- United States

- /

- Consumer Finance

- /

- NYSE:BFH

How Investors May Respond To Bread Financial Holdings (BFH) $72 Million Series A Preferred Stock Offering

Reviewed by Sasha Jovanovic

- Earlier this week, Bread Financial Holdings, Inc. announced the successful pricing of an underwritten public offering of 3,000,000 depositary shares, each representing a 1/40th interest in its Series A Preferred Stock with an 8.625% dividend rate and a liquidation preference of US$25 per share, expecting to raise approximately US$72.6 million in net proceeds for general corporate purposes and potential share repurchases.

- An interesting aspect of this offering is the listing of the depositary shares on the New York Stock Exchange, with Fitch Ratings assigning a 'B-' rating to the new perpetual, non-cumulative preferred stock issuance.

- We'll examine how this preferred stock offering, which enhances capital flexibility and funding, could influence Bread Financial's investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Bread Financial Holdings Investment Narrative Recap

To be a shareholder in Bread Financial Holdings, you need to believe in its ability to balance funding flexibility and credit discipline as it shifts toward tech-driven financial solutions. The recent preferred stock offering helps improve the company’s capital position but doesn’t materially shift the immediate catalyst, which continues to be managing credit quality amid ongoing loan growth constraints; the largest risk remains that tighter credit standards could hinder future earnings expansion, especially if competitive pressures and higher funding costs persist.

The most relevant recent announcement is the October 2025 dividend increase, reflecting management's ongoing focus on shareholder returns. While this signals confidence, it should be considered in context with the company’s efforts to maintain cost discipline, increasing payouts alongside new capital raises and loan mix adjustments as Bread Financial faces an evolving operating environment and heightened pressure on margins.

However, investors should be aware that unlike the improving capital flexibility, the persistent risk of...

Read the full narrative on Bread Financial Holdings (it's free!)

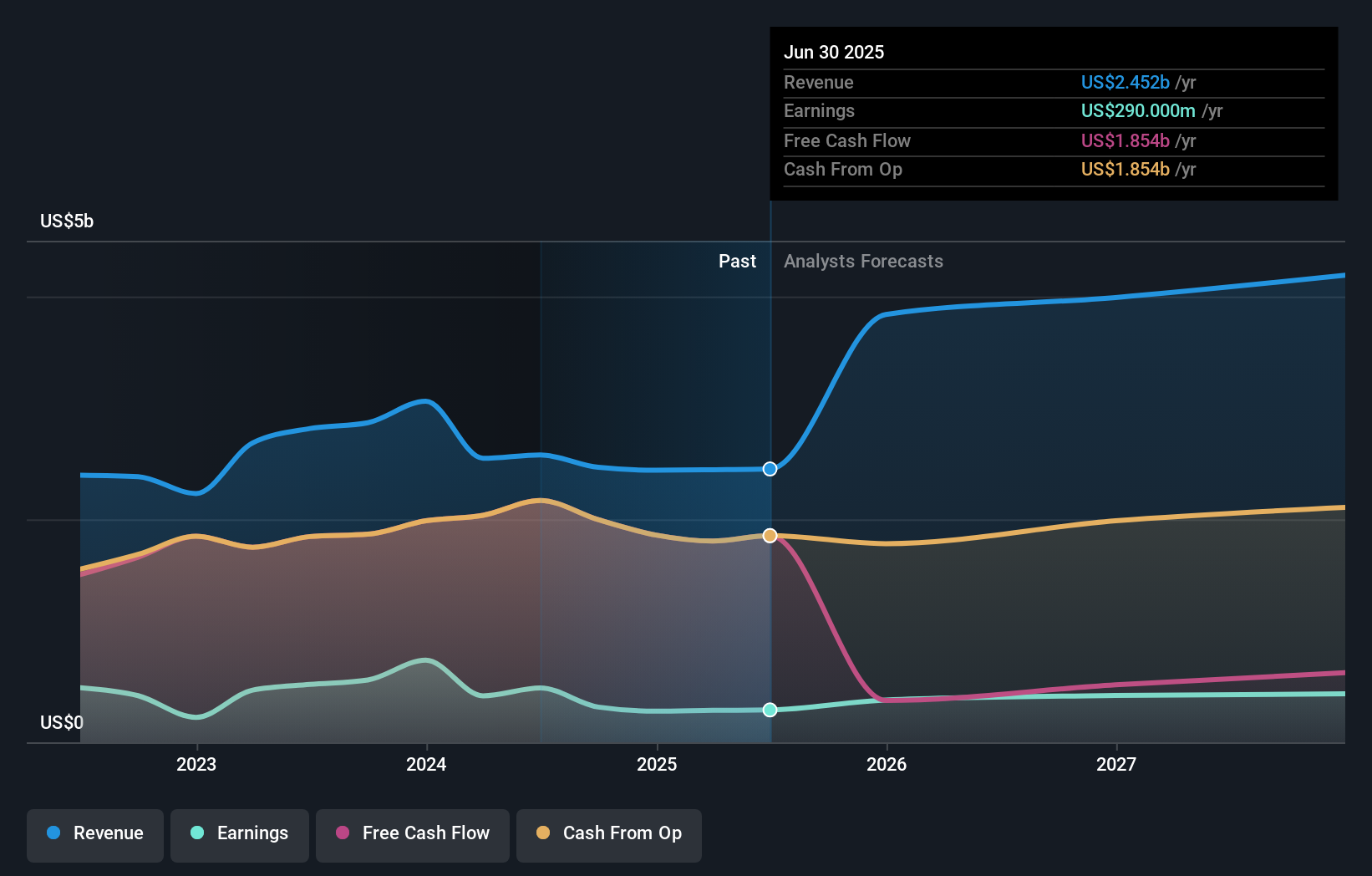

Bread Financial Holdings is projected to reach $4.3 billion in revenue and $379.5 million in earnings by 2028. This scenario assumes annual revenue growth of 20.3% and an earnings increase of $89.5 million from the current earnings of $290.0 million.

Uncover how Bread Financial Holdings' forecasts yield a $70.20 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Only one fair value estimate from the Simply Wall St Community pegs Bread Financial at US$70.20 per share. With limited consensus and ongoing pressure from tighter credit standards potentially restricting earnings, your view on the path ahead could differ significantly from others, take time to compare a range of perspectives.

Explore another fair value estimate on Bread Financial Holdings - why the stock might be worth just $70.20!

Build Your Own Bread Financial Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bread Financial Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Bread Financial Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bread Financial Holdings' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bread Financial Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BFH

Bread Financial Holdings

Provides tech-forward payment and lending solutions to customers and consumer-based industries in North America.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives