- United States

- /

- Diversified Financial

- /

- NYSE:AGM

Farmer Mac (AGM) Profit Margin Tops 50%, Reinforcing Narratives on Profitability Versus Growth Debates

Reviewed by Simply Wall St

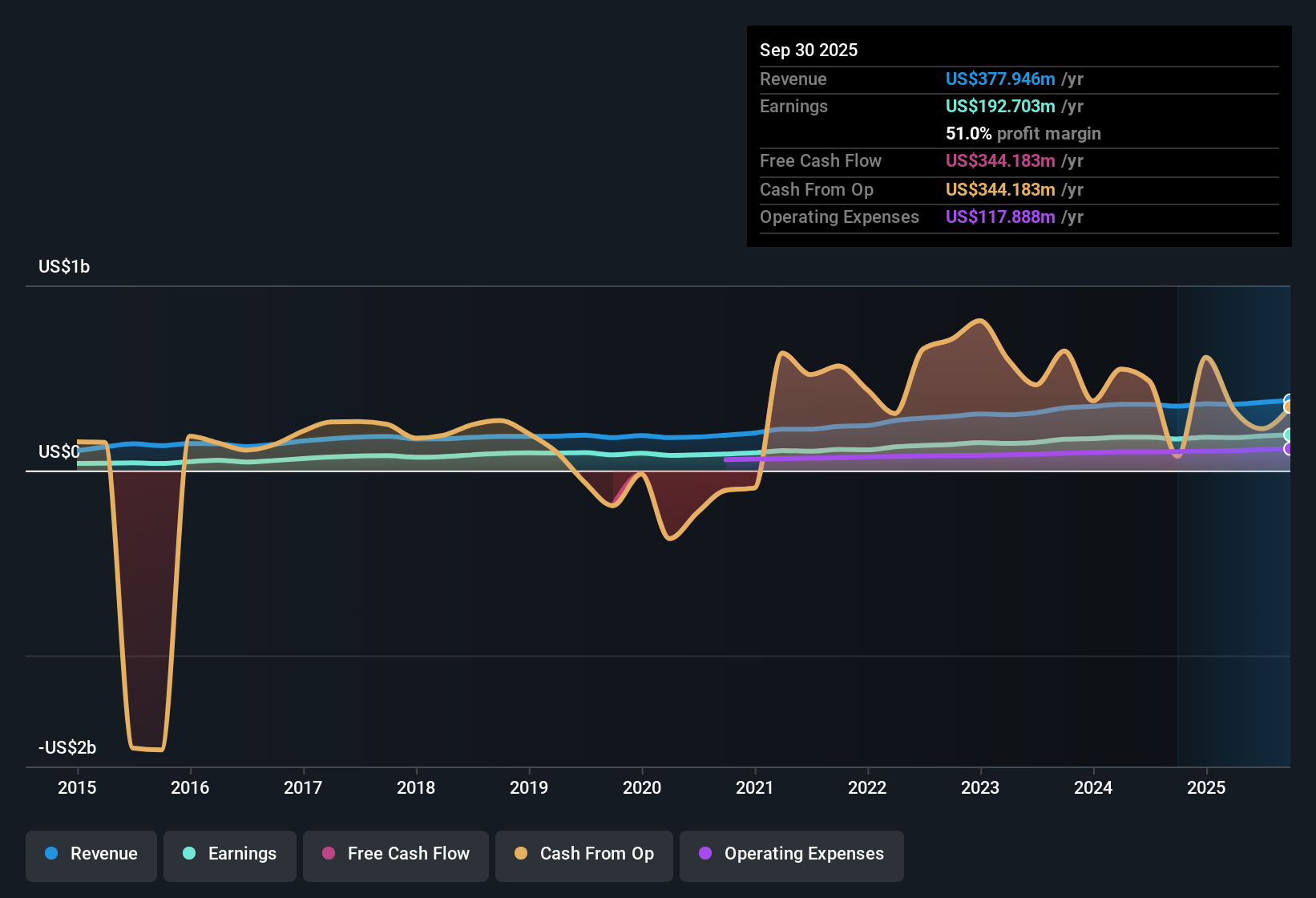

Federal Agricultural Mortgage (AGM) posted net profit margins of 50.9%, edging up from last year’s 49%. Over the past five years, AGM has averaged 14.2% annual earnings growth, and most recently, earnings climbed 13.1%. Looking ahead, earnings are projected to rise about 8% per year, a pace that trails the wider US market's expected 16% annual growth. Revenue growth is anticipated to slightly outperform at 10.8% per year compared to the US market’s 10.5%.

See our full analysis for Federal Agricultural Mortgage.Next, we’ll see how these results measure up against the narratives that investors and analysts have been watching. Some stories may be confirmed, while others could face new questions.

See what the community is saying about Federal Agricultural Mortgage

Profit Margin Holds Above 50%

- AGM’s net profit margin stands at 50.9%, staying above the industry average and just above last year’s 49%. This highlights ongoing profitability strength, despite some margin compression forecast ahead.

- Analysts’ consensus view points out that a margin in the 50% range offers a safety buffer as AGM expands lending into new sectors. However, they caution that profit margins are expected to slip to 46.5% by 2028 as the company invests more heavily in technology and navigates rising operating and regulatory costs.

- Margin durability is a key reason analysts believe AGM can sustain its earnings expansion, even as broader market earnings are projected to grow faster.

- There is tension as efforts to branch into broadband and energy finance bring new growth but may also result in a less profitable business mix if expense growth overshoots revenue gains.

Peer Discount Raises Valuation Debate

- AGM trades at a 9.4x Price-to-Earnings ratio, far below the peer group average of 22x and the Diversified Financial industry’s 14.8x. This is despite shares sitting at $165.48 and exceeding the DCF fair value of $138.22.

- Consensus narrative highlights investors are split. On one hand, AGM’s lower multiple signals potential undervaluation compared to peers. On the other hand, the share price is above the calculated DCF fair value yet below the analyst price target of $226.0, creating an ongoing debate over whether the valuation discount is justified by growth prospects or limited by slowing earnings momentum.

- Supporters point to consistent revenue growth and attractive dividends as reasons AGM might deserve to close the gap with rivals, despite the fair value caveat.

- Skeptics focus on the company not matching the broader market’s 16% growth forecast, which could leave the stock stuck at a low multiple.

Growth Bets Meet Rising Risks

- Analysts project revenue growth at 11.8% annually and expect outstanding shares to creep up only 0.44% per year. However, there is a headwind as profit margins are projected to drop from 50.6% to 46.5% through 2028, suggesting that growth bets come with thinner profitability down the line.

- According to the consensus narrative, moves into renewable energy, broadband, and infrastructure sectors are fueling top-line expansion. Yet these same segments expose AGM to credit quality challenges and greater regulatory risk, especially if government support weakens or portfolio credit losses mount.

- What is crucial is how well investments in technology and risk controls can offset the effects of sector diversification, helping to protect profitability even as operating costs rise.

- Acceleration in loan loss provisions or increased expenses from legal or compliance issues could materially slow future earnings expansion, particularly if sector volatility intensifies.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Federal Agricultural Mortgage on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a different take on the figures? Share your perspective and build your own narrative in just a few minutes. Do it your way

A great starting point for your Federal Agricultural Mortgage research is our analysis highlighting 6 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

While AGM boasts high profit margins, it faces slowing earnings growth and a share price that trades above fair value. This raises questions about future upside.

If you want stronger upside potential and more attractive valuations, check out these 842 undervalued stocks based on cash flows to discover companies the market may be pricing below their true worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AGM

Federal Agricultural Mortgage

Provides a secondary market for various loans made to borrowers in the United States.

Established dividend payer and good value.

Market Insights

Community Narratives