- United States

- /

- Capital Markets

- /

- NYSE:BX

Blackstone (BX): Examining Valuation After Recent Share Price Swings

Reviewed by Simply Wall St

See our latest analysis for Blackstone.

Blackstone's share price has seen some swings lately, reflecting investors' recalibrating expectations following a challenging stretch for alternative asset managers. While the past year included a -20.96% total shareholder return, the longer-term performance still stands out, with a 73% gain over three years and 180% over five years. Momentum for the firm's core businesses may be stabilizing as markets digest recent volatility and look ahead to potential catalysts.

If recent moves in Blackstone have you curious about what else is gaining attention, now’s an ideal time to broaden your perspective and discover fast growing stocks with high insider ownership

With Blackstone shares trading 25% below analyst price targets while maintaining steady long-term returns, the question remains: is the current weakness a buying opportunity, or is the market already factoring in the company’s growth prospects?

Most Popular Narrative: 19% Undervalued

Blackstone’s latest fair value estimate stands nearly $35 higher than the last close price, which reveals a belief in significant upside and strong business momentum behind this valuation.

Blackstone is positioned for strong future growth with high inflows and substantial capital for opportunistic investments in undervalued assets. Strategic alliances and innovations in private credit and wealth management aim to boost revenue through expanded market reach and larger spreads.

Curious how analysts justify such a bold target? The narrative hinges on ambitious forecasts, including rapid earnings acceleration, expanding margins, and a profit outlook that rivals industry heavyweights. The real surprise is that the assumptions behind these numbers might defy your expectations. Find out which financial factors are powering this valuation.

Result: Fair Value of $179.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing market volatility and shifting global trade policies could quickly undermine these optimistic forecasts. This could potentially impact Blackstone’s future valuations and growth trajectory.

Find out about the key risks to this Blackstone narrative.

Another View: What Do the Multiples Say?

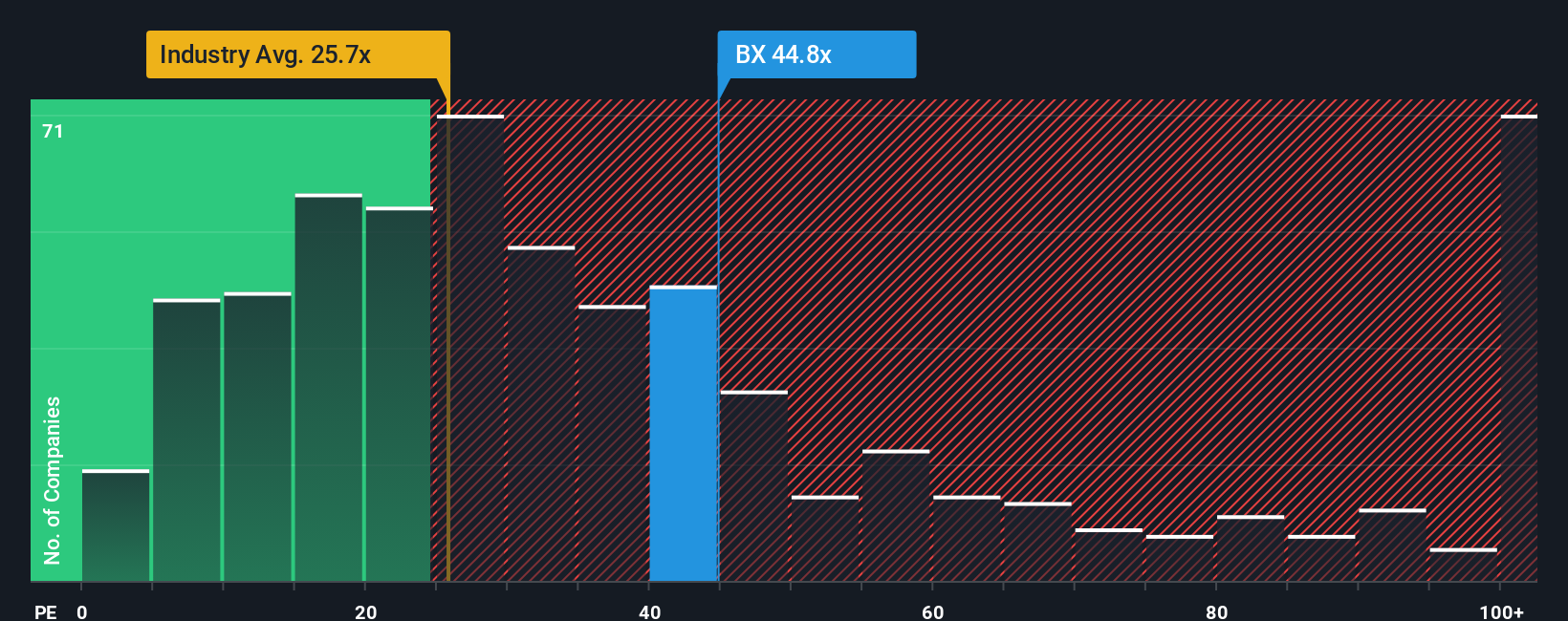

While the fair value estimate looks attractive, Blackstone’s current price-to-earnings ratio of 41.9x is much higher than both the industry average of 23.5x and the peer average of 35.9x. If the market shifts closer to the fair ratio of 25.3x, that could signal more valuation risk than opportunity. Does this premium reflect justified optimism, or is caution warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Blackstone Narrative

If the current analysis doesn't fully align with your view, or if you like diving into the numbers yourself, you can quickly assemble your own perspective in just a couple of minutes with Do it your way.

A great starting point for your Blackstone research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Elevate your strategy by uncovering companies on the move in fast-changing sectors with the Simply Wall Street Screener before the crowd catches on.

- Multiply your portfolio’s potential by searching for standout value among these 926 undervalued stocks based on cash flows with robust fundamentals and strong cash flows.

- Ride the surge in cutting-edge healthcare innovation as you access these 30 healthcare AI stocks, which blends medical advancements and artificial intelligence for tomorrow’s breakthroughs.

- Capitalize on the momentum in artificial intelligence trends by targeting these 25 AI penny stocks and position yourself at the forefront of market transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blackstone might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BX

Blackstone

An alternative asset management firm specializing in private equity, real estate, hedge fund solutions, credit, secondary funds of funds, public debt and equity and multi-asset class strategies.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success