- United States

- /

- Mortgage REITs

- /

- NYSE:BXMT

Blackstone Mortgage Trust (BXMT): Evaluating Valuation After Q3 Profitability Rebound and Renewed Investor Optimism

Reviewed by Simply Wall St

Blackstone Mortgage Trust (BXMT) just posted its third-quarter 2025 results, revealing a major turnaround in profitability and earnings per share compared to losses a year ago. Management points to strong momentum in credit quality, investment activity, and ongoing buybacks.

See our latest analysis for Blackstone Mortgage Trust.

This turnaround in profitability comes as Blackstone Mortgage Trust’s stock price remains well off previous highs, with an 11.95% total shareholder return over the past year hinting at renewed investor optimism even as the share price itself has yet to fully reflect business momentum. Recent buybacks at meaningful discounts, high dividend payouts, and board changes suggest the company is sharpening its focus for the long run. As a result, momentum could be building from here.

If you’re keen to see what other strong-performing companies are catching attention, now is a smart moment to discover fast growing stocks with high insider ownership.

With strong earnings growth, substantial investment activity, and shares trading at a discount to analyst targets, the key question now is whether Blackstone Mortgage Trust is still undervalued or if the market has already priced in future growth opportunities.

Most Popular Narrative: 9.9% Undervalued

With Blackstone Mortgage Trust’s narrative fair value set at $20.50, there is a notable upside compared to the last close price of $18.48. This narrative brings together ambitious projections, strategic pivots, and new capital allocation to justify the gap.

The company is focusing on portfolio turnover through repayments and redeployment into high-quality new credit opportunities, which is expected to enhance future earnings by improving the overall credit composition and potentially increasing revenue from new investments. Resolution of impaired loans is expected to be a catalyst for future growth by reducing the non-performing assets and allowing the company to recapture earnings potential, thereby potentially increasing net margins as capital is redeployed into more productive investments.

Want to know the secret sauce behind that price target? This narrative’s fair value relies on transformative credit quality moves and significant future earnings, plus some bold analyst projections that have surprised even seasoned REIT watchers. Find out what numbers drive that optimistic outlook and see the blueprint behind the valuation.

Result: Fair Value of $20.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, uncertain tariff policy and the ongoing resolution of impaired loans could pressure earnings. This may challenge how quickly Blackstone Mortgage Trust delivers on its growth ambitions.

Find out about the key risks to this Blackstone Mortgage Trust narrative.

Another View: Market Multiples Suggest a Higher Price Tag

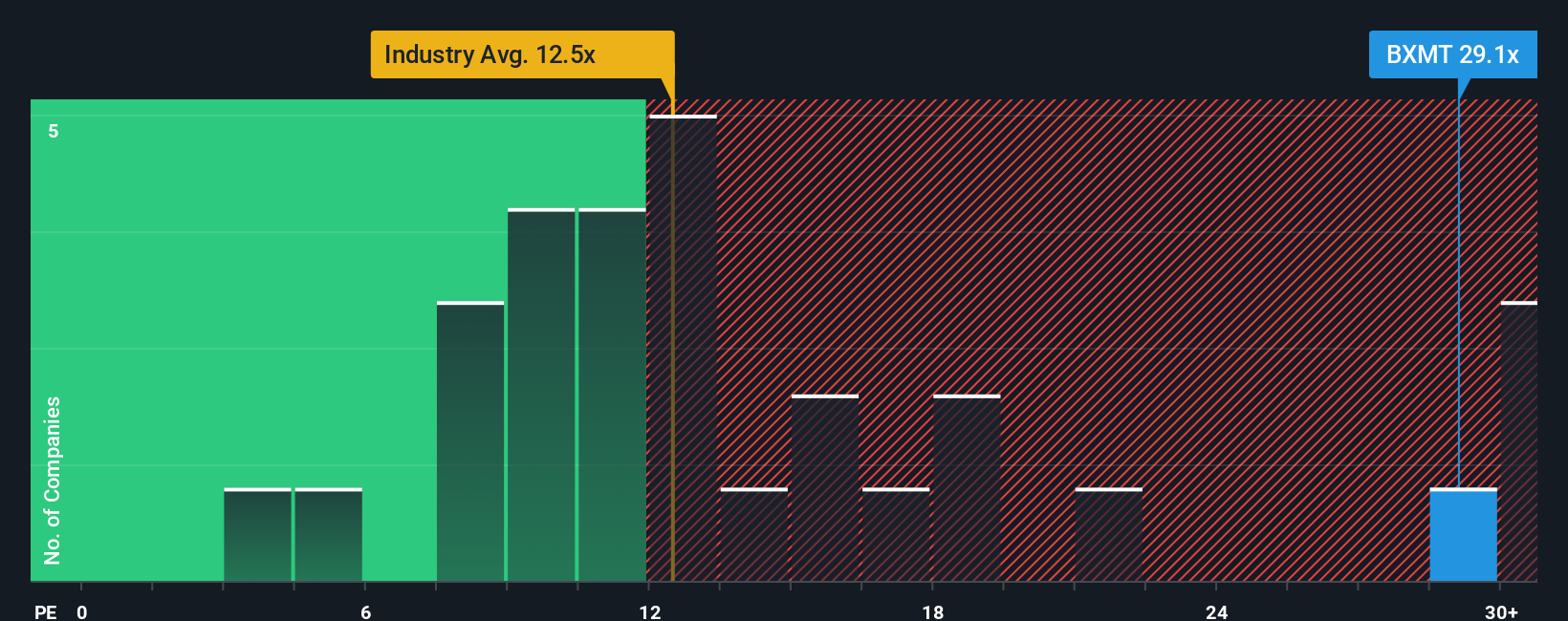

Looking from a different angle, Blackstone Mortgage Trust’s price-to-earnings ratio stands at 29.2x, which is substantially higher than both its peer average of 14.8x and the Mortgage REITs industry average of 12.8x. Compared to a fair ratio of 19.2x, the current multiple hints the stock may actually be overvalued, raising questions about whether recent optimism has gone too far. Are investors discounting risks in their search for growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Blackstone Mortgage Trust Narrative

If you think there’s more to the story or want to dig into the data yourself, you can shape your own perspective in just a few minutes. Do it your way.

A great starting point for your Blackstone Mortgage Trust research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

You’re missing out if you stop here. Make your next investing move count by comparing top opportunities in high-growth niches and proven wealth-building themes:

- Capture quality yield by reviewing these 22 dividend stocks with yields > 3% offering attractive income streams above 3% from companies with the fundamentals to keep paying.

- Tap into tomorrow’s breakthroughs by scanning these 26 AI penny stocks where artificial intelligence is driving exceptional potential and reshaping entire industries.

- Position yourself early by seeking out hidden value in these 3590 penny stocks with strong financials that combine strong financials with outsized upside most investors overlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blackstone Mortgage Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BXMT

Blackstone Mortgage Trust

A real estate finance company, originates senior loans collateralized by commercial properties in North America, Europe, and Australia.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives