- United States

- /

- Diversified Financial

- /

- NYSE:BRK.B

Has Berkshire Hathaway’s Portfolio Shifts Created a New Opportunity After Recent Price Dip?

Reviewed by Bailey Pemberton

- Wondering whether Berkshire Hathaway is actually a bargain right now? Let's dig into what the numbers and the market are really telling us.

- The stock has gained 6.1% year-to-date, but dipped 2.4% over the last week and 4.8% in the past month, a reminder that even steady giants can face short-term volatility.

- Recent headlines have focused on Berkshire's ongoing portfolio moves and Warren Buffett’s commentary on market conditions, which has fueled fresh debates about the company's future direction and signaled possible shifts in focus. News around strategic investments and high-profile divestitures has kept analysts and investors on their toes.

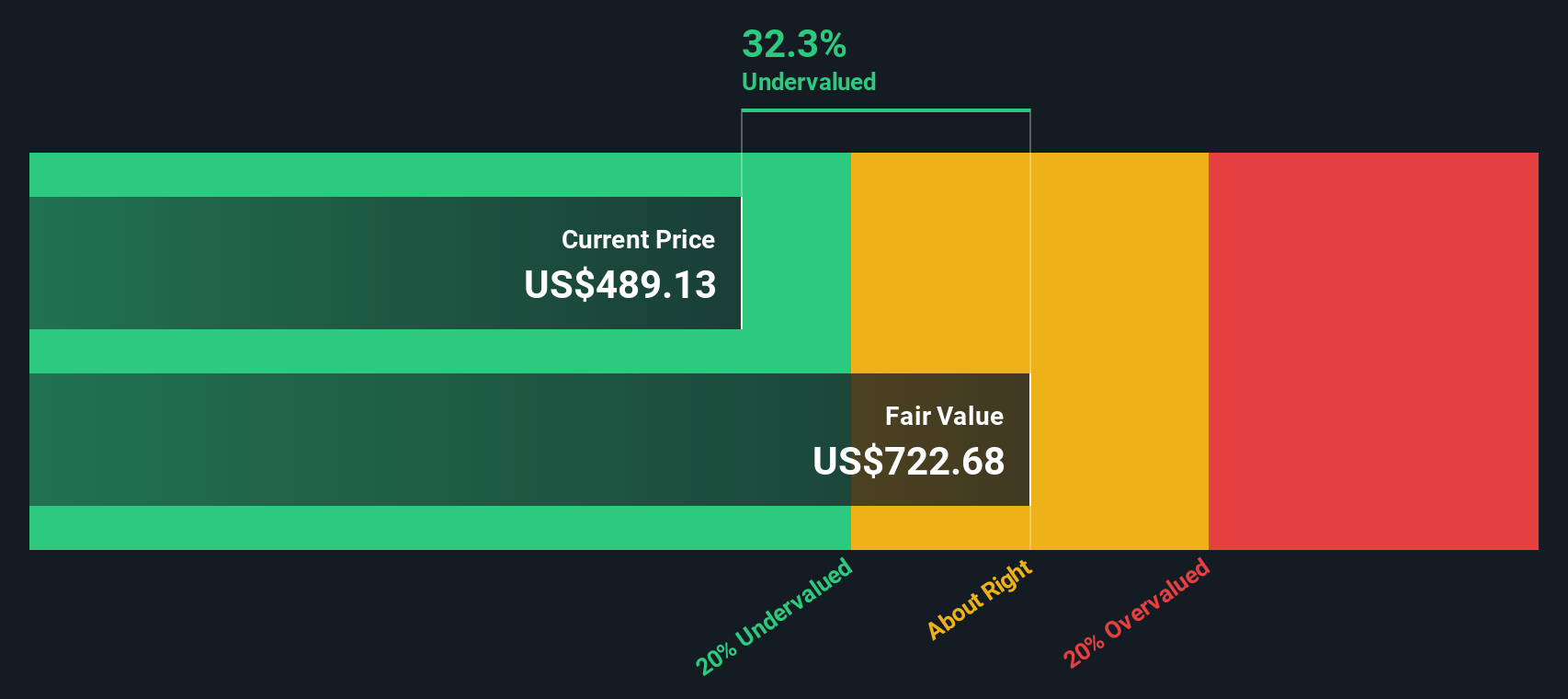

- On our valuation scorecard, Berkshire Hathaway scores a 4 out of 6, meaning it appears undervalued in several key checks but not all. We will break down those approaches next, with an even more insightful way to measure value coming up at this article's conclusion.

Approach 1: Berkshire Hathaway Excess Returns Analysis

The Excess Returns model evaluates Berkshire Hathaway by comparing how much profit it generates relative to the capital shareholders have invested, after accounting for what it would cost to obtain that capital elsewhere. This approach highlights Warren Buffett's emphasis on using capital efficiently over time.

Based on the latest data, Berkshire Hathaway's book value stands at $464,307.83 per share. The company’s stable earnings per share are estimated at $64,295.28, calculated from the median return on equity over the past five years. With a cost of equity of $37,725.59, Berkshire manages to deliver an excess return of $26,569.69 per share. The company’s average return on equity is a robust 13.00%, which underscores its strong record of adding value. Looking further ahead, the stable book value is projected at $494,433.12 per share, grounded in estimates from multiple analysts.

The intrinsic discount implied by the Excess Returns valuation indicates Berkshire Hathaway stock is 33.4% undervalued compared to its estimated value. This suggests that the market may be underestimating the company’s ability to deliver returns above its cost of equity, a key marker of long-term value.

Result: UNDERVALUED

Our Excess Returns analysis suggests Berkshire Hathaway is undervalued by 33.4%. Track this in your watchlist or portfolio, or discover 831 more undervalued stocks based on cash flows.

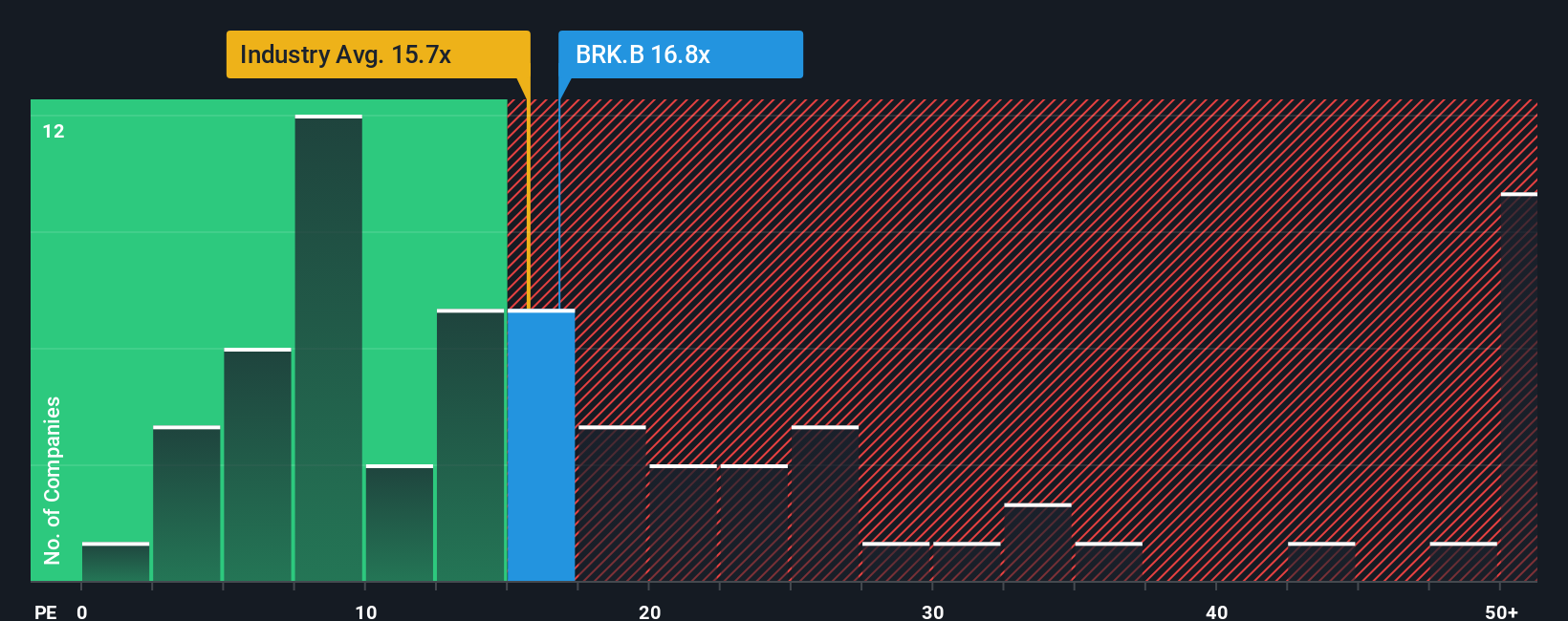

Approach 2: Berkshire Hathaway Price vs Earnings

For profitable companies like Berkshire Hathaway, the Price-to-Earnings (PE) ratio is a widely used way to judge whether a stock offers good value. The PE ratio indicates how much investors are willing to pay for each dollar of earnings. Investors typically expect to pay a higher PE for companies with strong earnings growth or lower risk, while slower growth or more uncertain prospects justify a lower PE.

Berkshire Hathaway currently trades at a PE ratio of 16.42x. This is above the Diversified Financial industry average of 14.79x, but well below the average for its closest peers at 27.35x. On the surface, this suggests Berkshire trades at a modest premium to the broader industry, but at a notable discount to high-profile comparables.

Simply Wall St’s proprietary Fair Ratio estimate for Berkshire is 19.21x, the level at which its current growth trajectory, profit margins, risk profile, industry, and size would justify. The Fair Ratio stands out as a more comprehensive benchmark than simply comparing with industry averages or peers because it factors in the company’s unique strengths and potential risks, as well as broader market and sector trends.

With Berkshire's actual PE ratio at 16.42x and the Fair Ratio at 19.21x, the stock appears undervalued by this measure, pointing to potential upside if the market closes the gap.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1394 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Berkshire Hathaway Narrative

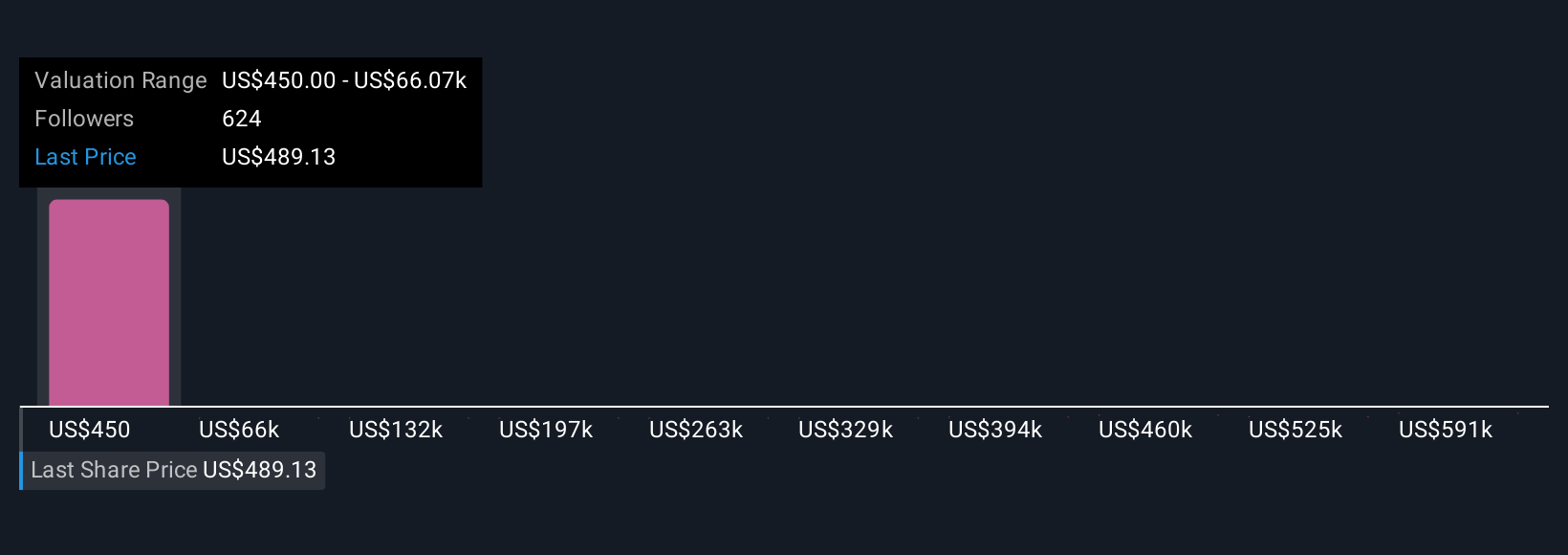

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personalized story about a company, connecting your view of Berkshire Hathaway’s business fundamentals with your estimates for its future performance, and turning that outlook into a Fair Value estimate. Narratives link what you believe is happening at the company, from leadership’s long-term strategy to evolving industry trends, directly to the numbers, creating a forecast that reflects your unique perspective.

Available right on Simply Wall St’s Community page, Narratives are a powerful yet easy way to make investment decisions, guiding millions of investors as they compare their Fair Value to the current share price for timely buy or sell signals. The best part is that Narratives are always dynamic and automatically update when news or earnings are announced, keeping your outlook relevant. For example, Berkshire Hathaway’s Narratives currently show a wide range of Fair Values, from the most bullish investor seeing a 45% upside to the most cautious expecting a 10% downside, highlighting just how much perspectives can differ. Now, you can build your own investment story, fact-based and instantly updated, so you never lose sight of what matters most: your thesis and the real numbers behind it.

Do you think there's more to the story for Berkshire Hathaway? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Berkshire Hathaway might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRK.B

Berkshire Hathaway

Through its subsidiaries, engages in the insurance, freight rail transportation, and utility businesses.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives