- United States

- /

- Capital Markets

- /

- NYSE:CNS

Cohen & Steers (CNS): Exploring Valuation Gaps and Growth Drivers in a Volatile Market

Reviewed by Simply Wall St

Cohen & Steers (CNS) has attracted attention for its performance trends this month, especially as investors look for signs of momentum after recent swings. The company’s value proposition remains tied to its underlying fundamentals and revenue growth.

See our latest analysis for Cohen & Steers.

Shares of Cohen & Steers have been under pressure this year, with a 1-year total shareholder return of -28.75% and the share price currently at $67.78. While recent momentum has been mixed, with a 30-day share price return of 3.26% but still down 25.82% year-to-date, the longer-term picture shows the stock is still up nearly 24% over five years. This suggests bouts of volatility within a generally constructive trend.

If the market’s shifting mood around financial stocks has you curious, now’s the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares trading below analyst price targets and signs of improved earnings growth, the ongoing sell-off prompts a key question: is Cohen & Steers undervalued right now, or is the market already factoring in its future prospects?

Most Popular Narrative: 6.3% Undervalued

At $67.78, Cohen & Steers trades below the narrative fair value estimate of $72.33. This has fueled debate over what is driving the gap between market price and expectations, especially in light of shifting earnings forecasts and revised growth assumptions.

Strategic expansion into active ETFs and broader product diversification (including the launch of integrated listed/private real estate strategies) is expected to attract new investor segments and improve client retention, supporting future AUM growth and revenue stability.

Curious what is behind that higher fair value? There is a mix of product launches, international scaling, and bold profit margin projections fueling this outlook. Want to see which key financial lever moves the target most? The narrative numbers might surprise you. Find out inside.

Result: Fair Value of $72.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent outflows from institutional clients and rising costs tied to global expansion could undermine future earnings and put pressure on Cohen & Steers' valuation outlook.

Find out about the key risks to this Cohen & Steers narrative.

Another View: Market-Based Valuation Signals Caution

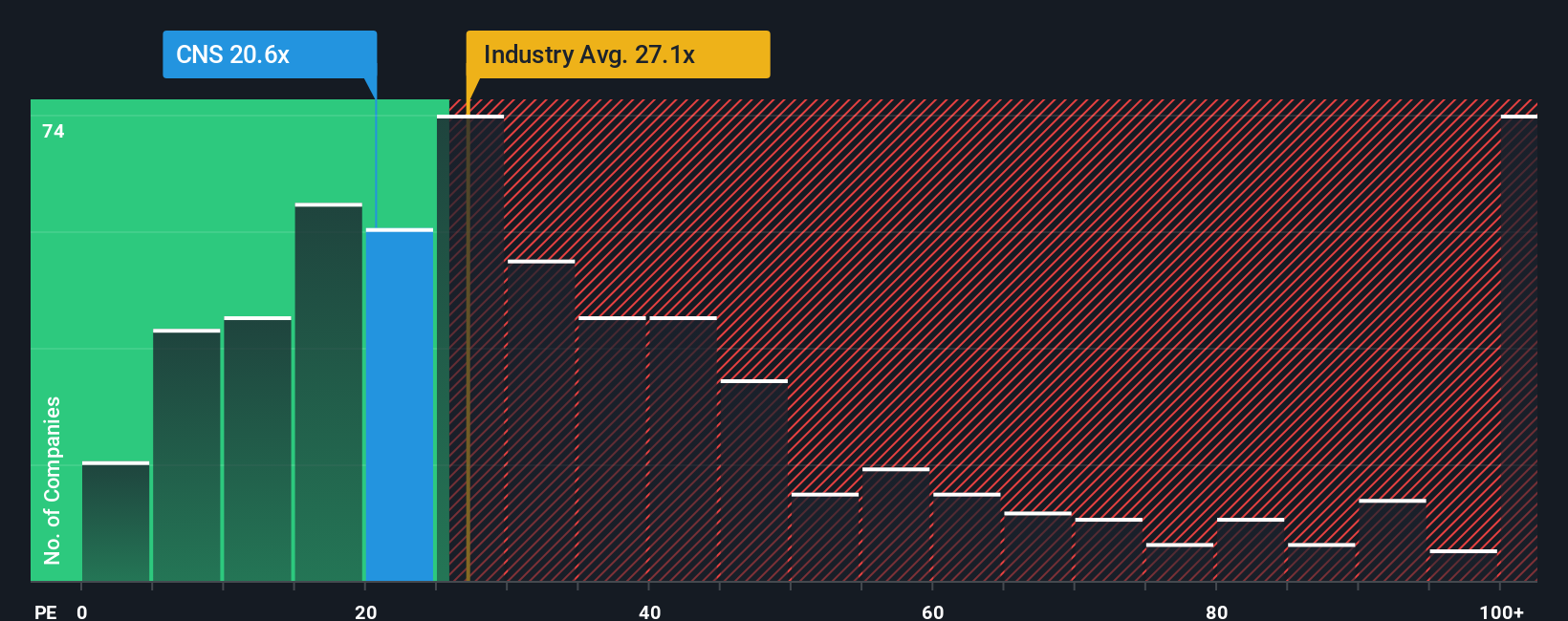

Looking at earnings ratios, Cohen & Steers trades at 21.1 times its earnings, which is below the US Capital Markets industry average of 24 times but nearly twice the average of its closest peers at 11.6 times. The fair ratio is 15 times. This gap suggests valuation risk if the market decides to shift closer to peer standards instead of rewarding a premium. What would make investors pay up or drive the price down to match those numbers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cohen & Steers Narrative

If these numbers spark different conclusions, or you prefer diving into the details firsthand, you can craft your own viewpoint in just a few minutes by using Do it your way.

A great starting point for your Cohen & Steers research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your search. Expand your investing edge by uncovering unique opportunities in fast-changing markets across overlooked and trending sectors before everyone else.

- Capitalize on robust yields and financial resilience by targeting these 18 dividend stocks with yields > 3% offering attractive income potential alongside strong fundamentals.

- Position yourself at the forefront of innovation and growth by targeting these 26 AI penny stocks that are transforming industries with advancements in artificial intelligence.

- Seize timely value with these 842 undervalued stocks based on cash flows that the market hasn’t fully appreciated, and sharpen your portfolio’s long-term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNS

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives