- United States

- /

- Diversified Financial

- /

- NYSE:AGM

Leadership Changes and Growth Ambitions Could Be a Game Changer for Federal Agricultural Mortgage (AGM)

Reviewed by Sasha Jovanovic

- In late September 2025, Federal Agricultural Mortgage Corporation (Farmer Mac) announced the immediate appointment of Zachary N. Carpenter as President and COO following the resignation of Bradford T. Nordholm, with plans for Carpenter to succeed Nordholm as CEO upon his retirement in March 2027; the White House has also nominated Jeffrey Kaufmann to replace Chester Culver on the company's Board of Directors, pending Senate confirmation.

- These leadership transitions coincide with Farmer Mac's continued focus on expanding into new sectors such as renewable energy, broadband infrastructure, and corporate agribusiness to serve a broader segment of rural America.

- With Zachary Carpenter set to lead Farmer Mac, we'll assess how this shift in executive leadership could influence its longer-term investment thesis.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Federal Agricultural Mortgage Investment Narrative Recap

To be a shareholder in Federal Agricultural Mortgage Corporation (Farmer Mac), you need confidence in its role as a critical provider of credit flow into rural America, particularly its push into renewable energy, broadband, and infrastructure lending. Recent top-level executive and board transitions are not expected to materially change the near-term catalyst for Farmer Mac: maintaining loan growth and credit quality in volatile agricultural markets. However, these changes have not lessened the core risk, which remains exposure to rising credit losses amid sector headwinds.

The most relevant company development is the appointment of Zachary N. Carpenter as President and Chief Operating Officer, and his planned succession to CEO. His leadership has been central to expanding Farmer Mac's business into new segments, directly supporting ongoing efforts to find growth beyond traditional agricultural lending and providing some resilience against market shocks.

Yet, investors should also be aware that, in contrast to these growth efforts, rising credit risk in newer sectors like broadband and infrastructure finance remains an important consideration for...

Read the full narrative on Federal Agricultural Mortgage (it's free!)

Federal Agricultural Mortgage is projected to reach $514.9 million in revenue and $239.2 million in earnings by 2028. This forecast assumes an annual revenue growth rate of 11.8% and an earnings increase of $52.9 million from the current earnings of $186.3 million.

Uncover how Federal Agricultural Mortgage's forecasts yield a $226.00 fair value, a 40% upside to its current price.

Exploring Other Perspectives

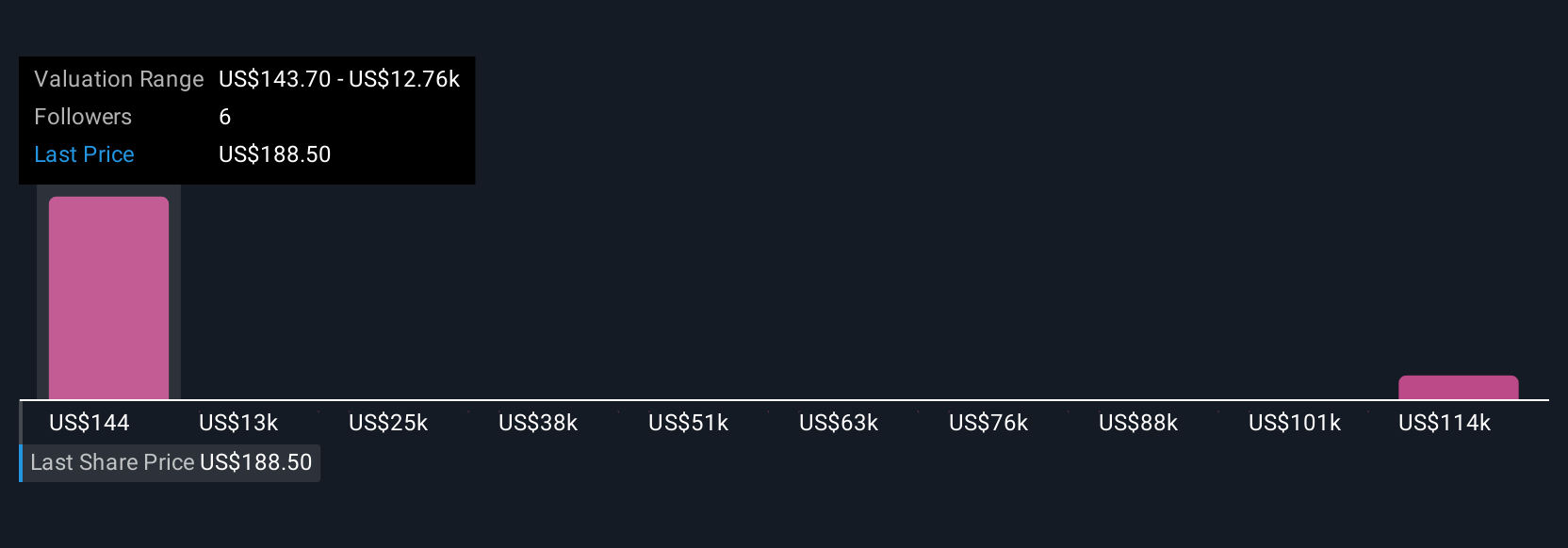

Five Simply Wall St Community fair value estimates for Farmer Mac range from US$143.70 to US$126,258.88 per share, capturing wide variation in outlooks. Persistent credit risk in newer lending sectors continues to shape expectations and is a key factor behind much of the debate about the company’s future performance.

Explore 5 other fair value estimates on Federal Agricultural Mortgage - why the stock might be a potential multi-bagger!

Build Your Own Federal Agricultural Mortgage Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Federal Agricultural Mortgage research is our analysis highlighting 6 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Federal Agricultural Mortgage research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Federal Agricultural Mortgage's overall financial health at a glance.

No Opportunity In Federal Agricultural Mortgage?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AGM

Federal Agricultural Mortgage

Provides a secondary market for various loans made to borrowers in the United States.

Established dividend payer and good value.

Market Insights

Community Narratives