- United States

- /

- Mortgage REITs

- /

- NYSE:ABR

Assessing Arbor Realty Trust (ABR) Valuation After Recent Share Price Drift

Reviewed by Simply Wall St

See our latest analysis for Arbor Realty Trust.

Arbor Realty Trust’s share price has moved lower recently, reflecting ongoing concerns about both market sentiment and earnings outlooks. However, momentum has cooled compared to earlier in the year. Over the longer term, its three- and five-year total shareholder returns remain notably positive, suggesting the underlying business has weathered recent turbulence better than headline share price shifts might imply.

If shifts like these prompt you to look beyond the usual picks, now is a great moment to broaden your investing search and discover fast growing stocks with high insider ownership

With shares now trading at a sizeable discount to some analyst estimates and mixed financial results in the rearview, the key question is whether Arbor Realty Trust is genuinely undervalued or if the market has already factored in its long-term prospects.

Most Popular Narrative: 3.8% Undervalued

Compared to Arbor Realty Trust’s last close price of $11.54, the prevailing narrative places fair value at $12.00. This provides an opportunity to examine the core factors driving the estimate and consider what could trigger a shift in sentiment.

The company has a large cushion between earnings and dividends and has maintained its dividend, unlike its peers. This contributes to shareholder confidence and supports earnings. The management has successfully modified and repositioned a significant portion of its loan book, improving collateral values. This could safeguard future revenues and earnings.

Curious what projections drive that price target? The narrative’s numbers highlight potentially significant profit margins and a move from shrinking revenue toward future stability. Want to find out exactly which assumptions make analysts view Arbor’s future positively? Explore the quantitative factors behind the story inside the full narrative.

Result: Fair Value of $12.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including persistent inflation and ongoing uncertainty over interest rates. These factors could challenge both earnings growth and analyst optimism.

Find out about the key risks to this Arbor Realty Trust narrative.

Another View: What Do Multiples Reveal?

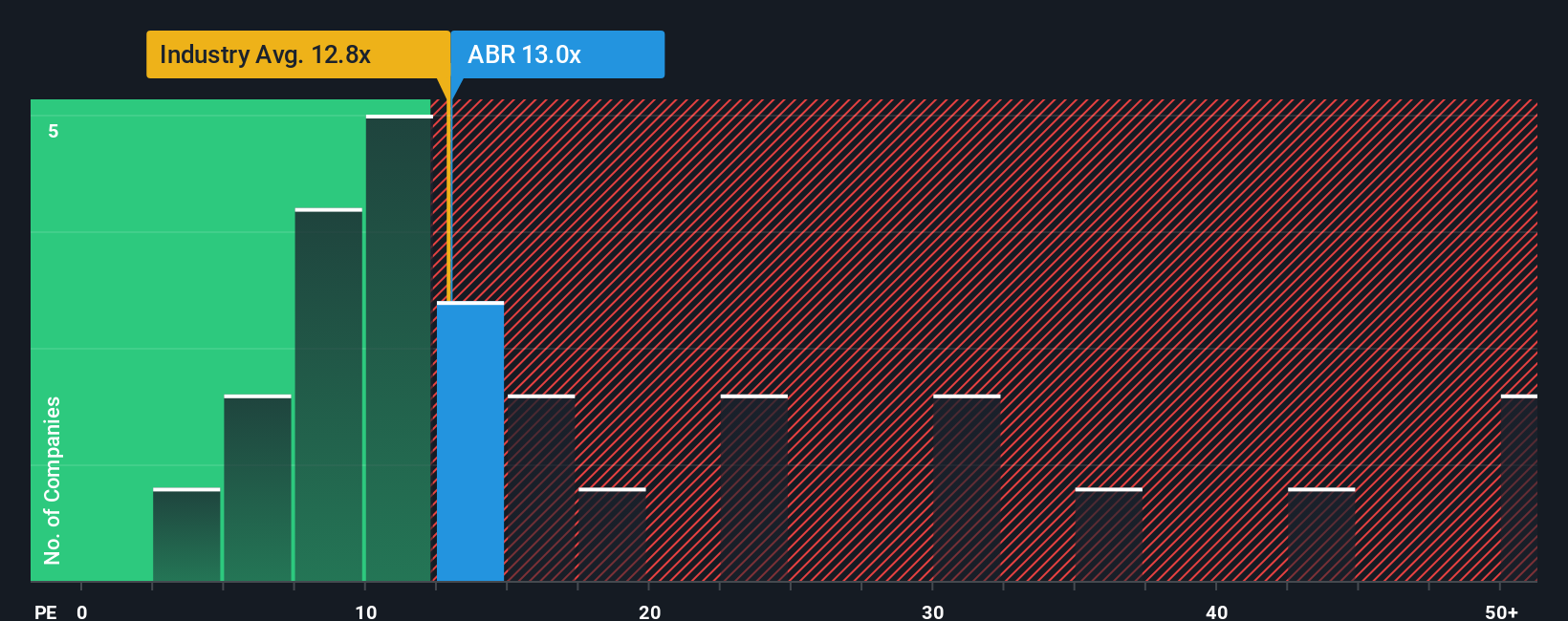

Looking beyond price targets, Arbor Realty Trust currently trades at a price-to-earnings ratio of 12.9x. That is higher than the industry average of 12.5x and the peer group average of 11.9x, but sits below the fair ratio of 13.7x our analysis suggests the market could return to. This creates a mixed picture: there is some apparent upside if sentiment improves, but also a risk if industry norms pull the valuation lower. Is the premium justified, or is the stock vulnerable to a shift in market mood?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Arbor Realty Trust Narrative

If you see things differently or want to test your own ideas, it's easy to dig into the numbers and craft your own view in just a few minutes. Do it your way

A great starting point for your Arbor Realty Trust research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by when smart strategies are just a click away. Use the Simply Wall Street Screener to uncover alternatives that could spark your next great investment move.

- Spot tomorrow’s affordable game changers by sorting through these 3578 penny stocks with strong financials that combine growth potential with strong financials.

- Capture the momentum in artificial intelligence when you evaluate these 26 AI penny stocks that are reshaping industries and tech landscapes.

- Maximize your cash flow with these 21 dividend stocks with yields > 3% offering attractive yields and consistent rewards for income-focused investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABR

Arbor Realty Trust

Invests in a diversified portfolio of structured finance assets in the multifamily, single-family rental, and commercial real estate markets in the United States.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives