- United States

- /

- Capital Markets

- /

- NYSE:BX

Blackstone (BX) Commits US$25 Billion To Enhance Pennsylvania's Digital and Energy Infrastructure

Reviewed by Simply Wall St

Blackstone (BX) reported a 23% price increase over the last quarter, influenced by its impressive investment initiative aimed at Pennsylvania's digital and energy infrastructure. This $25 billion investment signifies a strong commitment to advancing infrastructure growth, likely resonating positively with investors. Although market volatility was high amid political tensions involving President Trump's critique of Fed Chair Powell, Blackstone's investments, especially in data centers and power infrastructure, provided weight to broader market trends. Despite muted performance in some sectors, Blackstone's robust expansion efforts and strategic investments have captured significant investor interest, aligning with overall market growth trends.

Find companies with promising cash flow potential yet trading below their fair value.

The recent 23% quarterly price surge in Blackstone's shares, supported by its US$25 billion investment initiative in Pennsylvania's digital and energy sectors, highlights investors' optimism towards the firm's infrastructure expansion. Over the longer-term, Blackstone shares have delivered a substantial total return of 230.04% over five years. However, the firm underperformed the US Capital Markets industry, which returned 29.1% over the past year, yet managed to exceed the broader US market's 10% return during the same period. This long-term growth demonstrates Blackstone’s ability to generate substantial returns but hints at its vulnerability to short-term market dynamics.

The company's current share price of US$159.80 slightly exceeds the consensus analyst price target of US$159.17, reflecting the market's cautiously optimistic view of Blackstone's valuation. This discrepancy suggests investors are factoring in the potential positive impact of recent investments on future earnings, despite the risks associated with its heavy reliance on large-scale infrastructure and technological shifts. Analysts forecast robust earnings growth at 27% per year, outpacing the broader market's 14.8% annual growth expectation. However, given Blackstone's expensive valuation compared to its peers, achieving the anticipated growth will be crucial to justify its current price and support higher revenue and profit projections.

The valuation report we've compiled suggests that Blackstone's current price could be inflated.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blackstone might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BX

Blackstone

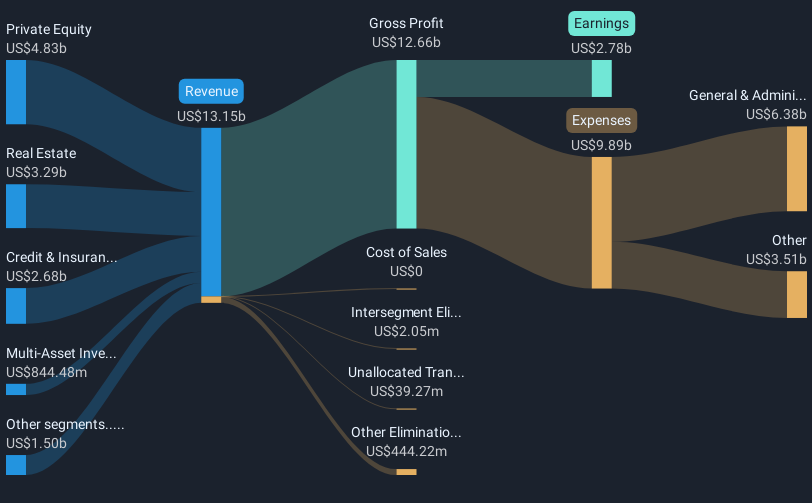

An alternative asset management firm specializing in private equity, real estate, hedge fund solutions, credit, secondary funds of funds, public debt and equity and multi-asset class strategies.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives