- United States

- /

- Mortgage REITs

- /

- NYSE:BXMT

Does New Leadership Signal a Strategic Shift for Blackstone Mortgage Trust (BXMT)?

Reviewed by Sasha Jovanovic

- Blackstone Mortgage Trust recently announced a leadership transition, appointing Timothy S. Johnson as CEO and F. Austin Peña as President following the resignation of Katharine A. Keenan, who departed to lead Blackstone Real Estate Income Trust.

- This executive change comes at a time when stakeholders are closely watching for potential shifts in strategy and the company's approach to portfolio management, given the significant influence of new leadership on real estate finance companies.

- We'll explore how the appointment of a new CEO and President could shape Blackstone Mortgage Trust's future investment strategy and performance.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Blackstone Mortgage Trust Investment Narrative Recap

To own shares in Blackstone Mortgage Trust, you need to believe in the firm’s ability to resolve impaired loans and redeploy capital into higher quality investments, all while maintaining stable dividend payouts. The recent leadership change is unlikely to materially affect the immediate focus on impaired asset resolution, which remains the most important short-term catalyst, but it does bring potential risk around continuity in portfolio management and strategy.

The board’s latest dividend announcement, a third consecutive $0.47 per share payout, signals the company’s commitment to regular shareholder returns, even as it works through the backlog of impaired loans. For investors, this regular income stream remains a key attractor, but the sustainability of these payments is intimately tied to the ongoing resolution of non-performing assets and successful portfolio turnover amid executive transition.

By contrast, the uncertain timeline for resolving the remaining $970 million in impaired loans could represent a sticking point investors should be aware of...

Read the full narrative on Blackstone Mortgage Trust (it's free!)

Blackstone Mortgage Trust's narrative projects $547.4 million in revenue and $513.3 million in earnings by 2028. This requires 32.2% yearly revenue growth and a $525.9 million earnings increase from current earnings of $-12.6 million.

Uncover how Blackstone Mortgage Trust's forecasts yield a $20.50 fair value, a 9% upside to its current price.

Exploring Other Perspectives

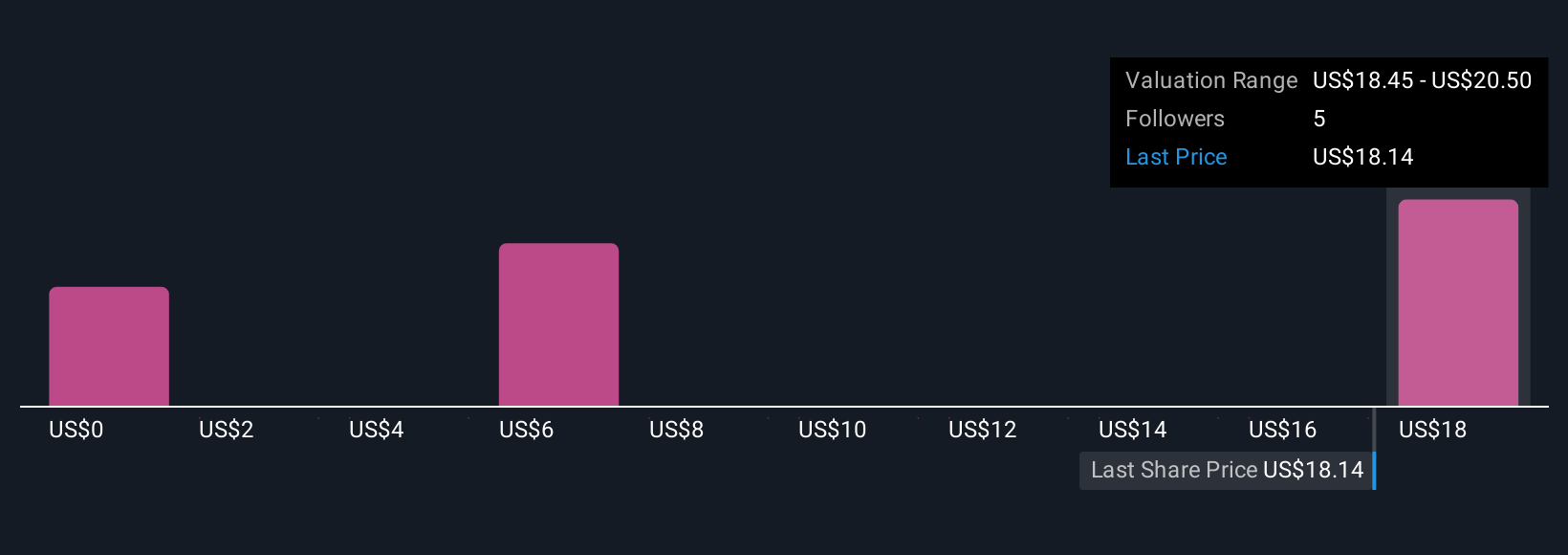

Five fair value estimates from the Simply Wall St Community range from US$2.05 to US$20.50 per share. While opinions vary widely, the pace of portfolio recovery is front of mind for many participants, shaping views on Blackstone Mortgage Trust’s outlook.

Explore 5 other fair value estimates on Blackstone Mortgage Trust - why the stock might be worth as much as 9% more than the current price!

Build Your Own Blackstone Mortgage Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Blackstone Mortgage Trust research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Blackstone Mortgage Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Blackstone Mortgage Trust's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blackstone Mortgage Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BXMT

Blackstone Mortgage Trust

A real estate finance company, originates senior loans collateralized by commercial properties in North America, Europe, and Australia.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives