- United States

- /

- Diversified Financial

- /

- NYSE:BRK.A

Buffett’s Retirement and Record Cash Hoard Could Be a Game Changer for Berkshire Hathaway (BRK.A)

Reviewed by Sasha Jovanovic

- Berkshire Hathaway recently reported strong third-quarter results, with operating earnings and net income rising year-over-year, and disclosed a record cash reserve of approximately US$381.7 billion.

- In addition, company founder Warren Buffett announced his upcoming retirement at year-end, with Vice Chair Greg Abel slated to become CEO, marking a significant leadership transition for this widely watched conglomerate.

- We'll explore how Berkshire Hathaway's pending leadership handoff and robust insurance performance shape the ongoing investment narrative for the company.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Berkshire Hathaway's Investment Narrative?

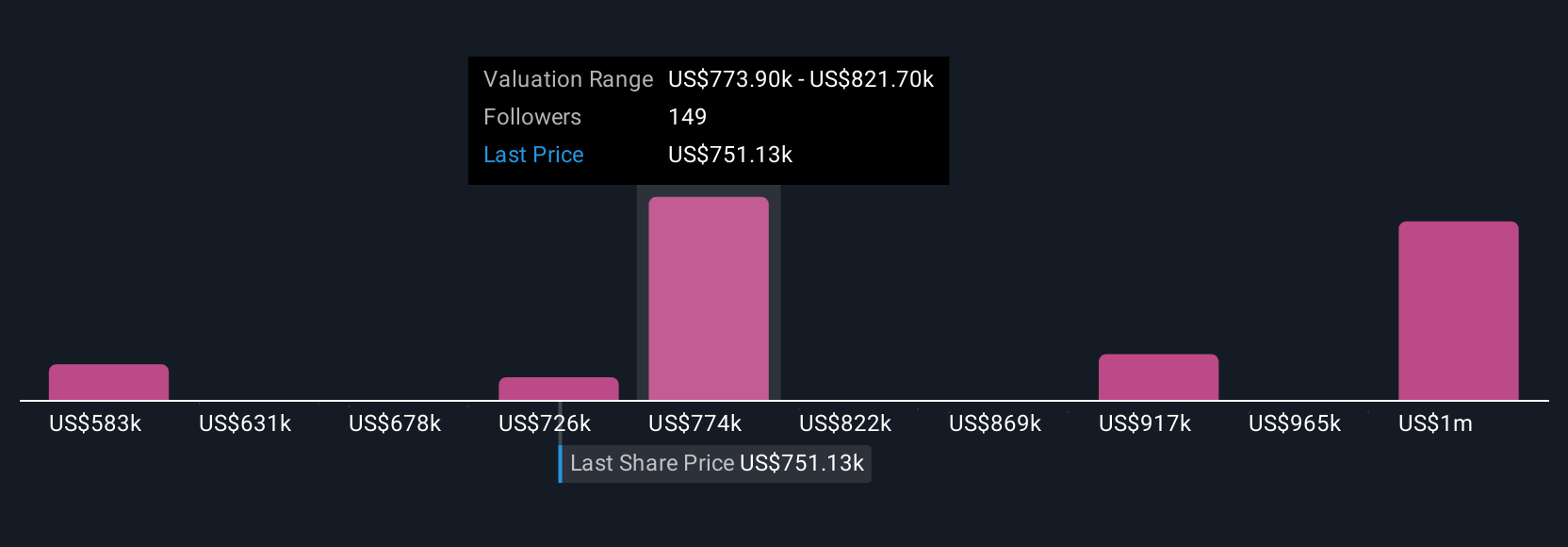

Berkshire Hathaway has long been a company where investors look beyond quarterly numbers and focus on the strength of its balance sheet, management discipline, and ability to seize opportunity when markets are turbulent. The record US$381.7 billion cash reserve now stands as a testament to this approach and shapes the short-term catalyst: the potential for large-scale acquisitions. That said, the immediate boost from insurance profits and Q3’s sharp operating earnings jump appear to provide resilience, but do not fundamentally alter the current risk picture. The most significant change is Warren Buffett’s imminent exit, with Greg Abel stepping in. While early price moves after earnings were positive, analysts continue to debate whether the so-called “Buffett premium” will fade, especially as profit margins and growth rates remain subdued. Recent news confirms the conglomerate’s steady hand, but also puts extra focus on future leadership and the effective use of its vast cash pile.

But with a historic leadership transition ahead, execution risk is now front and center for shareholders.

Berkshire Hathaway's shares have been on the rise but are still potentially undervalued by 37%. Find out what it's worth.Exploring Other Perspectives

Explore 26 other fair value estimates on Berkshire Hathaway - why the stock might be worth as much as 58% more than the current price!

Build Your Own Berkshire Hathaway Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Berkshire Hathaway research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Berkshire Hathaway research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Berkshire Hathaway's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Berkshire Hathaway might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRK.A

Berkshire Hathaway

Through its subsidiaries, engages in the insurance, freight rail transportation, and utility businesses.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives