- United States

- /

- Diversified Financial

- /

- NYSE:BRK.B

Assessing Berkshire Hathaway (BRK.B) Valuation: Is There More Upside for Long-Term Investors?

Reviewed by Simply Wall St

Berkshire Hathaway (BRK.B) continues to attract attention, especially as long-term shareholders revisit its performance and valuation. After a steady run in recent months, questions remain about the next chapter for the conglomerate’s stock price.

See our latest analysis for Berkshire Hathaway.

Berkshire Hathaway’s share price has climbed 11.56% year-to-date, with steady momentum supported by its recent quarterly update. The total shareholder return stands at 6.58% over the past year, highlighting the company’s ability to generate value above and beyond simple price moves while navigating a shifting market landscape.

If you’re looking for inspiration beyond the usual blue chips, now’s a great time to see what’s trending in fast growing stocks with high insider ownership.

With the stock’s steady gains and analyst targets only slightly above its current price, investors face a familiar crossroads: is Berkshire Hathaway undervalued right now, or has the market already priced in the company’s next wave of growth?

Price-to-Earnings of 16.1x: Is it justified?

Berkshire Hathaway is currently trading at a price-to-earnings (P/E) ratio of 16.1x, which is notably lower than its peer group average of 24.2x. This signals that, at the current share price of $503.26, investors are paying less for each dollar of earnings than they would for most similar companies.

The price-to-earnings ratio measures how much investors are willing to pay now for a company’s earnings. For a diverse conglomerate like Berkshire Hathaway, this ratio reflects market perceptions of immediate growth prospects and the value of consistent profitability across economic cycles.

Despite underwhelming recent earnings growth, the P/E ratio of 16.1x is currently well below the peer average. This may indicate the market is discounting the company’s near-term earnings challenges or that investors see greater long-term stability and are pricing in a potential rebound. Compared to the estimated fair P/E of 17x, Berkshire trades at a level that leaves reasonable room for upside if performance turns more positive.

Berkshire's P/E is higher than the Diversified Financial industry average of 13x, signaling a premium for its unique position but still offering relative value among its peers. Compared to both its peer group and the estimated fair ratio, Berkshire appears attractively valued in today's market.

Explore the SWS fair ratio for Berkshire Hathaway

Result: Price-to-Earnings of 16.1x (UNDERVALUED)

However, slowing net income growth and a limited discount to analyst price targets could hamper future outperformance, especially if earnings momentum remains muted.

Find out about the key risks to this Berkshire Hathaway narrative.

Another View: Discounted Cash Flow Tells a Different Story

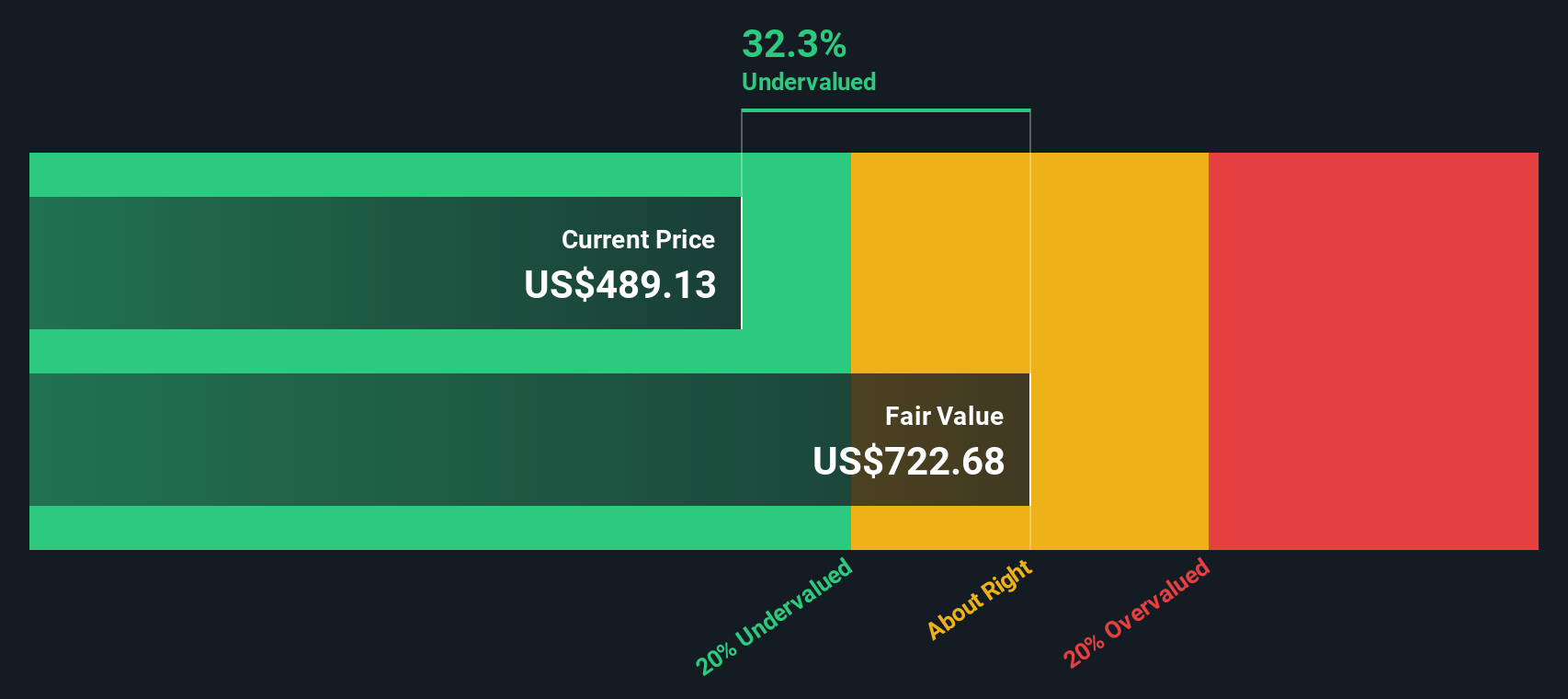

While Berkshire Hathaway’s price-to-earnings ratio points to relative value among peers, our SWS DCF model calculates the shares are actually trading about 34.5% below fair value, with an estimated fair price of $768.81. This method suggests even more upside than traditional multiples indicate. Could the market be overlooking something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Berkshire Hathaway for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 894 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Berkshire Hathaway Narrative

If you’d like to follow your own path or want to dig deeper into the numbers, you can easily craft your personal take on Berkshire Hathaway in just a few minutes. Do it your way.

A great starting point for your Berkshire Hathaway research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors keep their eyes open for the next opportunity. Don’t let a great stock slip by when you can use these powerful screeners to target winning themes in seconds.

- Tap into tomorrow’s hottest companies by starting with these 27 AI penny stocks, which are poised to benefit from rapid advances in artificial intelligence.

- Uncover breakthrough potential by scanning these 26 quantum computing stocks, which are transforming industries through quantum computing innovation.

- Boost your search for consistent cash flow with these 18 dividend stocks with yields > 3%, offering attractive yields and strong financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Berkshire Hathaway might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRK.B

Berkshire Hathaway

Through its subsidiaries, engages in the insurance, freight rail transportation, and utility businesses.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives