- United States

- /

- Capital Markets

- /

- NYSE:BK

A Fresh Look at BNY Mellon's (BK) Valuation Following Recent Share Price Momentum

Reviewed by Simply Wall St

See our latest analysis for Bank of New York Mellon.

Bank of New York Mellon's share price has climbed about 43% so far this year, reflecting solid momentum as investors take note of the bank’s execution and consistent earnings growth. Its 1-year total shareholder return of 44% and a striking 3-year total return above 170% show that long-term holders have been well rewarded recently. The short-term trend continues to point upward for now.

If you’re looking to spot more potential winners riding similar momentum, now’s a great chance to expand your search and discover fast growing stocks with high insider ownership

The big question now is whether Bank of New York Mellon's rapid gains mean its shares still trade at a discount or if investors have already priced in all the company's future growth prospects. Is there a real buying opportunity left?

Most Popular Narrative: 6.5% Undervalued

Compared to its last close at $110.48, the narrative projects Bank of New York Mellon's fair value at $118.10, suggesting the share price could still move higher if all their assumptions play out.

Accelerated investment in digital platforms (including digital asset custody, AI integration, and the NEXEN ecosystem), coupled with strong early adoption, positions BNY Mellon for improved operating leverage and net margin expansion over the coming years. Scalable technology reduces costs and increases cross-selling opportunities.

Curious what’s driving this bullish target? The linchpin is a forecast of enhanced margins and big leaps in digital operations. Find out how fresh innovation, changing earnings dynamics, and aggressive long-term bets underpin a fair value that stands well above today’s market price. Unlock the full story behind these projections.

Result: Fair Value of $118.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained client outflows or unexpected market downturns could quickly challenge BNY Mellon's current growth trajectory and put pressure on long-term earnings momentum.

Find out about the key risks to this Bank of New York Mellon narrative.

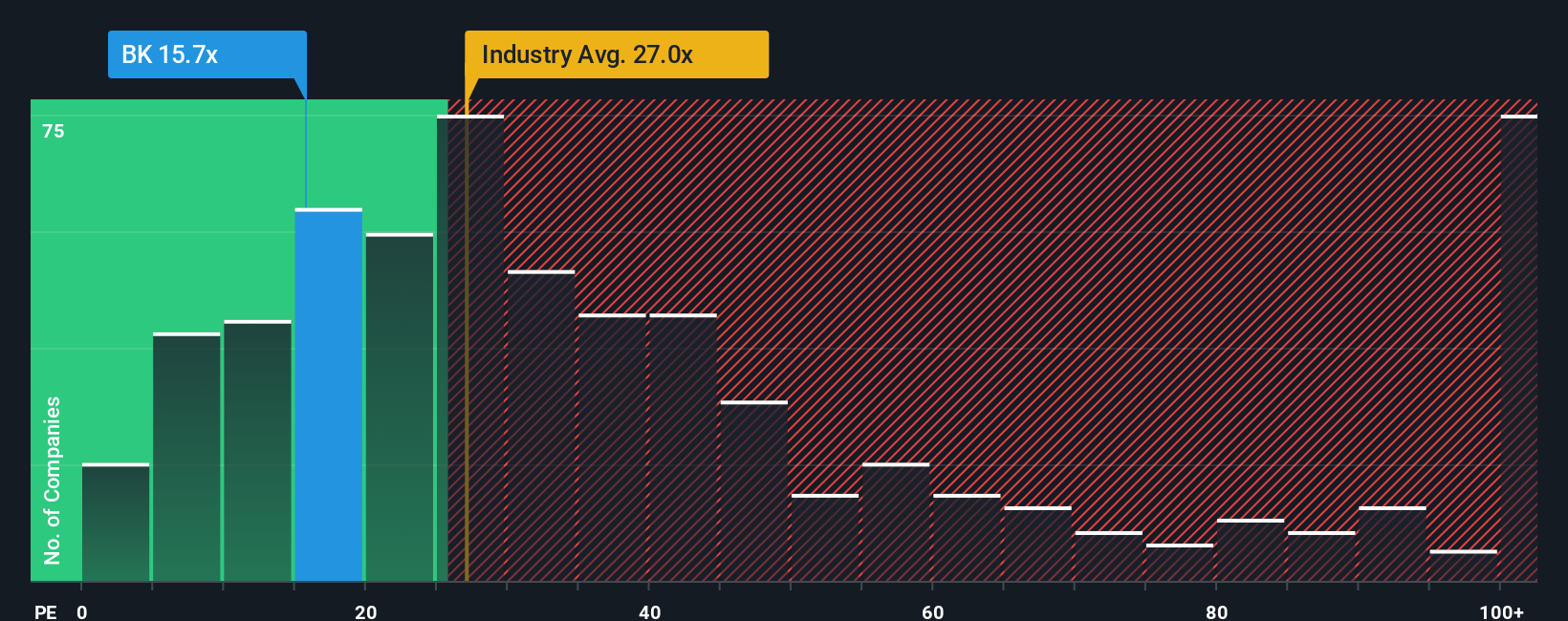

Another View: Multiples Tell a Value Story Too

While the latest narrative targets a fair value above today’s price, a quick check of Bank of New York Mellon's current P/E ratio tells its own story. At 15.4x, it stands well below both the peer average of 27.4x and the US industry at 24.4x. The fair ratio, estimated at 16.2x, offers yet another benchmark close to the current level. This sizable gap hints at potential undervaluation, but market sentiment could shift quickly. Has all the opportunity been captured, or does the discount remain?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bank of New York Mellon for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 882 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bank of New York Mellon Narrative

If you’re keen to dig deeper and put your own perspective to the test, you can easily build your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Bank of New York Mellon.

Looking for more investment ideas?

Smart investors never stand still. Those who act quickly can secure exciting opportunities before the crowd catches on, and the right screener on Simply Wall Street makes it easy.

- Boost your income potential by reviewing these 16 dividend stocks with yields > 3%, where strong yields could help power your portfolio returns above 3%.

- Stay ahead of financial innovation with these 82 cryptocurrency and blockchain stocks; see which public companies are accelerating blockchain technology and shaping the future of digital finance.

- Tap into tomorrow’s breakthroughs by investigating these 32 healthcare AI stocks, featuring innovators fusing artificial intelligence with healthcare for game-changing growth prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of New York Mellon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BK

Bank of New York Mellon

Provides a range of financial products and services in the United States and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives