- United States

- /

- Capital Markets

- /

- NYSE:APAM

Will Analyst Confidence and Revenue Growth Shape Artisan Partners Asset Management's (APAM) Investment Narrative?

Reviewed by Sasha Jovanovic

- Artisan Partners Asset Management recently reported quarterly earnings, with analysts having anticipated 8.7% year-on-year revenue growth to US$304 million, signaling steady operational momentum.

- Analyst expectations remained steady prior to the announcement, indicating confidence in Artisan Partners' consistency and alignment with sector performance among capital markets peers who reported earlier.

- We’ll assess how strong analyst confidence and revenue growth expectations ahead of the latest earnings shape the company’s investment narrative.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Artisan Partners Asset Management Investment Narrative Recap

To be a shareholder in Artisan Partners Asset Management, you need to believe in the company’s ability to deliver steady growth in assets under management and navigate operational expansion in a competitive sector. The latest earnings expectations reinforce management’s track record for meeting analyst forecasts, though they do not materially shift the key short-term catalyst, continued growth through new client channels, nor do they affect the biggest risk, which remains margin pressure driven by increased operating complexity and distribution costs. Of recent announcements, the Q2 2025 financials are most relevant, as they showed rising revenue and improved net income, directly aligning with the company’s earnings momentum. These results reinforce the importance of Artisan’s growth efforts, particularly as it launches new investment strategies and expands into the intermediated wealth channel, though at the risk of cost pressures weighing on profitability. In contrast, investors should not overlook how margin compression from increased operating expenses could affect returns in the quarters ahead...

Read the full narrative on Artisan Partners Asset Management (it's free!)

Artisan Partners Asset Management's outlook forecasts $1.4 billion in revenue and $303.7 million in earnings by 2028. This scenario assumes annual revenue growth of 8.1% and a $56.7 million increase in earnings from the current $247.0 million.

Uncover how Artisan Partners Asset Management's forecasts yield a $46.12 fair value, a 3% upside to its current price.

Exploring Other Perspectives

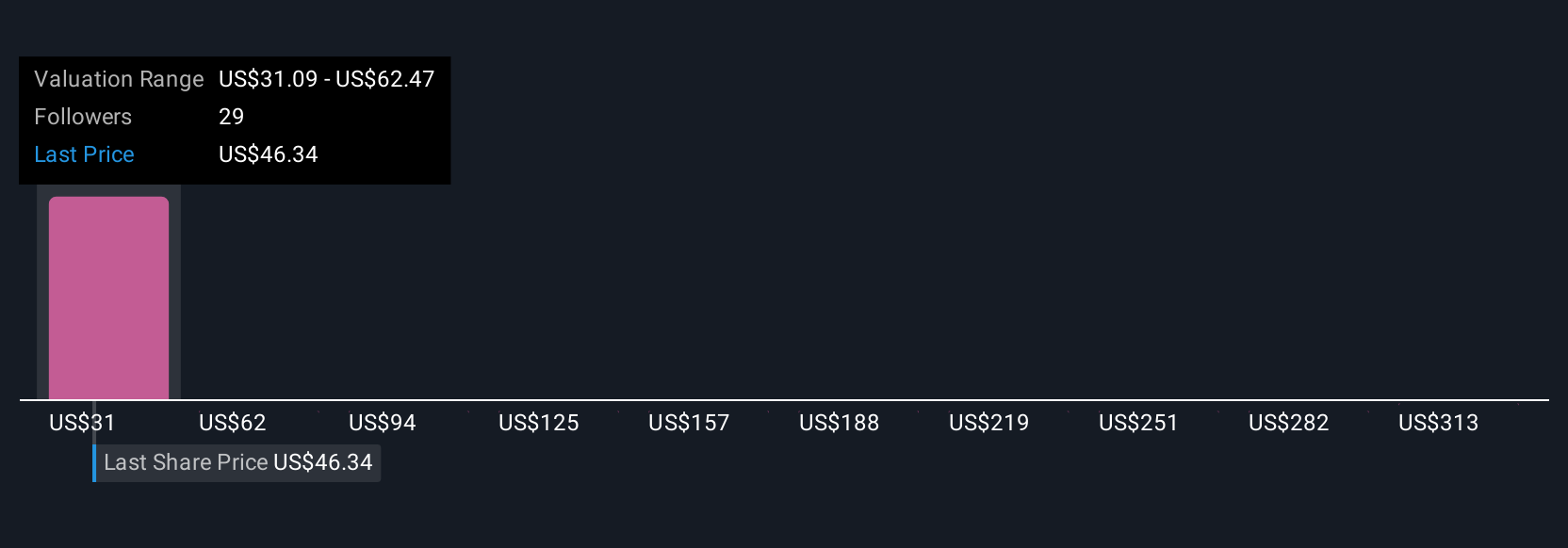

Six members of the Simply Wall St Community estimate APAM’s fair value anywhere from US$31.09 to US$344.87 per share. With expanded investment strategies adding operational complexity, now is the time to consider how different expectations might impact the company’s future growth and margins.

Explore 6 other fair value estimates on Artisan Partners Asset Management - why the stock might be worth 30% less than the current price!

Build Your Own Artisan Partners Asset Management Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Artisan Partners Asset Management research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Artisan Partners Asset Management research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Artisan Partners Asset Management's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APAM

Artisan Partners Asset Management

Artisan Partners Asset Management Inc. is publicly owned investment manager.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives