- United States

- /

- Consumer Finance

- /

- NYSE:AXP

Do American Express’ (AXP) Las Vegas Perks Point to a New Era of Brand Differentiation?

Reviewed by Sasha Jovanovic

- American Express recently announced a series of premium card member experiences in Las Vegas, offering exclusive access to luxury hotels, restaurants, and major events such as the Formula 1 Heineken Las Vegas Grand Prix, in addition to launching a dedicated pop-up lounge at ARIA Resort & Casino.

- A particularly interesting aspect is the expanded integration with Resy, enabling eligible card members to secure exclusive dining experiences at top Las Vegas venues, further strengthening the company’s appeal among affluent and experience-seeking consumers.

- We'll explore how these enhanced Las Vegas experiences could reinforce American Express's premium brand positioning and customer engagement strategy.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

American Express Investment Narrative Recap

To own American Express stock, you need to believe in its ability to maintain a strong premium brand and capitalize on consumer demand for exclusive experiences, particularly among affluent and younger cardholders. The recent Las Vegas experiences announcement plays to these strengths, but does not materially change the near-term catalyst, continued premium cardmember growth, or significantly alter the main risk, which is intensifying competition driving up acquisition costs and pressuring margins.

Of all recent announcements, the launch of "1850 by American Express" at ARIA Resort & Casino stands out. This exclusive, hospitality-focused lounge experience directly supports American Express’s strategy of deepening engagement with premium cardholders, which remains the key driver for brand loyalty and long-term fee income growth.

Yet, in contrast, investors should also watch for signs that premium market competition may push customer expenses even higher than...

Read the full narrative on American Express (it's free!)

American Express' narrative projects $85.7 billion in revenue and $13.5 billion in earnings by 2028. This requires 10.6% yearly revenue growth and a $3.5 billion earnings increase from $10.0 billion today.

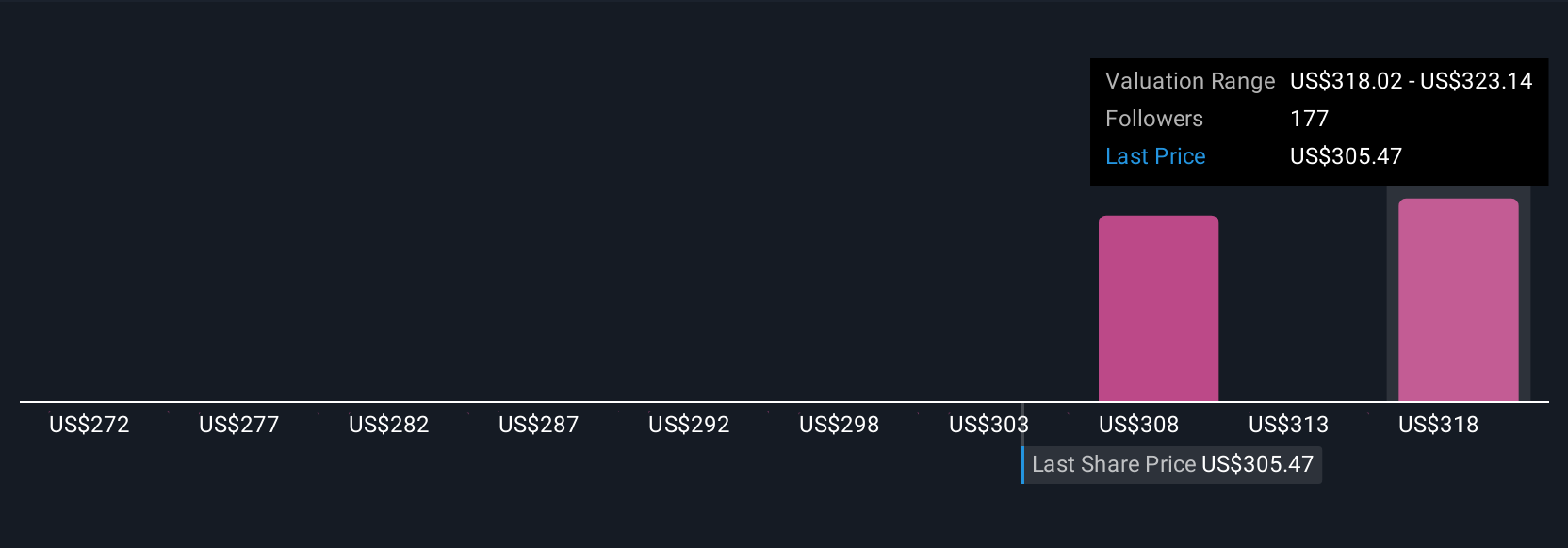

Uncover how American Express' forecasts yield a $349.41 fair value, a 5% downside to its current price.

Exploring Other Perspectives

Compared to the baseline outlook, the most optimistic analysts were expecting American Express to hit US$85,000,000,000 in annual revenue and US$14,700,000,000 in earnings before this news. You may want to compare their upbeat view, driven by expectations of younger cardholder spend and international growth, to the increased risk that digital alternatives and persistent competition could eat into future profits. There is always more than one way to view where American Express goes from here.

Explore 8 other fair value estimates on American Express - why the stock might be worth as much as $366.63!

Build Your Own American Express Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Express research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free American Express research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Express' overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AXP

American Express

Operates as integrated payments company in the United States, Europe, the Middle East and Africa, the Asia Pacific, Australia, New Zealand, Latin America, Canada, the Caribbean, and Internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives