- United States

- /

- Diversified Financial

- /

- NYSE:AGM

Should Investors Rethink Farmer Mac After a 20% Monthly Drop in 2025?

Reviewed by Bailey Pemberton

Trying to decide what to do with Federal Agricultural Mortgage stock can feel like you are standing at a crossroads, especially when the price movements have been anything but subtle lately. After hitting a peak earlier in the year, the stock recently dipped by 3.4% in the past week and a notable 20.6% over the last month. Year to date, it is still down 15.1%, and looking back over the past year, the slide totals 8.1%. If you zoom out, the story changes dramatically. Over the last five years, Federal Agricultural Mortgage shares are up a strong 180.2%. Even over a three-year window, the return stands at a healthy 75.9%.

These swings have reflected the broader shifts in market sentiment and sector developments. Changing interest rate expectations and investor reassessments of risk in the agricultural finance sector have created some short-term volatility, but that does not always tell the whole story about a company’s true worth. At today’s close of $163.12, the question many investors are asking is, “Is this stock undervalued or has the market fairly priced in the risks?”

Based on a 6-point valuation check, Federal Agricultural Mortgage earns a value score of 4, meaning it appears undervalued on four out of six measures. In the next section, I will walk you through these valuation approaches, highlighting both the factors that support the stock and those that may temper expectations. If you are searching for the best way to assess whether shares are truly a bargain, be sure to stick around for a unique perspective at the end of the article.

Why Federal Agricultural Mortgage is lagging behind its peers

Approach 1: Federal Agricultural Mortgage Excess Returns Analysis

The Excess Returns model is designed to assess whether a company creates value beyond its cost of equity by focusing on how efficiently management turns shareholder equity into profit over the long run. This approach highlights return on equity and the difference between what investors expect and what the business consistently delivers.

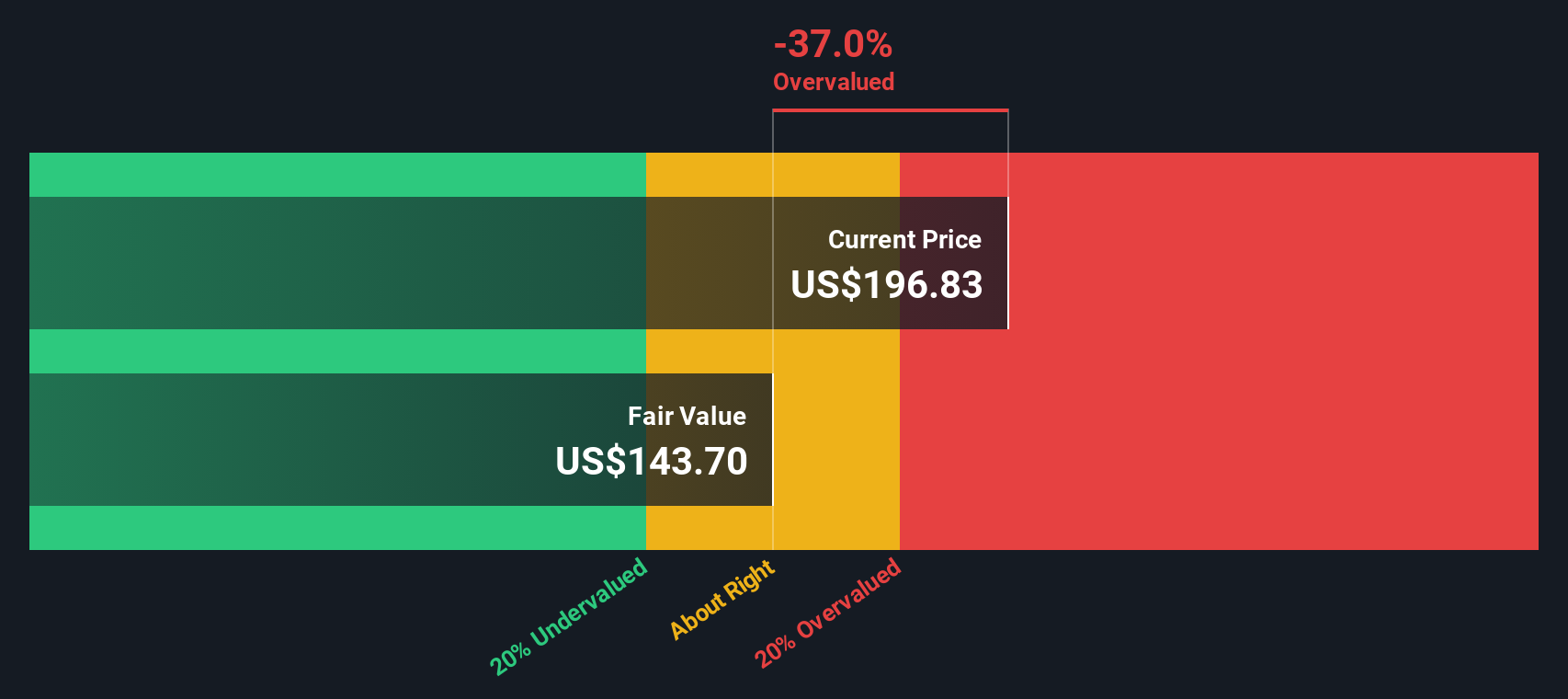

Federal Agricultural Mortgage shows a Book Value of $103.64 per share and a Stable Earnings Per Share of $17.01, representing the median return on equity from the past five years. With a Cost of Equity at $14.92 per share, the company delivers an Excess Return of $2.09 per share. Its average Return on Equity stands at 14.05%, indicating solid efficiency in generating profits from shareholders’ investments. Analysts estimate the Stable Book Value could rise to $121.09 per share in the coming years, based on future weighted projections.

Using these fundamentals, the Excess Returns model arrives at an intrinsic value of $143.70 per share. With the stock currently trading at $163.12, this approach suggests the shares are 13.5% overvalued. This implies that the market price already factors in or exceeds the value generated by the company’s ongoing returns on equity.

Result: OVERVALUED

Our Excess Returns analysis suggests Federal Agricultural Mortgage may be overvalued by 13.5%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Federal Agricultural Mortgage Price vs Earnings

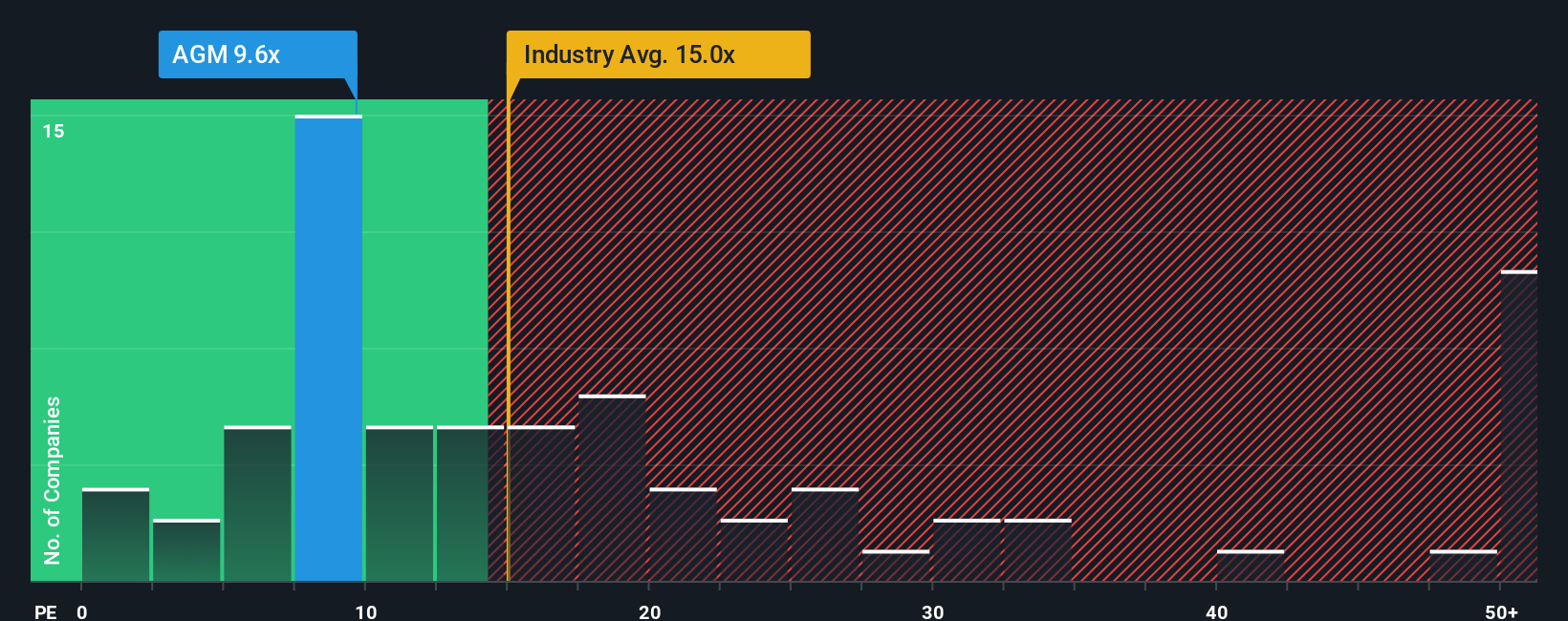

For companies like Federal Agricultural Mortgage that are consistently profitable, the price-to-earnings (PE) ratio is often the benchmark for market value. The PE ratio is popular because it quickly shows what investors are willing to pay for each dollar of current earnings, making it especially relevant for steady, earnings-producing businesses.

Interpreting a “normal” or “fair” PE ratio, though, is far from straightforward. Growth prospects, sector trends, and risk create wide differences across companies. Generally, faster-growing or less risky companies trade on higher PE multiples, while those with slowing growth or greater uncertainty command lower ones.

Federal Agricultural Mortgage currently trades at a PE ratio of 9.6x, which looks inexpensive alongside the Diversified Financial industry average of 16.5x and the peer average of 22.3x. To go a step beyond these broad comparisons, Simply Wall St uses a “Fair Ratio,” which is an in-depth calculation based on factors such as Federal Agricultural Mortgage’s projected earnings growth, profit margins, size, and industry risk profile. The Fair Ratio for the company comes in at 13.3x. This proprietary approach offers a more tailored benchmark than a plain industry or peer comparison, factoring in the specific strengths and risks relevant to Federal Agricultural Mortgage.

Since the Fair Ratio of 13.3x is notably higher than the company’s actual 9.6x, this indicates Federal Agricultural Mortgage stock is undervalued by this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Federal Agricultural Mortgage Narrative

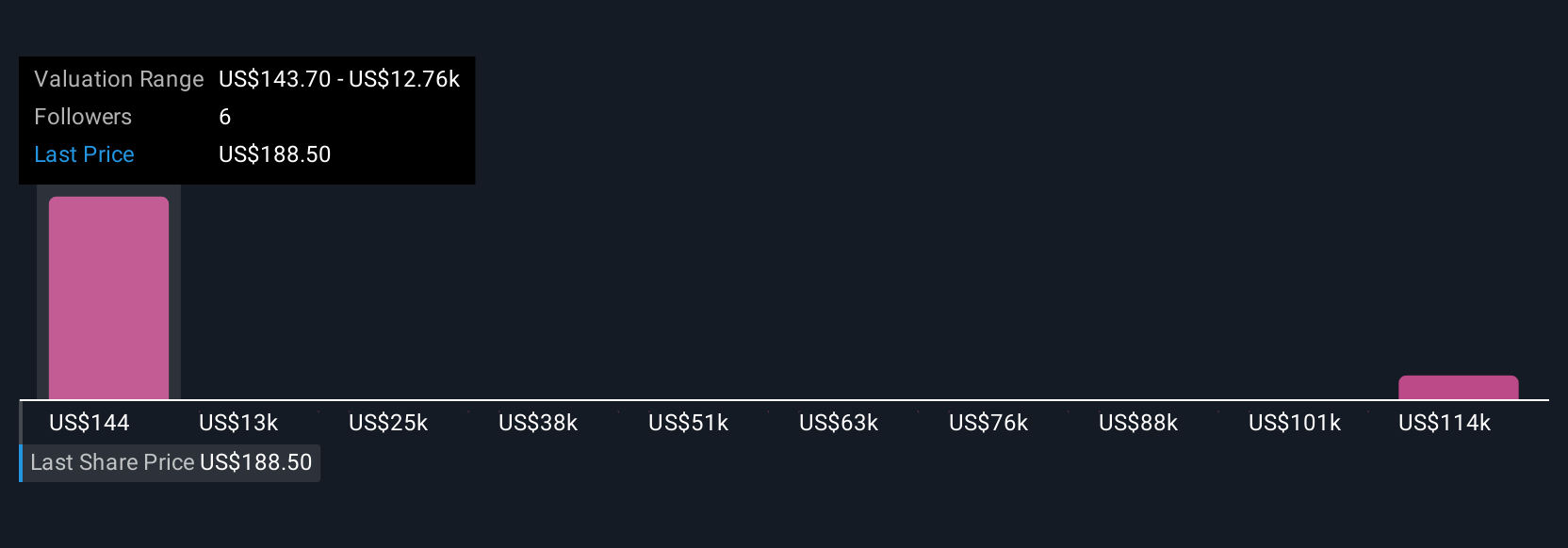

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your unique, evidence-based story about a company. It connects your assumptions about future revenue, profits, and business direction to a financial forecast and a fair value estimate, making your investment decisions both personal and data-driven.

Instead of just relying on ratios or models, Narratives allow you to create and adjust your own view of the company’s future, seeing how your expectations would affect its fair value. These dynamic Narratives, available right inside the Simply Wall St Community page, are a user-friendly tool trusted by millions of investors. They help you decide when to buy or sell by clearly comparing each Narrative’s fair value with the current price, and they automatically update when new earnings reports or news become available, so you are always equipped with the latest view.

For Federal Agricultural Mortgage, one investor might see strong revenue growth and assign a fair value of $226 per share, while another may focus on future risks and estimate just $143. Simply put, Narratives let every investor map out their own path with the numbers and the story together.

Do you think there's more to the story for Federal Agricultural Mortgage? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AGM

Federal Agricultural Mortgage

Provides a secondary market for various loans made to borrowers in the United States.

Established dividend payer and good value.

Market Insights

Community Narratives