- United States

- /

- Capital Markets

- /

- NYSE:BK

How Investors May Respond To Bank of New York Mellon (BK) Strong Q3, Buyback, and Digital Wealth Momentum

Reviewed by Sasha Jovanovic

- In October 2025, Bank of New York Mellon reported strong third quarter earnings, updated its 2025 full-year guidance, and declared quarterly and preferred dividends alongside a completed buyback tranche of over 35.92 million shares for US$3.16 billion.

- A key development was TIAA Wealth Management announcing its selection of BNY Pershing's Wove platform, highlighting BNY Mellon's growing influence in integrated digital wealth management solutions for institutional clients.

- We'll examine how the company's double-digit net interest income growth outlook could influence Bank of New York Mellon's long-term investment narrative.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Bank of New York Mellon Investment Narrative Recap

To be a shareholder in Bank of New York Mellon today, you must believe in its ability to convert robust institutional client relationships and technology investments into steady fee growth, while managing headwinds from industry fee compression and asset outflows. The latest third quarter earnings, dividend affirmations, and guidance for double-digit net interest income growth support the short-term outlook, but these results don't eliminate longer-term risks tied to sluggish organic asset growth or market volatility.

Among recent announcements, TIAA Wealth Management’s adoption of BNY Pershing's Wove platform stands out as directly relevant to the firm’s ambitions in digital wealth management. This integration underscores BNY Mellon's commitment to deeper technology-enabled relationships and operational efficiency, which are both key short-term catalysts as the company seeks to offset competitive pressures and fee compression in traditional custody and servicing lines.

Yet, investors should keep in mind that, despite near-term strength, much of the projected cost efficiencies from these digital upgrades are still years away, meaning any setback or delay could...

Read the full narrative on Bank of New York Mellon (it's free!)

Bank of New York Mellon's narrative projects $21.3 billion revenue and $5.8 billion earnings by 2028. This requires 3.4% yearly revenue growth and a $1.0 billion earnings increase from $4.8 billion currently.

Uncover how Bank of New York Mellon's forecasts yield a $118.07 fair value, a 10% upside to its current price.

Exploring Other Perspectives

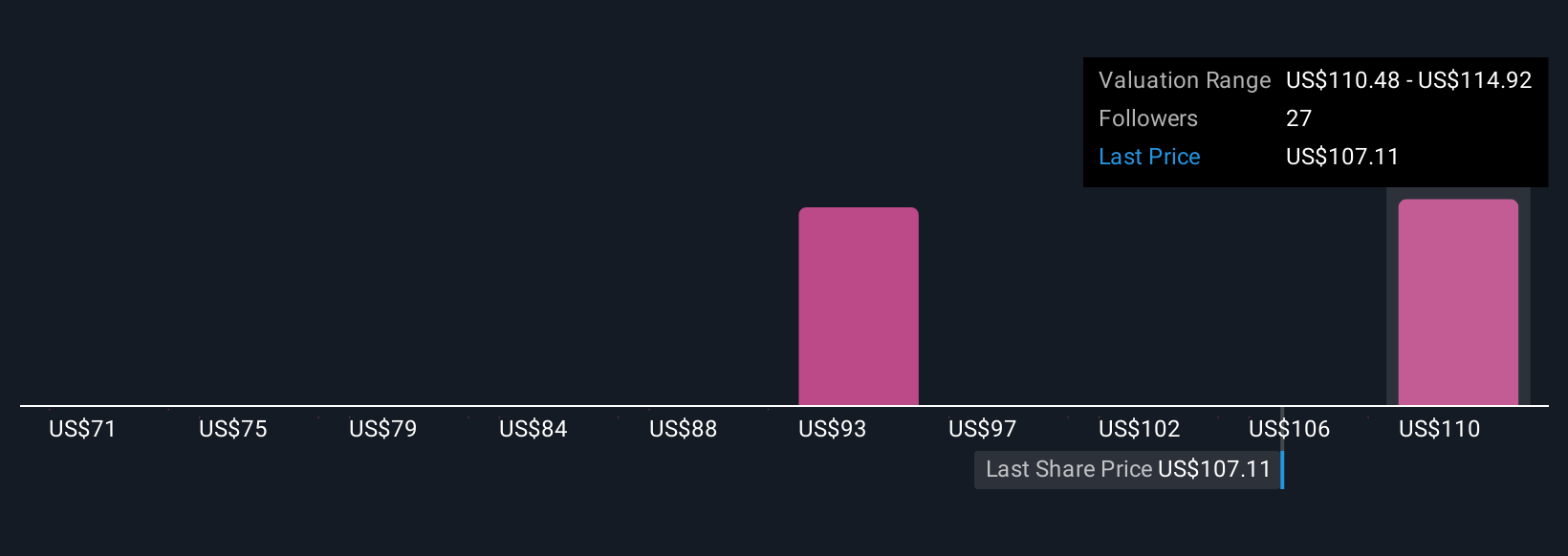

Simply Wall St Community members have set fair value estimates for BNY Mellon ranging from US$70.50 to US$118.07, based on five different forecasts. While some see significant upside, others point toward the risk that net interest income gains may not be sustainable if market conditions shift, reminding you performance expectations can diverge sharply in today’s market.

Explore 5 other fair value estimates on Bank of New York Mellon - why the stock might be worth as much as 10% more than the current price!

Build Your Own Bank of New York Mellon Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bank of New York Mellon research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Bank of New York Mellon research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bank of New York Mellon's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of New York Mellon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BK

Bank of New York Mellon

Provides a range of financial products and services in the United States and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives