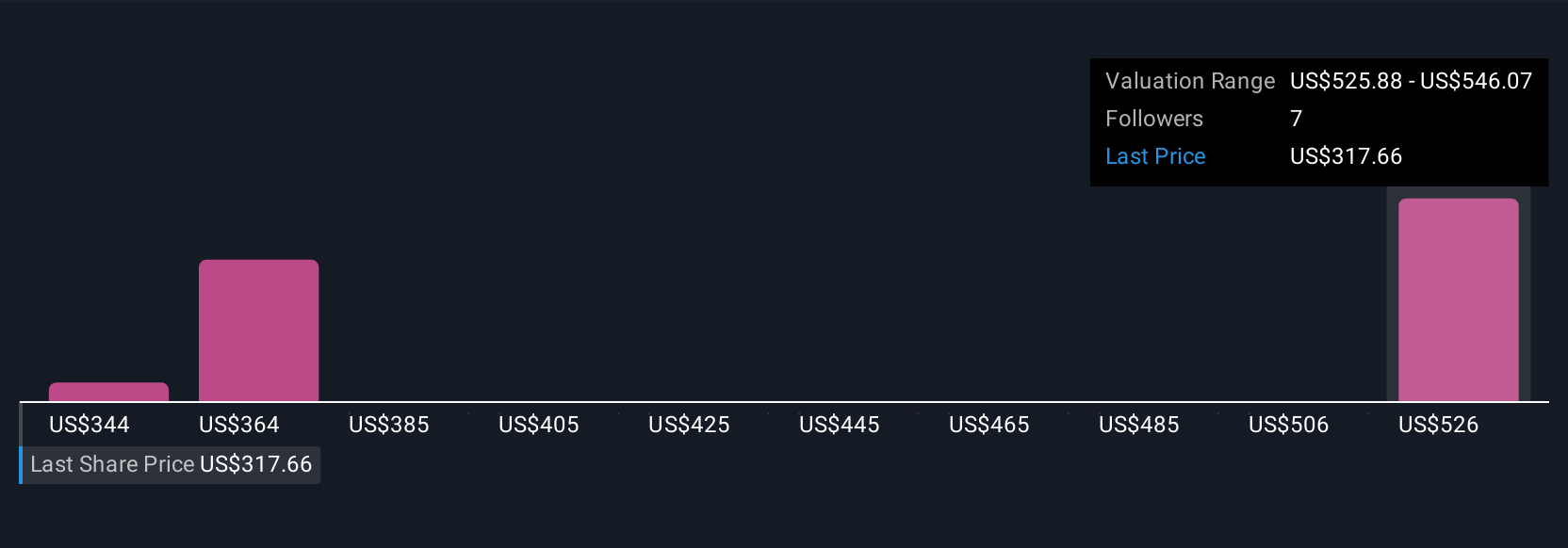

The Simply Wall St Community supplied four individual fair value estimates for Corpay shares, spanning from US$344.17 up to US$539.99. With competition from fintech and established firms identified as a major headwind, these wide-ranging perspectives underscore just how differently participants weigh the risks and opportunities shaping Corpay’s future.

Explore 4 other fair value estimates on Corpay - why the stock might be worth just $344.17!

Build Your Own Corpay Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Corpay research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Corpay research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Corpay's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPAY

Corpay

Operates as a payments company that helps businesses and consumers manage vehicle-related expenses, lodging expenses, and corporate payments in the United States, Brazil, the United Kingdom, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives