- United States

- /

- Mortgage REITs

- /

- NYSE:CIM

A Fresh Look at Chimera Investment (CIM) Valuation After Recent Share Price Decline

Reviewed by Kshitija Bhandaru

See our latest analysis for Chimera Investment.

This latest slide fits a broader pattern for Chimera Investment, with the 1-year total shareholder return slightly negative and the share price drifting lower year-to-date. This suggests momentum has faded even as the market reassesses income stock risks and rewards.

If you’re open to finding fresh opportunities beyond the usual suspects, it’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

The question now is whether Chimera Investment's recent weakness presents an undervalued opportunity or if the market has already factored in future growth, which may leave little room for upside.

Most Popular Narrative: 15.7% Undervalued

According to the leading narrative, Chimera Investment's fair value is set at $15.50, almost 16% above the latest close of $13.06. This contrast highlights a divide between current market sentiment and future earnings optimism. It warrants a closer look at what is driving the higher target.

"Strategic acquisitions and portfolio diversification are expected to drive revenue growth, boost margins, and build resilience across changing market conditions. Strong housing demand and enhanced in-house capabilities position the company for sustainable earnings and stable asset pipelines."

A multi-layered earnings roadmap powers this valuation, but not just any forecast numbers. The narrative leans heavily on ambitious growth in both revenue and profit margins, supported by a shift in business strategy that could change everything for Chimera. Want to unpack the exact projections and discover the bold assumptions that could make or break this valuation?

Result: Fair Value of $15.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent credit risk and higher funding costs could pressure Chimera's earnings. This may challenge the bullish narrative and prompt a market rethink.

Find out about the key risks to this Chimera Investment narrative.

Another View: What Does Our DCF Model Show?

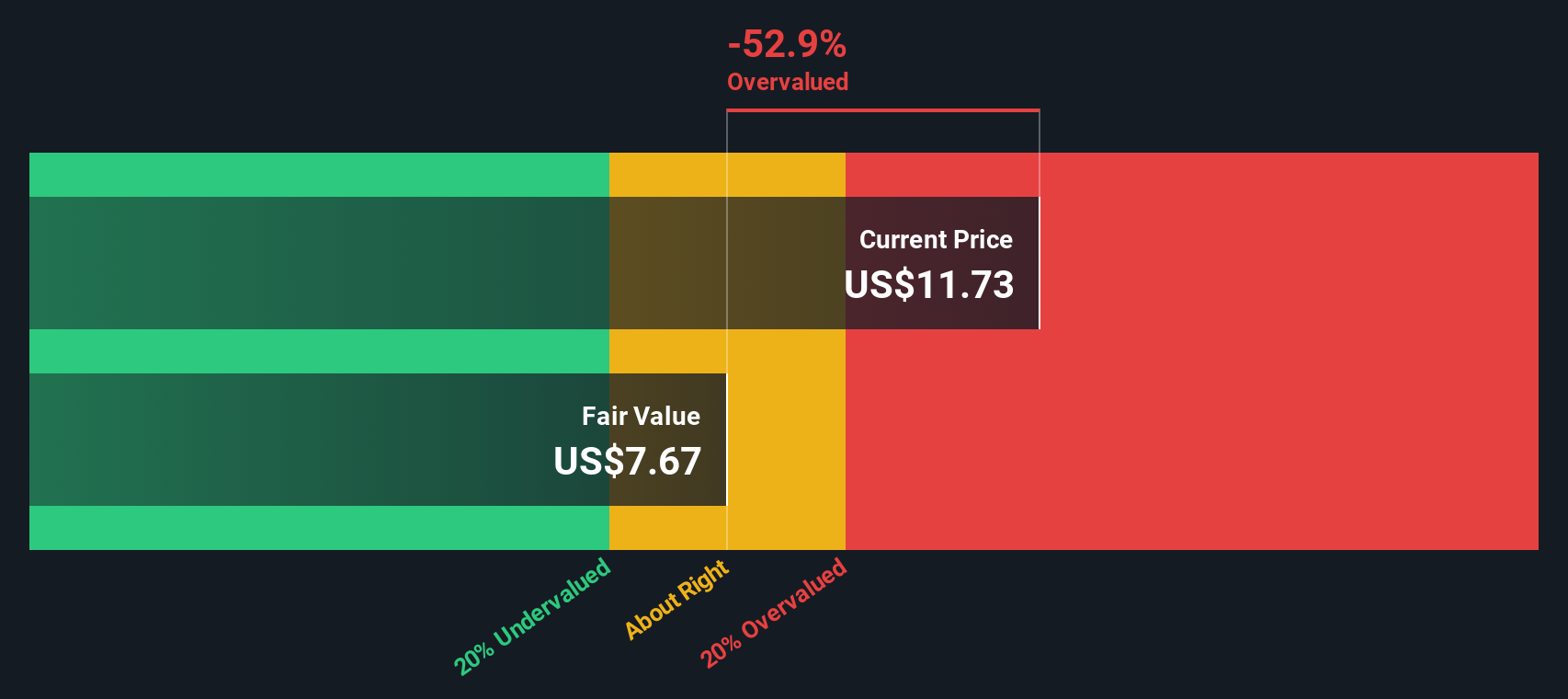

While analysts see Chimera Investment as undervalued based on future earnings and price targets, our SWS DCF model presents a different perspective. It suggests that the shares may actually be overvalued, with the recent price trading above the DCF fair value estimate. Should investors be cautious about this disconnect, or does one method overlook something important?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Chimera Investment for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Chimera Investment Narrative

Prefer a hands-on approach or want to challenge the consensus? You can build your own thesis in just a matter of minutes. Do it your way

A great starting point for your Chimera Investment research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take charge of your portfolio’s potential by spotting new trends and exciting growth opportunities that others may overlook. Simply Wall Street can help you find that next edge.

- Capture rising opportunities in artificial intelligence by checking out these 25 AI penny stocks, which are shaping this transformative landscape through innovation and rapid adoption.

- Boost your returns with these 19 dividend stocks with yields > 3%, offering reliable yields and the stability that many investors rely on, especially during uncertain markets.

- Position yourself early in the digital finance race and uncover the most promising players among these 78 cryptocurrency and blockchain stocks who are poised to disrupt the financial industry.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CIM

Chimera Investment

Operates as a real estate investment trust (REIT) in the United States.

Fair value with limited growth.

Similar Companies

Market Insights

Community Narratives