- United States

- /

- Capital Markets

- /

- NYSE:ARES

Assessing Ares Management After a 6.5% Rally and Regulatory Headline Volatility

Reviewed by Bailey Pemberton

- Ever catch yourself wondering if Ares Management is a hidden gem or an overhyped play? You are not alone. Breaking down the numbers can reveal more than you might expect.

- Shares have moved up 6.5% over the last week and 2.4% over the past 30 days. However, they are still down 13.6% for the year and 9.3% over the last 12 months, despite a substantial 291.8% gain in five years.

- Much of the recent volatility has been tied to shifting market sentiment about alternative asset managers, along with news of potential regulatory changes that could impact the sector. These headlines have influenced the stock, but long-term growth trends remain a central topic in financial circles.

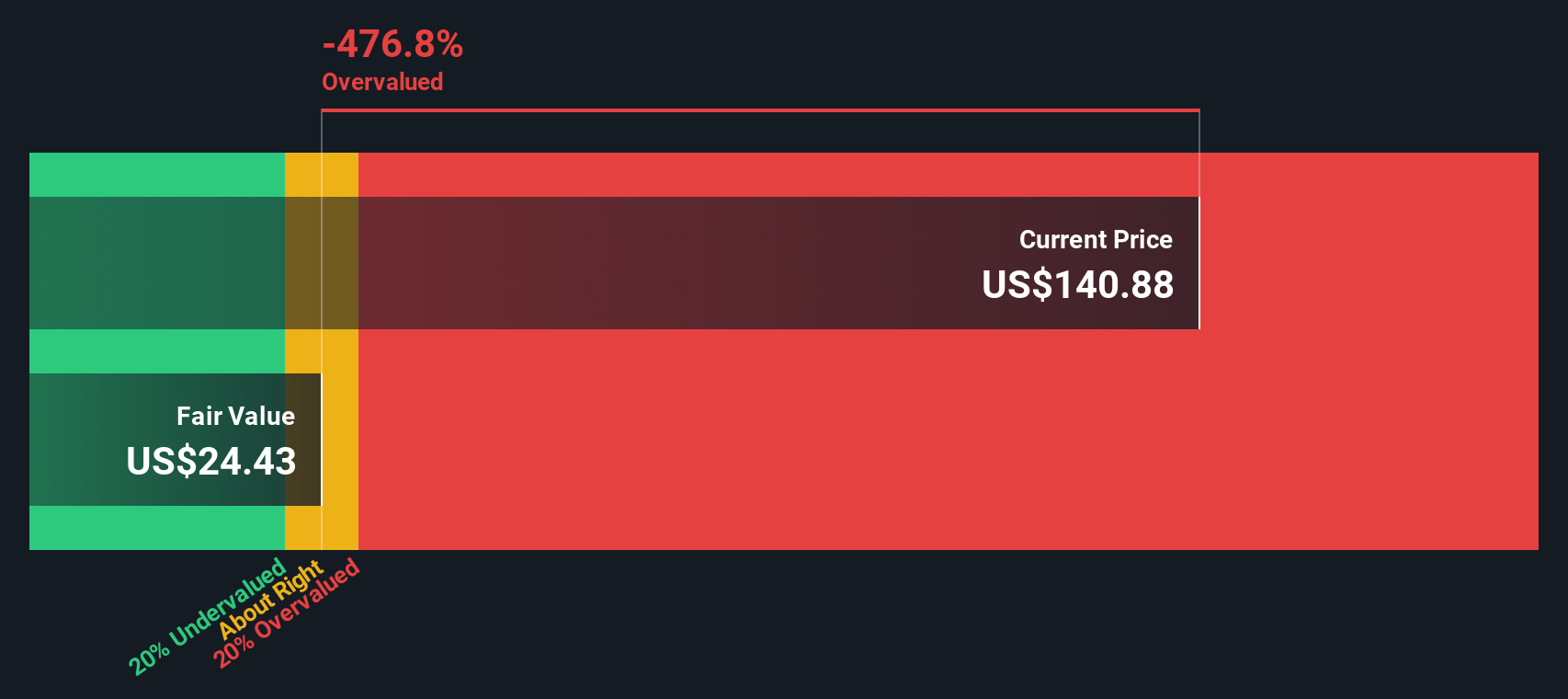

- Ares Management currently has a valuation score of 0 out of 6 based on our analysis of undervaluation checks. Let’s look further into how different valuation methods compare. There is also a more nuanced way to put price into context that will be discussed before we finish.

Ares Management scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Ares Management Excess Returns Analysis

The Excess Returns model estimates a company’s intrinsic value by evaluating how much value it creates above its cost of equity. Specifically, it looks at the returns generated on invested capital after accounting for the minimum rate of return required by shareholders. This helps investors gauge whether management is making decisions that generate ongoing value beyond the cost of simply holding the capital.

For Ares Management, the Excess Returns approach highlights the following:

- Book Value: $13.68 per share

- Stable EPS: $2.03 per share (Source: Median Return on Equity from the past 5 years.)

- Cost of Equity: $0.87 per share

- Excess Return: $1.16 per share

- Average Return on Equity: 20.43%

- Stable Book Value: $9.94 per share (Source: Median Book Value from the past 5 years.)

Applying this model to Ares Management yields a projected intrinsic value that is substantially below its current market price. The model estimates the stock is 393.8% overvalued, signaling that investors are paying a significant premium above what its long-term fundamentals might justify.

Result: OVERVALUED

Our Excess Returns analysis suggests Ares Management may be overvalued by 393.8%. Discover 929 undervalued stocks or create your own screener to find better value opportunities.

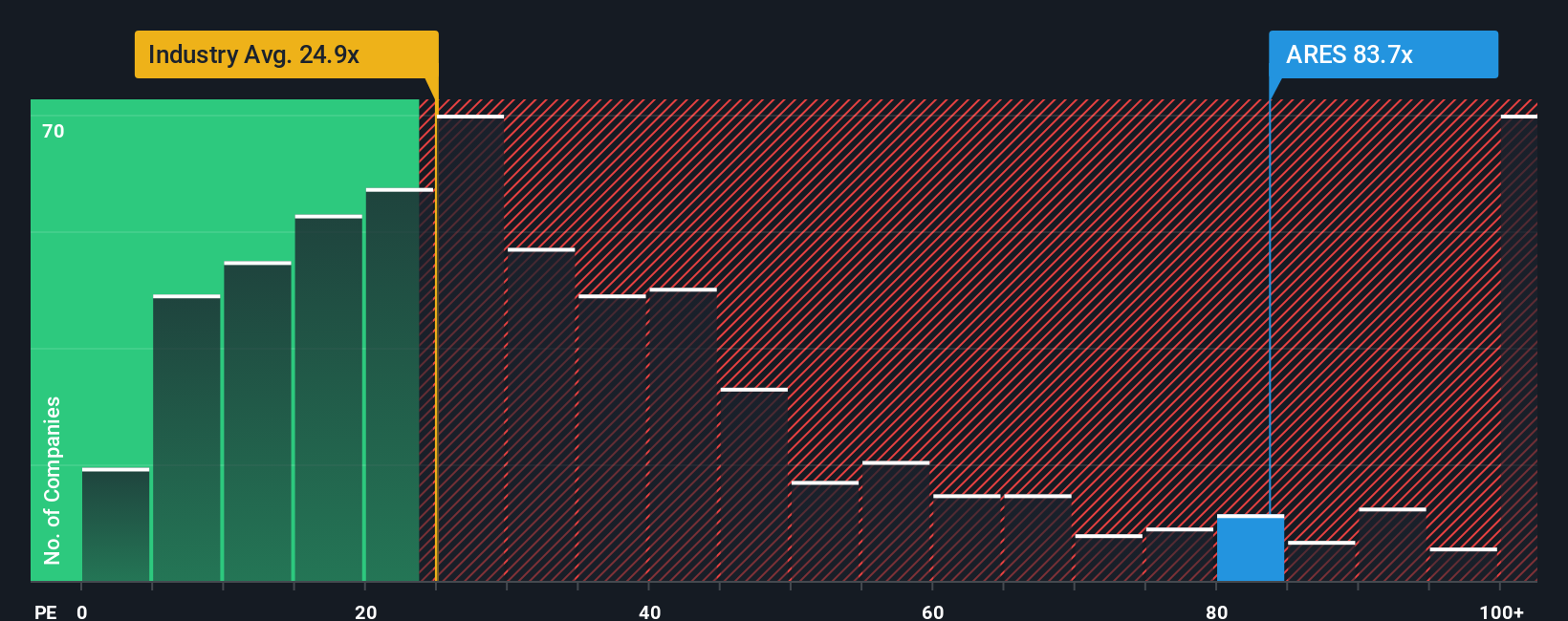

Approach 2: Ares Management Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies like Ares Management, as it gives investors a sense of how much they are paying for each dollar of earnings. This approach is especially relevant for companies with steady profits, providing a straightforward way to compare market valuations across businesses and sectors.

However, determining what constitutes a "normal" or "fair" PE ratio depends on a company’s expected earnings growth and perceived risk. Higher growth firms tend to justify higher PE ratios, as investors are willing to pay up for future prospects, while higher-risk companies usually warrant lower multiples.

Ares Management currently trades at a PE ratio of 66.5x. This is significantly above the Capital Markets industry average of 23.5x, as well as the peer average of 13.5x. While these direct comparisons can flag overvaluation, they sometimes overlook important factors unique to each business.

That is where Simply Wall St’s “Fair Ratio” stands out. This proprietary metric predicts a suitable multiple by incorporating not just growth rates, but also the company’s profit margins, industry group, market cap, and specific risks. For Ares Management, the Fair Ratio is estimated at 23.2x, capturing context that broad averages miss.

Comparing Ares’s current multiple of 66.5x to its Fair Ratio of 23.2x suggests the stock is trading at a substantial premium relative to what would be justified by its fundamentals and outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

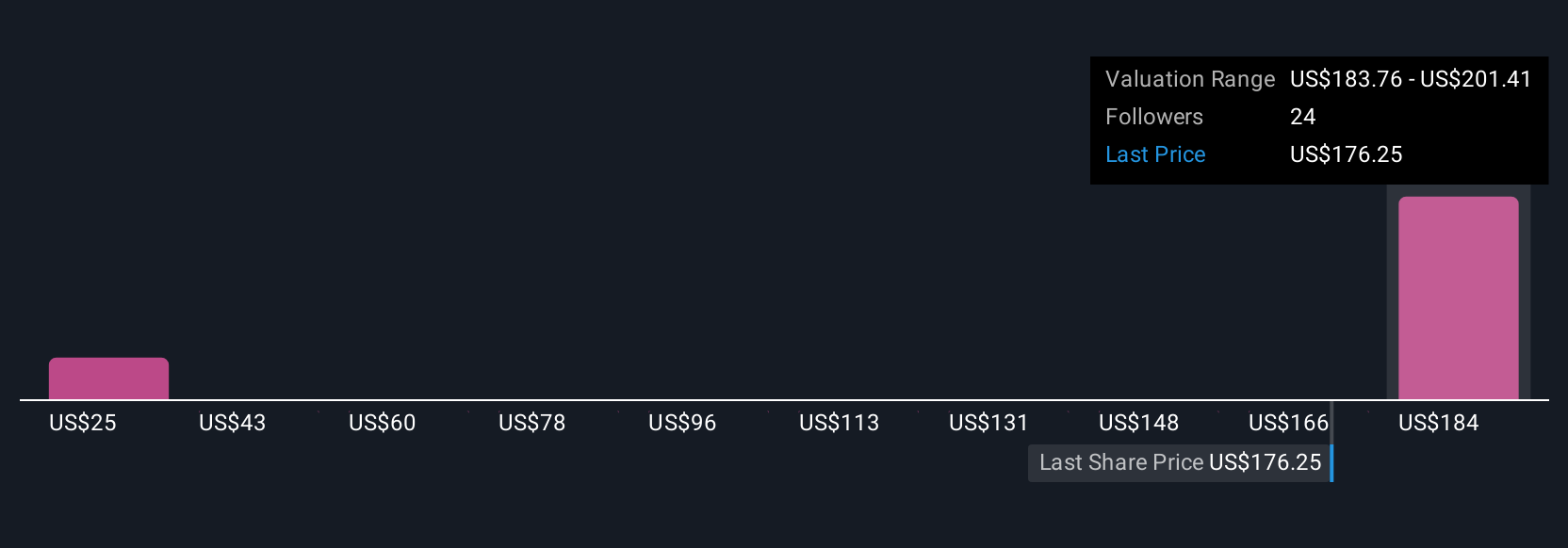

Upgrade Your Decision Making: Choose your Ares Management Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personalized story about where a company is headed, built by combining your assumptions for future revenue, earnings, and margins into a forecast and a fair value that makes sense to you. Narratives connect a company's business outlook, explaining the "why" behind the numbers, to a financial forecast. This results in a fair value estimate that is rooted in your perspective, not just in averages or analyst estimates.

The Simply Wall St Community page gives every investor a platform to create, share, and revise Narratives using simple, guided tools. This approach makes advanced investing strategies more accessible and interactive. By crafting or comparing Narratives, you can easily see when your fair value is above or below the market price, helping to clarify your investment decisions.

Narratives update dynamically as news or earnings are released, so your investment thesis evolves with the market. For example, in the Community, one investor might believe Ares Management deserves a $215 price target due to its global expansion and recurring revenues, while another could justify a more cautious $160 target, reflecting different expectations for competition and regulatory risk. Narratives enable you to base your investment choices on your own analysis and keep them updated in real time, rather than relying on someone else's perspective.

Do you think there's more to the story for Ares Management? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARES

Ares Management

Operates as an alternative asset manager in the United States, Europe, and Asia.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success