- United States

- /

- Capital Markets

- /

- NYSE:BX

Is It Too Late to Consider Blackstone After Its Recent Rebound and Growth Headlines?

Reviewed by Bailey Pemberton

- Wondering if Blackstone is still a buy at around $153 a share, or if most of the upside has already been priced in? This piece will walk you through the numbers in plain English.

- Despite being down 11.5% year to date and 7.2% over the last year, the stock has bounced 10.9% in the past month and 1.7% over the last week. This hints that sentiment may be turning after a long, powerful 3-year gain of 124.7% and 5-year gain of 181.1%.

- That recent rebound has come as investors digest a wave of headlines around Blackstone's expanding role in private credit, new fund launches targeting institutional capital, and ongoing regulatory chatter around alternative asset managers. Together, these developments are shaping how the market views Blackstone's growth runway, fee durability, and risk profile.

- Yet on our framework Blackstone scores just 0/6 on traditional undervaluation checks. Next, we will unpack what that really means across different valuation methods, and why there may be an even better way to think about fair value than the usual metrics suggest.

Blackstone scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Blackstone Excess Returns Analysis

The Excess Returns model looks at how much value Blackstone creates above the minimum return shareholders demand, rather than just projecting cash flows. It starts from what the business can consistently earn on its equity base and how fast that equity can grow.

For Blackstone, the model uses a Book Value of $10.72 per share and a Stable EPS of $3.70 per share, based on weighted future return on equity estimates from 7 analysts. With an Average Return on Equity of 47.21% and a Stable Book Value of $7.83 per share, the company is assumed to generate an Excess Return of $3.05 per share after covering a Cost of Equity of $0.65 per share.

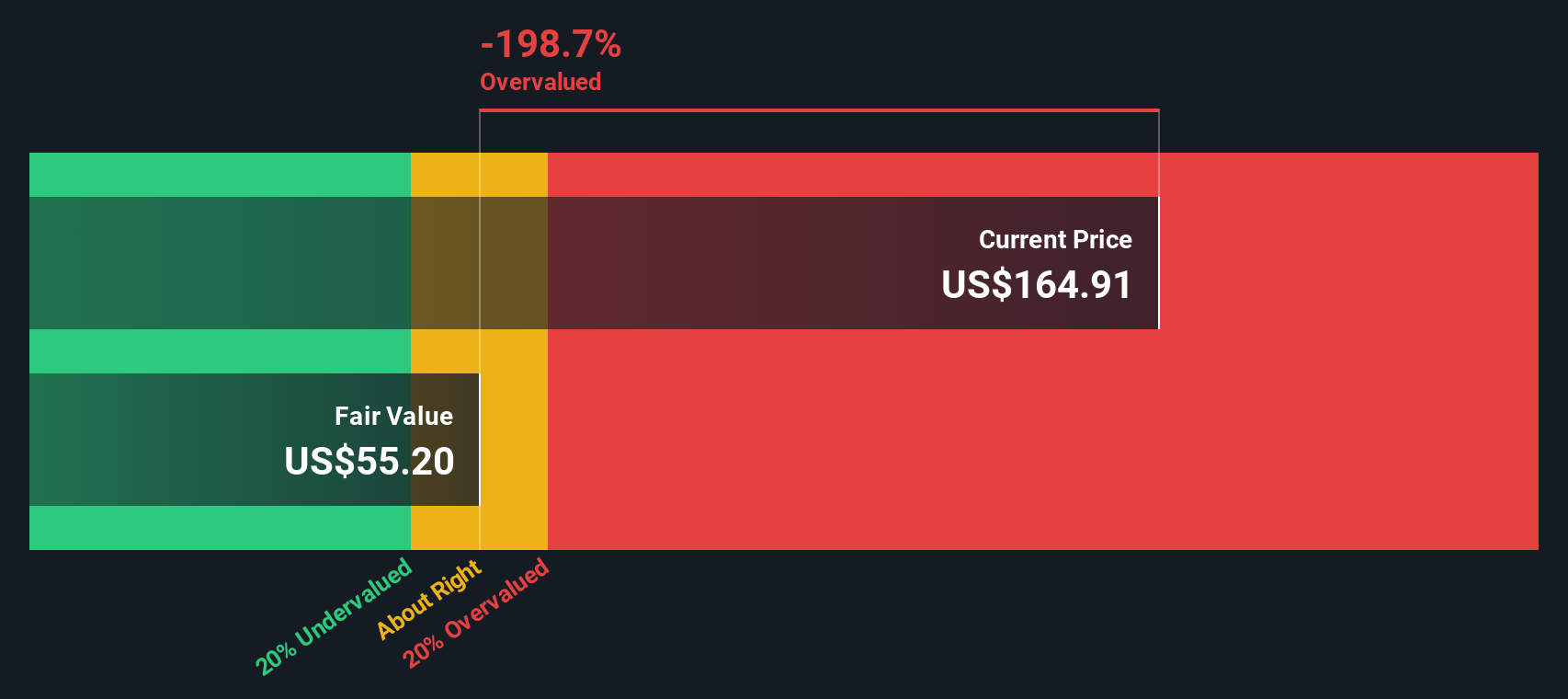

These strong excess returns are then capitalised into an intrinsic value of about $69 per share under the Excess Returns framework. Versus a market price around $153, that implies the stock is roughly 122.8% overvalued on this method. This suggests investors are paying a very full premium for future growth that may already be reflected in the price.

Result: OVERVALUED

Our Excess Returns analysis suggests Blackstone may be overvalued by 122.8%. Discover 916 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Blackstone Price vs Earnings

For a profitable, mature business like Blackstone, the price to earnings ratio is a useful shorthand for how much investors are willing to pay for each dollar of current earnings. It tends to work well for established cash generators, where earnings are a reasonable proxy for long term value creation.

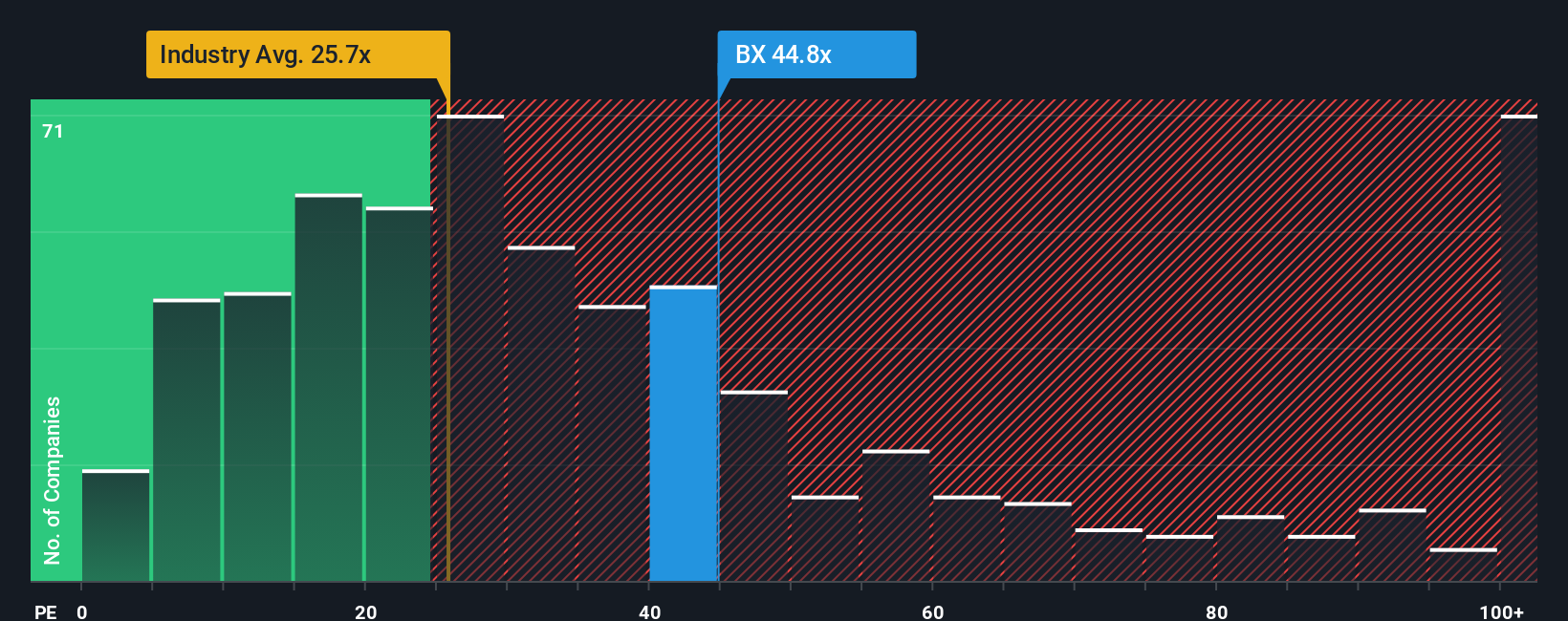

In practice, faster expected earnings growth and lower perceived risk usually justify a higher normal or fair PE, while slower growth or higher volatility argue for a lower one. Blackstone currently trades on about 44.4x earnings, well above the broader Capital Markets industry at roughly 25.3x and also richer than its peer group average of about 38.0x.

Simply Wall St’s Fair Ratio framework estimates that, once you factor in Blackstone’s earnings growth outlook, profitability, industry, size, and risk profile, a more appropriate PE would be closer to 24.3x. This company specific Fair Ratio is more informative than simple peer or industry comparisons because it adjusts for the things that actually drive sustainable value rather than just mirroring how others are priced. With the current 44.4x multiple sitting far above the 24.3x Fair Ratio, Blackstone again screens as materially overvalued on this lens.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1455 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Blackstone Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Blackstone’s future to hard numbers and a clear fair value.

A Narrative is your story about a company, where you spell out what you think will happen to its revenue, earnings and margins, and then turn that story into a financial forecast and an estimated fair value per share.

On Simply Wall St, Narratives live on the Community page and are easy to use, letting millions of investors quickly see how a company’s story links to a forecast and then to a fair value they can compare to today’s share price to decide whether it looks buyable or too expensive.

Because Narratives on the platform update dynamically as fresh news, earnings and analyst revisions come in, they help you keep your view current instead of relying on a one off model that quickly goes stale.

For Blackstone, one Narrative might lean toward the lower analyst fair value near $164, assuming more modest growth and margins. Another could lean toward the higher fair value around $193, assuming faster compounding from private credit and private wealth. The platform lets you see exactly which assumptions you agree with before you buy, hold or sell.

Do you think there's more to the story for Blackstone? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Blackstone might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BX

Blackstone

An alternative asset management firm specializing in private equity, real estate, hedge fund solutions, credit, secondary funds of funds, public debt and equity and multi-asset class strategies.

High growth potential with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion