- United States

- /

- Diversified Financial

- /

- NYSE:APO

Apollo Global Management (APO) Valuation After Its Defensive Pivot Toward Risk Management and Balance Sheet Strength

Reviewed by Simply Wall St

Apollo Global Management (APO) is pivoting hard toward defense by unloading higher risk AI and software linked loans, stockpiling cash, and publicly flagging insurance sector vulnerabilities tied to offshore regulatory arbitrage.

See our latest analysis for Apollo Global Management.

Those moves sit against a choppy backdrop for Apollo, where a strong 14.51 percent one month share price return contrasts with a negative year to date share price return and a still impressive 143.97 percent three year total shareholder return. This hints that near term jitters have not fully derailed the longer term momentum.

If Apollo’s more cautious stance has you thinking about portfolio resilience, it could be a good moment to explore aerospace and defense stocks as another way to position around defense related themes.

With the shares down double digits over the past year, but still trading only modestly below Wall Street’s target, is Apollo quietly offering value after its defensive pivot, or is the market already pricing in the next leg of growth?

Most Popular Narrative: 5.9% Undervalued

Compared with Apollo Global Management's last close at $148.89, the most followed narrative points to a modest upside based on its fair value estimate.

The analysts have a consensus price target of $161.856 for Apollo Global Management based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $178.0, and the most bearish reporting a price target of just $117.7.

Want to see how shrinking revenues can coexist with rising profits and a higher earnings multiple? The playbook behind this fair value is anything but conventional.

Result: Fair Value of $158.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent execution challenges or tougher regulation in insurance and credit could squeeze spreads, delay growth targets, and force a reconsideration of today’s generally positive assumptions.

Find out about the key risks to this Apollo Global Management narrative.

Another Angle on Valuation

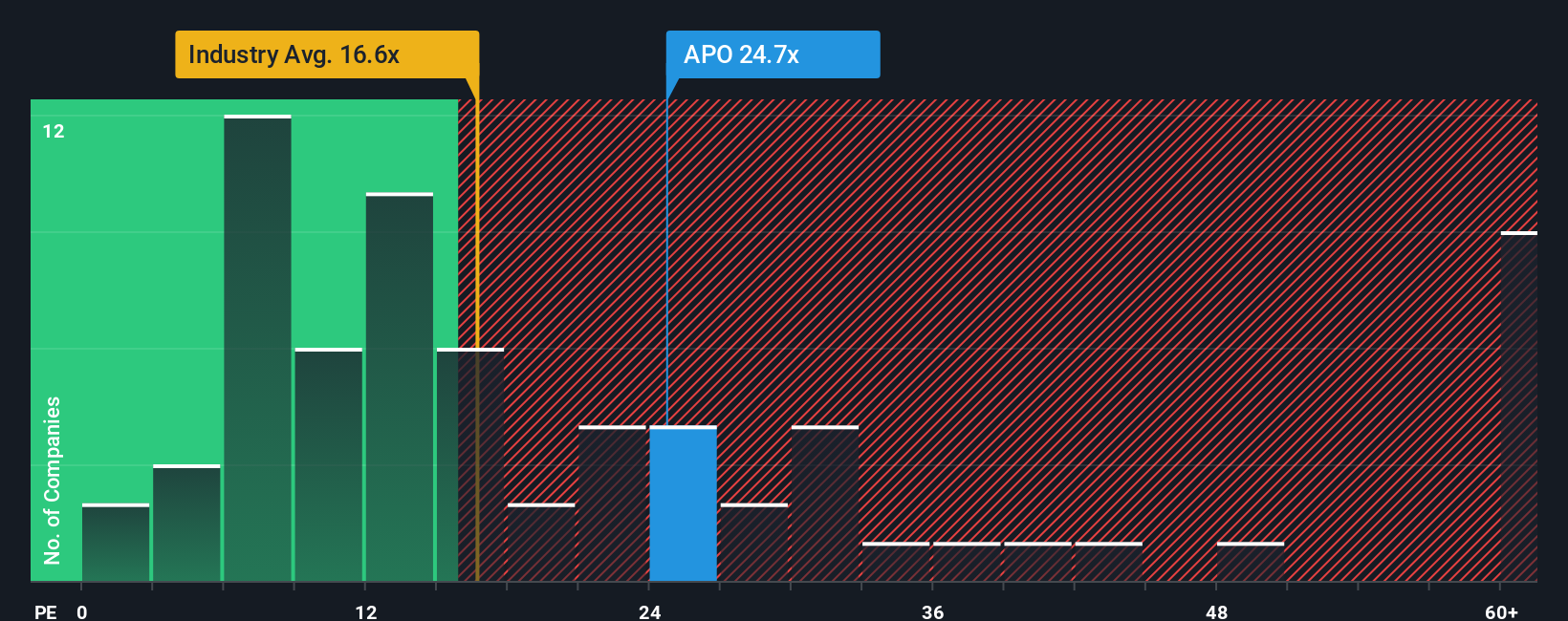

On earnings, Apollo does not look cheap. It trades on a 21.3x price to earnings ratio versus 13.7x for the US diversified financials industry and a fair ratio of 23.4x. That leaves less room for error if profit growth or margins fall short of the optimistic narrative.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Apollo Global Management Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a personalized view in just minutes: Do it your way.

A great starting point for your Apollo Global Management research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next investing edge?

Do not stop at one opportunity; use the Simply Wall Street Screener today to uncover fresh ideas that sharpen your strategy and help you stay ahead of the crowd.

- Capture potential market mispricings by targeting quality companies trading below intrinsic value through these 902 undervalued stocks based on cash flows.

- Capitalize on transformative trends in machine intelligence by scouting high growth innovators featured in these 24 AI penny stocks.

- Strengthen your income stream by focusing on resilient businesses highlighted in these 10 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APO

Apollo Global Management

A private equity firm specializing in investments in credit, private equity, infrastructure, secondaries and real estate markets.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion