- United States

- /

- Diversified Financial

- /

- NYSE:APO

Apollo Global Management (APO): Exploring Valuation Following Recent Market Volatility

Reviewed by Kshitija Bhandaru

Apollo Global Management (APO) has recently drawn attention as investors survey the stock’s recent moves, with shares closing at $121.38. Market sentiment appears split, especially as APO has seen swings over the past month.

See our latest analysis for Apollo Global Management.

Over the past year, Apollo Global Management’s share price has taken investors for a ride, with notable volatility in recent weeks adding to the bigger picture. While the year-to-date share price return stands at -26.82%, long-term holders have still seen an impressive 232.83% five-year total shareholder return. This hints at enduring strength behind the short-term noise.

If you’re watching how market momentum shifts, it could be the perfect moment to broaden your scope and discover fast growing stocks with high insider ownership

With APO shares trading below analyst targets and at a sizable discount to estimated intrinsic value, investors are left to wonder if the market is overlooking future growth potential or if everything is already priced in.

Most Popular Narrative: 25% Undervalued

The most widely followed narrative sees Apollo Global Management’s fair value as meaningfully above its $121.38 last close. This sets up a tension: are investors missing a key opportunity, or are there hidden assumptions driving such optimism?

"The company's strategic focus on the global industrial renaissance, particularly in areas like energy and infrastructure, is anticipated to significantly boost origination volumes, enhancing both revenue and earnings. Apollo's expansion into retirement solutions and evolving products for guaranteed income, alongside legislative prospects, could stimulate strong growth in retirement inflows, positively impacting net margins."

Want to know the bold financial projections behind this narrative’s high valuation? The real story hinges on rapid profit growth and transformed margins. The numbers fueling this fair value are far from conservative. Discover which outlier forecasts power this dramatic upside scenario.

Result: Fair Value of $161.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, internal execution challenges and rising competition in the insurance sector could stall Apollo’s growth if management fails to deliver on its ambitious targets.

Find out about the key risks to this Apollo Global Management narrative.

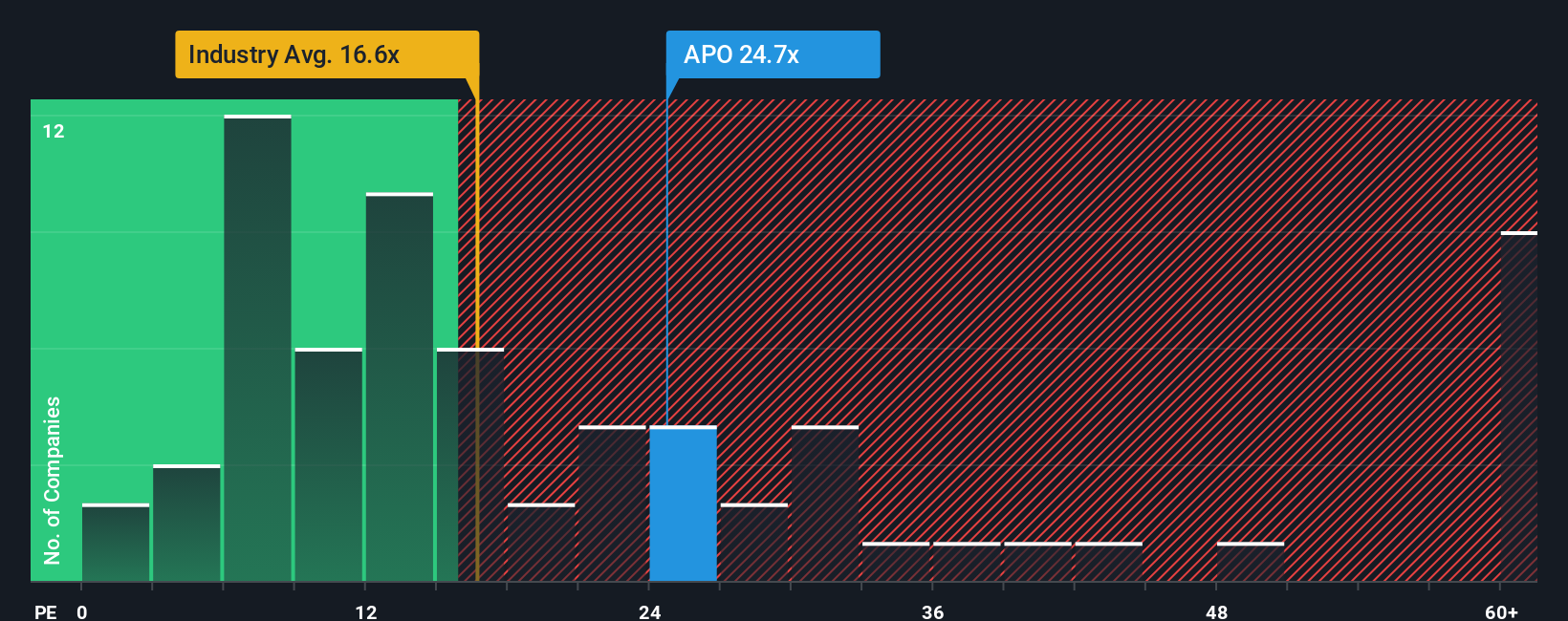

Another View: How Multiples Stack Up

Looking at valuation through the price-to-earnings lens, Apollo Global Management trades at 22x earnings. This is notably higher than both the industry average of 16.1x and the peer average of 20.2x. The fair ratio, however, sits at 25.1x. This suggests that while Apollo appears pricey on the surface, the market could eventually assign it an even higher multiple. Does this signal untapped upside or extra risk if sentiment changes?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Apollo Global Management Narrative

If you see things differently or want to dig deeper on your own, the tools to craft your own view are just a few clicks away, and it only takes minutes. Do it your way

A great starting point for your Apollo Global Management research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

There is a whole world of exciting stocks waiting for you. Don’t limit yourself. See what you could be missing and make your next move count.

- Target future income by tapping into these 18 dividend stocks with yields > 3% with attractive yields for cash flow-focused investors.

- Accelerate your portfolio’s growth by checking out these 24 AI penny stocks making waves with breakthroughs in automation, data, and next-gen intelligence.

- Capitalize on emerging blockchain trends and financial innovation through these 79 cryptocurrency and blockchain stocks shaping how digital assets and technologies are transforming markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APO

Apollo Global Management

A private equity firm specializing in investments in credit, private equity, infrastructure, secondaries and real estate markets.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives