- United States

- /

- Capital Markets

- /

- NYSE:BK

A Fresh Look at Bank of New York Mellon's (BK) Valuation Following Recent Share Price Trends

Reviewed by Simply Wall St

See our latest analysis for Bank of New York Mellon.

Zooming out, Bank of New York Mellon's share price momentum has eased a bit recently, but the stock’s overall trend remains positive. Its 38% year-to-date share price return speaks to revived confidence. Meanwhile, the 44% total shareholder return over the past year makes it a standout among peers, as investors factor in both capital gains and dividends.

If the financial sector’s shift has you thinking bigger, consider broadening your scope and check out fast growing stocks with high insider ownership.

The big question for investors now is whether Bank of New York Mellon’s strong run leaves the stock undervalued, or if the current price already reflects all the expected growth ahead. This could make future returns harder to capture.

Most Popular Narrative: 9.3% Undervalued

With Bank of New York Mellon's fair value narrative at $118.07 per share versus a last close of $107.05, the market’s pricing falls behind the narrative's growth expectations. This forms the basis for a bold and forward-looking storyline.

Accelerated investment in digital platforms (including digital asset custody, AI integration, and the NEXEN ecosystem), combined with strong early adoption, positions BNY Mellon for improved operating leverage and net margin expansion over the coming years. Scalable technology is expected to reduce costs and increase cross-selling opportunities.

What fuels this higher fair value? The narrative points to a future shaped by advanced tech efficiency, margin expansion, and ambitious profit opportunities. The specific combination of growth drivers and analyst assumptions behind this price target may surprise you. Get the full breakdown inside the complete narrative.

Result: Fair Value of $118.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a downturn in global markets or slower adoption of digital assets could quickly undermine these upbeat projections and reshape BNY Mellon's outlook.

Find out about the key risks to this Bank of New York Mellon narrative.

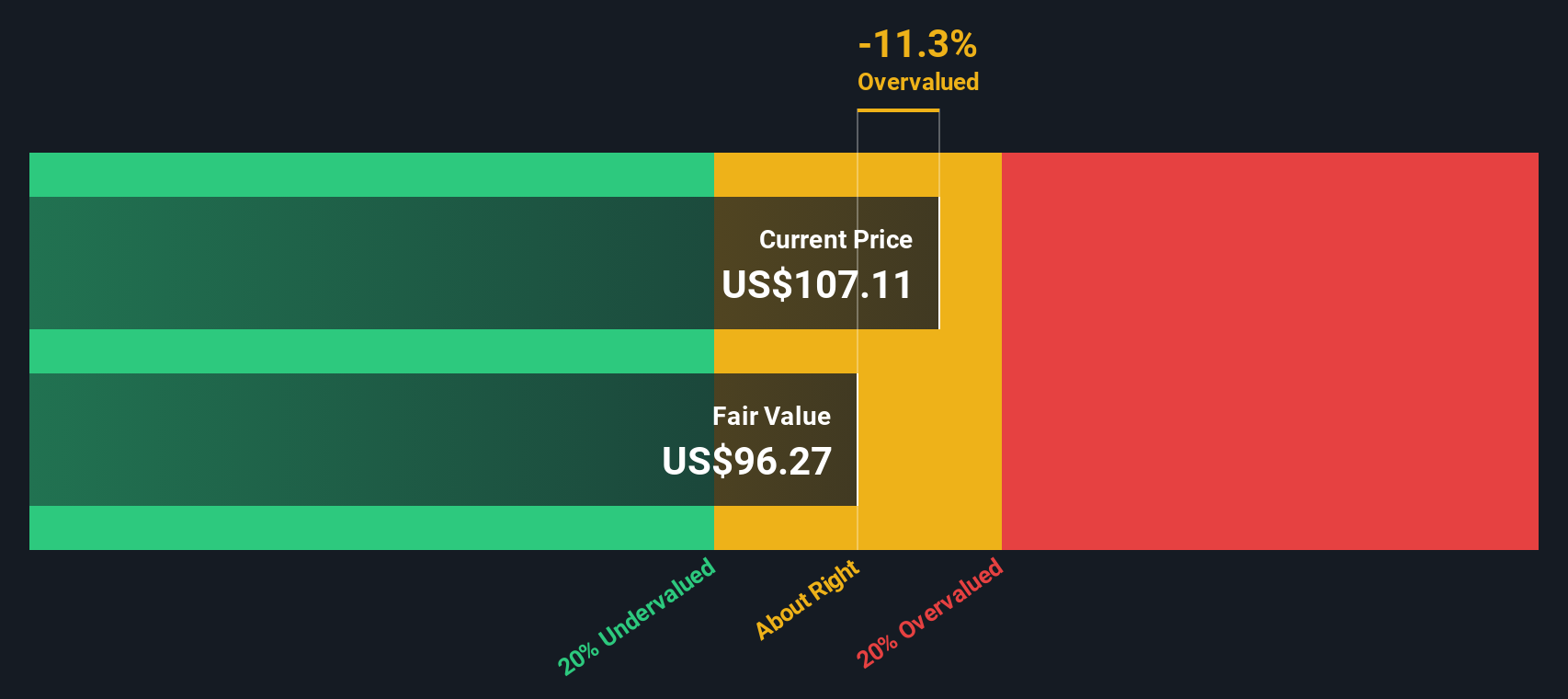

Another View: SWS DCF Model

Looking at Bank of New York Mellon through the lens of our DCF model, the numbers tell a slightly different story. Based on future cash flow projections, the SWS DCF estimate puts the fair value below the current share price. This suggests the market might already be factoring in most of the company’s upside. Which scenario do you find more convincing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bank of New York Mellon for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 850 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bank of New York Mellon Narrative

If you have a different perspective or want to dig deeper into the data yourself, you can easily develop your own narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Bank of New York Mellon.

Looking for more investment ideas?

Great investing means always staying one step ahead. Don’t wait to find out what you could be missing. Take action and see what other opportunities are out there.

- Spot promising up-and-comers with potential by checking out these 3584 penny stocks with strong financials. These companies are shaking up their industries and attracting fresh investor interest.

- Tap into the artificial intelligence wave by reviewing these 26 AI penny stocks. This list features businesses innovating faster than the market can keep up.

- Power up your portfolio by targeting income potential through these 21 dividend stocks with yields > 3%. These selections deliver reliable returns above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of New York Mellon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BK

Bank of New York Mellon

Provides a range of financial products and services in the United States and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives