- United States

- /

- Capital Markets

- /

- NYSE:BLK

Does BlackRock’s (BLK) Q2 Earnings Beat and Buybacks Change the Bull Case?

Reviewed by Simply Wall St

- BlackRock recently reported second quarter 2025 earnings, highlighting revenue of US$5.42 billion and net income of US$1.59 billion, along with a US$375 million share repurchase during the quarter.

- Alongside improved profits and continued buybacks, BlackRock is considering a potential sale of its stake in Aramco’s natural-gas pipeline network, reflecting ongoing portfolio management efforts.

- We’ll now explore how BlackRock’s increased earnings and renewed share buybacks could shape its longer-term investment narrative.

BlackRock Investment Narrative Recap

To be a BlackRock shareholder, one needs to believe in its ability to deliver consistent revenue growth and shareholder value by expanding across private markets, technology, and global asset management. The latest earnings, showing higher revenue and net income alongside continued share repurchases, support this view. However, none of these developments appear to materially alter the main short-term catalysts, growth in alternatives and technology, or the ongoing risk from performance fee declines, which still warrant close attention.

Among recent updates, BlackRock’s US$375 million share buyback in the second quarter stands out. This action signals ongoing capital return to shareholders, aligning with the firm’s narrative of asset growth and efficiency. While supportive of the investment story, it does not address the underlying risks facing performance fees or client behavior amid market shifts.

By contrast, investors should pay attention to the risk that performance fee pressures could weigh on future profitability and ...

Read the full narrative on BlackRock (it's free!)

BlackRock's outlook anticipates $27.8 billion in revenue and $9.1 billion in earnings by 2028. This is based on annual revenue growth of 9.9% and a $2.8 billion increase in earnings from the current $6.3 billion.

Uncover how BlackRock's forecasts yield a $1019 fair value, a 6% downside to its current price.

Exploring Other Perspectives

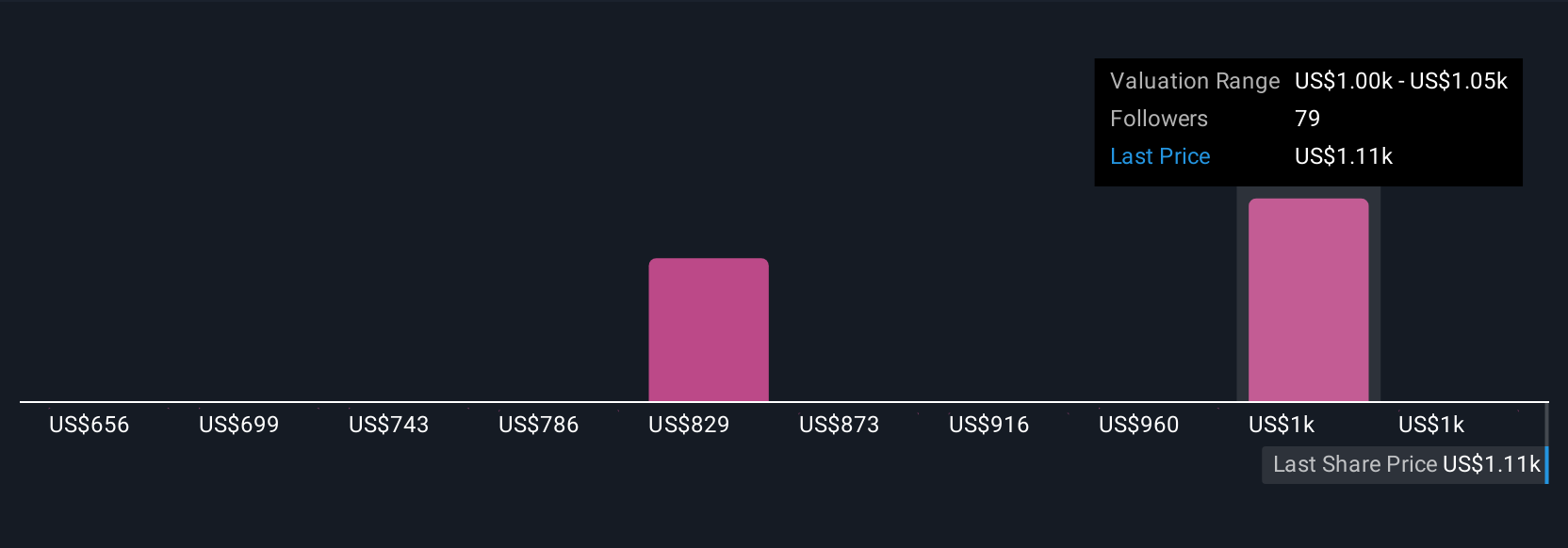

Thirteen members of the Simply Wall St Community estimate BlackRock’s fair value from as low as US$655.81 to as high as US$1,090. With such differing views, keep in mind that ongoing performance fee declines remain a key risk that could impact both sentiment and results.

Explore 13 other fair value estimates on BlackRock - why the stock might be worth as much as $1090!

Build Your Own BlackRock Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BlackRock research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BlackRock research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BlackRock's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BlackRock might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLK

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives