- United States

- /

- Capital Markets

- /

- NYSE:BLK

Is the Recent 10% Drop a Signal to Reassess BlackRock’s Value in 2025?

Reviewed by Bailey Pemberton

- Wondering if BlackRock could be a bargain or if its time in the spotlight is fading? You are not alone. Digging a bit deeper into the valuation numbers can reveal opportunities that typical headlines might miss.

- Shares have cooled off recently, with the stock flat over the past week and down 10.4% for the month. BlackRock is still up 5.1% year-to-date and has delivered strong long-term returns of nearly 80% over five years.

- Much of this recent movement follows industry-wide unease around global markets, along with headlines about BlackRock’s continued expansion into new investment solutions and intensifying debates over its role in ESG investing. News such as its launch of innovative ETFs and involvement in public policy often put BlackRock in the spotlight, shaping sentiment and ultimately driving share price swings.

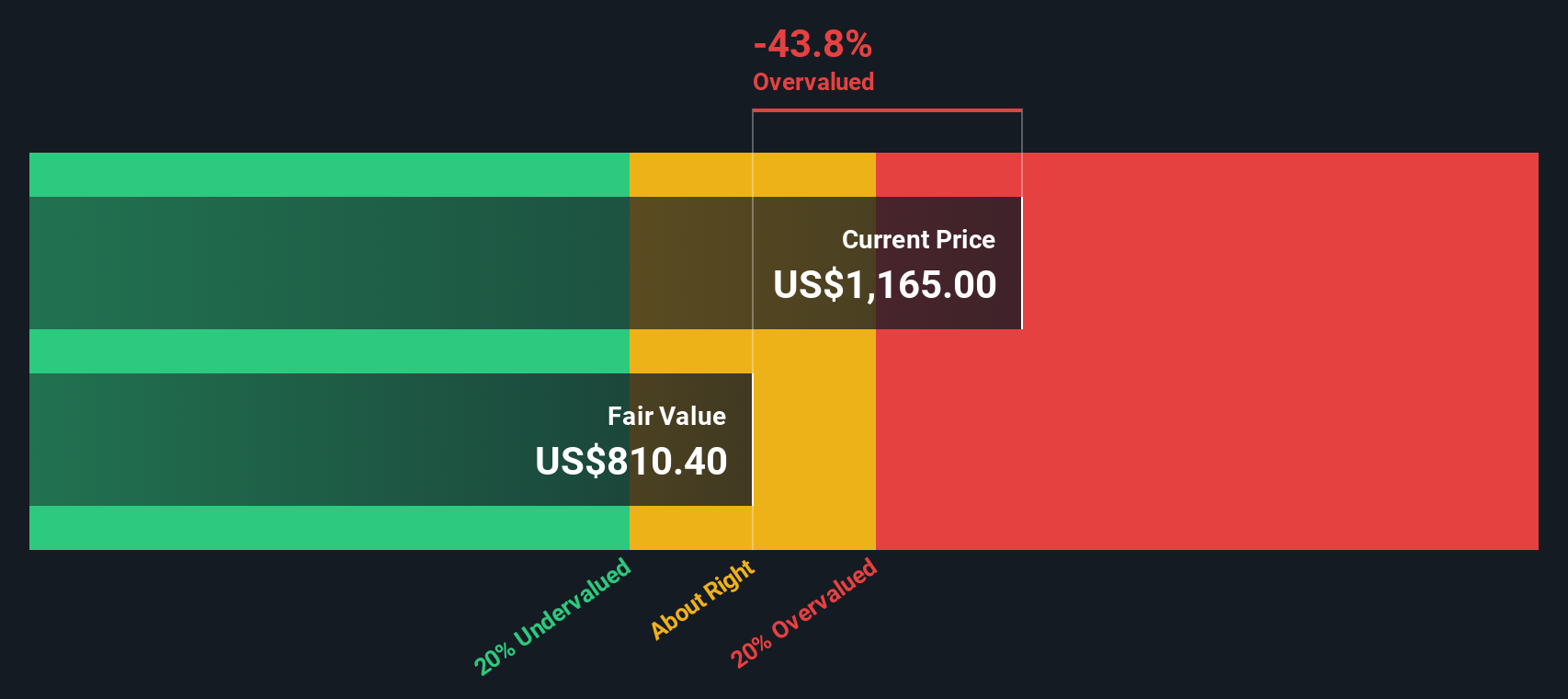

- As it stands, BlackRock currently scores 2 out of 6 on our valuation checks. This hints at some undervalued areas but also a few red flags. Next, we will dig into how this score is calculated across different valuation approaches and reveal an even more insightful way of looking at value that most investors overlook.

BlackRock scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: BlackRock Excess Returns Analysis

The Excess Returns model assesses whether a company generates value above its cost of equity. Essentially, it calculates how much more BlackRock earns from its investments compared to what investors require as a minimum return. This approach focuses on stable earnings power and the company’s ability to produce profits even after accounting for the business’s risk.

For BlackRock, the key measurements include a Book Value of $357.90 per share and a Stable Earnings Per Share (EPS) of $50.04, based on weighted future return on equity estimates from five analysts. The average return on equity is robust at 16.61%, comfortably outpacing the cost of equity, which stands at $25.14 per share. This means the calculated 'excess return', or the value created above the required return by shareholders, is $24.90 per share. Long term, the Stable Book Value is projected to be $301.21 per share, as estimated by three analysts.

Based on these factors, the Excess Returns model arrives at an intrinsic value suggesting that BlackRock’s current share price is about 35.3% higher than its calculated worth. This points to the stock being overvalued by this measure.

Result: OVERVALUED

Our Excess Returns analysis suggests BlackRock may be overvalued by 35.3%. Discover 870 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: BlackRock Price vs Earnings

For a consistently profitable company like BlackRock, the price-to-earnings (PE) ratio is a straightforward and widely used valuation tool. The PE ratio compares a stock's price to its earnings, helping investors gauge whether they are paying a reasonable price for each dollar of profit. A higher PE can reflect expectations for growth or reduced risks, while a lower PE may indicate market skepticism or elevated risk.

BlackRock currently trades at a PE ratio of 27.22x. This is above the industry average for Capital Markets companies, which sits at 24.04x, but notably below the peer group average of 41.77x. Importantly, Simply Wall St’s proprietary Fair Ratio for BlackRock is calculated at 19.95x. This figure is tailored by considering the company’s growth expectations, profit margins, size, risk profile, and industry context.

The Fair Ratio is a more insightful benchmark than simple peer or industry comparisons because it integrates how quickly BlackRock is expected to grow, the stability of its earnings, and industry risks. This makes it a forward-looking measure of what would be a reasonable PE for BlackRock specifically, rather than a one-size-fits-all gauge.

Comparing BlackRock’s current PE of 27.22x to its Fair Ratio of 19.95x suggests the stock is trading at a premium valuation and may be somewhat overvalued using this approach.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1398 companies where insiders are betting big on explosive growth.

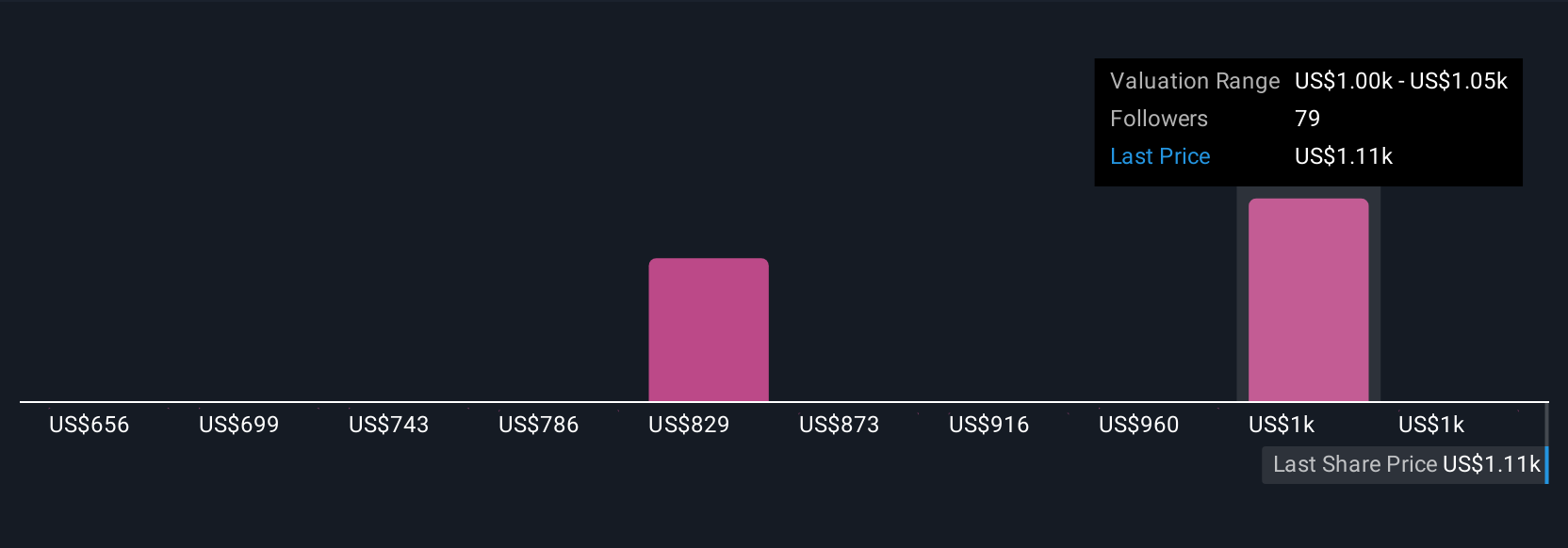

Upgrade Your Decision Making: Choose your BlackRock Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your unique perspective about where a company is headed, which links your view of the business’s story to its financial forecasts and ultimately to your definition of fair value. Rather than relying only on static ratios or consensus estimates, Narratives empower investors to describe their own outlook on factors like BlackRock’s future revenue, earnings, and profit margins, and then see how that story translates into a price they think is fair.

Narratives are easy to use and accessible for free in the Community page on Simply Wall St’s platform, already trusted by millions of investors. They let you quickly test out investment ‘stories’ by comparing your Fair Value to the current market price, so you can better decide whether to buy, hold, or sell. The best part is that Narratives automatically update as new information, such as earnings releases or major news, comes in, keeping your valuation relevant and up to date.

For example, some investors are optimistic, forecasting a fair value for BlackRock as high as $1,407, while others are more cautious, setting their estimates as low as $1,000, all reflecting different Narratives shaped by recent developments and personal expectations.

Do you think there's more to the story for BlackRock? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BlackRock might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLK

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives