- United States

- /

- Capital Markets

- /

- NYSE:AMP

Examining Ameriprise Financial Stock After 14% Drop and New Wealth Management Strategy

Reviewed by Bailey Pemberton

- Wondering if Ameriprise Financial stock is still a smart place for your money? Let's take a closer look at what makes it stand out on a value basis.

- The share price closed at $453.47, delivering a steady 0.8% gain in the past week. However, it remains down 6.4% over the last month and 14.4% year-to-date, so there has been real movement for investors to consider.

- Recent headlines have drawn attention to Ameriprise Financial’s evolving strategy in wealth management and the growing demand for financial planning, fueling some uncertainty and optimism among investors. Notably, industry analysts have highlighted Ameriprise’s ongoing focus on client retention and strategic expansion as a response to changing market dynamics.

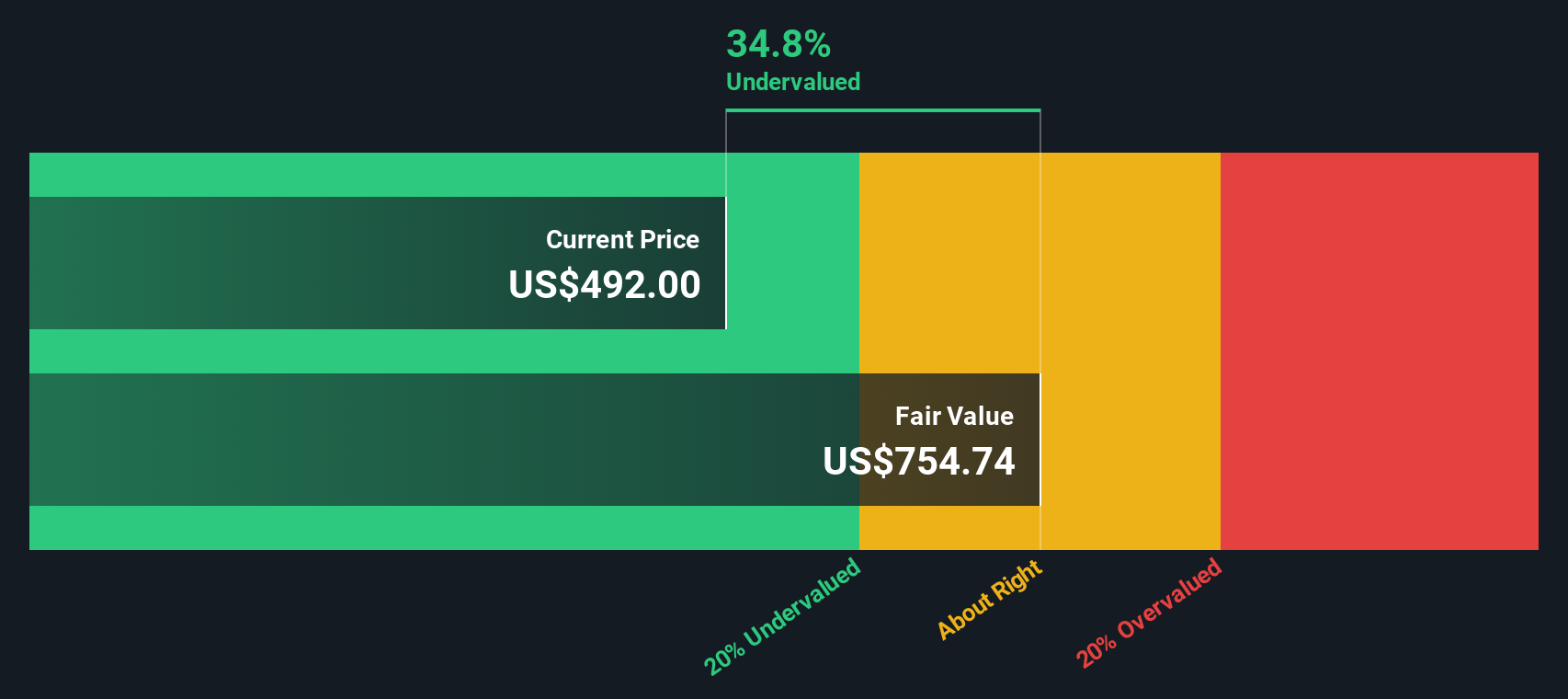

- Ameriprise Financial currently holds a valuation score of 5 out of 6, suggesting it is undervalued by most metrics we track. In this article, we will break down those different valuation approaches and, at the end, reveal a way to get an even deeper understanding of what that valuation score means.

Find out why Ameriprise Financial's -19.7% return over the last year is lagging behind its peers.

Approach 1: Ameriprise Financial Excess Returns Analysis

The Excess Returns model helps investors understand a company's ability to generate returns beyond its cost of equity. In other words, it measures how much value Ameriprise Financial can create above the minimum required by its shareholders. This approach emphasizes sustainable profitability, efficient capital use, and long-term growth prospects.

For Ameriprise Financial, the model calculates a Book Value of $69.31 per share and a Stable Earnings Per Share (EPS) of $42.55, based on forward-looking Return on Equity data from five analysts. The company’s Cost of Equity stands at $6.97 per share, which is the expected return required by investors. After accounting for this, Ameriprise Financial delivers an Excess Return of $35.59 per share. This highlights its ability to consistently generate value well above its funding cost.

Ameriprise’s average Return on Equity is remarkably strong at 50.51%, with a Stable Book Value projection of $84.26 per share provided by six analysts. These figures reflect the company’s historical and potential capability to create shareholder value through prudent capital management.

The resulting intrinsic value from this Excess Returns analysis is $794.97 per share. Compared to the current share price of $453.47, the stock appears 43.0% undervalued based on this methodology.

Result: UNDERVALUED

Our Excess Returns analysis suggests Ameriprise Financial is undervalued by 43.0%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

Approach 2: Ameriprise Financial Price vs Earnings

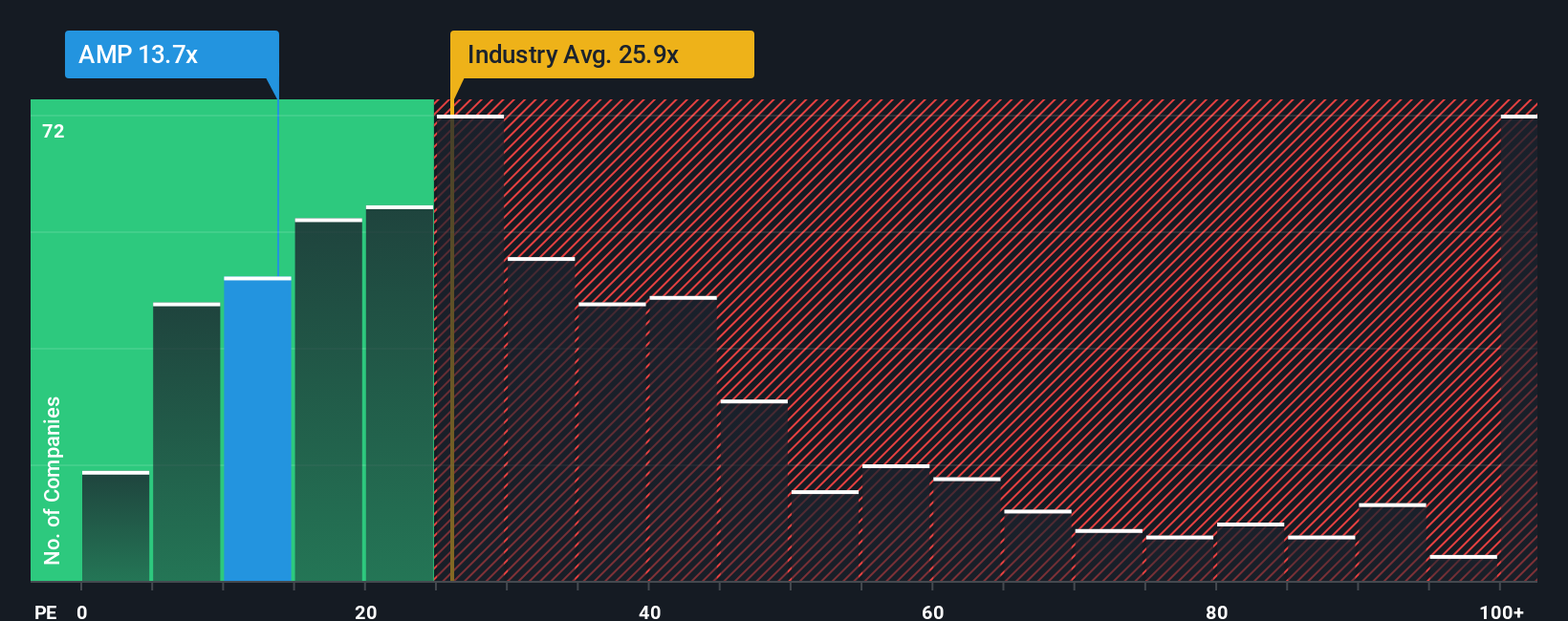

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies because it compares a company’s current share price to its per-share earnings. This allows investors to assess how much the market is willing to pay for each dollar of earnings. The PE ratio is particularly relevant for companies like Ameriprise Financial that generate strong and consistent profits.

Growth expectations and perceived risk are major factors that shape what is considered a "normal" or "fair" PE ratio. Companies expected to grow faster or perceived as lower risk typically command higher PE ratios. In contrast, those facing headwinds or risks tend to trade at lower multiples. It is important not just to look at the headline PE ratio in isolation.

Ameriprise Financial’s current PE ratio stands at 11.62x. When compared with the Capital Markets industry average of 23.54x and the peer average of 27.21x, AMP is trading at a significant discount. However, benchmarks like industry and peer multiples are only part of the story. Simply Wall St’s proprietary Fair Ratio for AMP is 15.10x. This figure is based on an in-depth analysis that not only considers industry and market factors, but also Ameriprise’s specific growth rates, profit margins, size and risk profile. This provides investors with a more tailored benchmark than using peer or industry averages alone.

Because AMP’s current PE ratio of 11.62x is notably lower than its Fair Ratio of 15.10x, the stock appears undervalued using this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ameriprise Financial Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a story you create about a company that combines your perspective with your own assumptions for its future revenue, earnings, and margins, helping you define what you believe is a fair value for the stock.

Rather than just looking at static numbers, Narratives connect what you know or believe about Ameriprise Financial, such as its expansion into new banking products or changes in market conditions, to a financial forecast and ultimately to a clear, actionable fair value.

Narratives are an easy and accessible feature on Simply Wall St’s Community page, trusted by millions of investors. They enable you to track your thesis in real-time because each Narrative is updated automatically when new news or earnings updates are released.

This approach means you can instantly see whether your fair value, calculated from your own story, suggests a buy, hold, or sell compared to the current price.

For example, one Ameriprise Financial Narrative could focus on positive catalysts such as adviser recruitment and tech investment, leading to a high fair value of $650 per share. In contrast, a more cautious Narrative might emphasize revenue headwinds and heightened market volatility, resulting in a lower fair value of $434. Narratives empower you to make decisions based on your convictions, with dynamic support as new information emerges.

Do you think there's more to the story for Ameriprise Financial? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMP

Ameriprise Financial

Operates as a diversified financial services company in the United States and internationally.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success