- United States

- /

- Capital Markets

- /

- NYSE:AAMI

Acadian Asset Management (NYSE:AAMI): Is the Stock Undervalued After Strong Revenue But Lower Earnings?

Reviewed by Simply Wall St

Acadian Asset Management (NYSE:AAMI) just released its third quarter earnings, revealing strong revenue growth for both the quarter and year-to-date periods. However, despite higher revenues, quarterly net income and earnings per share ticked down slightly.

See our latest analysis for Acadian Asset Management.

Strong revenue growth has certainly put Acadian Asset Management on investors’ radar, but the market’s response has reflected both optimism and caution; while the stock has soared with a remarkable 70% year-to-date share price return and a robust 48.6% total shareholder return over the past year, recent weeks show momentum cooling, likely as investors weigh mixed earnings signals against that rapid climb.

If impressive runs like Acadian’s make you curious about fresh opportunities, now’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With shares up sharply this year but earnings growth showing signs of moderating, the big question now is whether Acadian Asset Management is undervalued or if the recent rally has already priced in future gains.

Price-to-Earnings of 17.9x: Is it justified?

Acadian Asset Management trades at a price-to-earnings ratio of 17.9x, which is lower than both its industry peers and the overall US market. This suggests the stock may be undervalued compared to similar businesses.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for a dollar of company earnings. For diversified financials like Acadian, this is a standard yardstick and reflects how expectations for future profit growth are priced in. A lower P/E can either indicate that the market sees less growth ahead or that there may be a bargain if those expectations prove inaccurate.

At 17.9x, Acadian’s P/E stands below the US Capital Markets industry average of 24x and the peer average of 25.4x. This points to the market valuing Acadian’s earnings less optimistically than its competition. If the company continues its recent growth, there could be an opportunity for the market to close that valuation gap over time.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 17.9x (UNDERVALUED)

However, weaker net income growth and recent cooling of share price momentum could limit further upside if fundamentals do not improve in coming quarters.

Find out about the key risks to this Acadian Asset Management narrative.

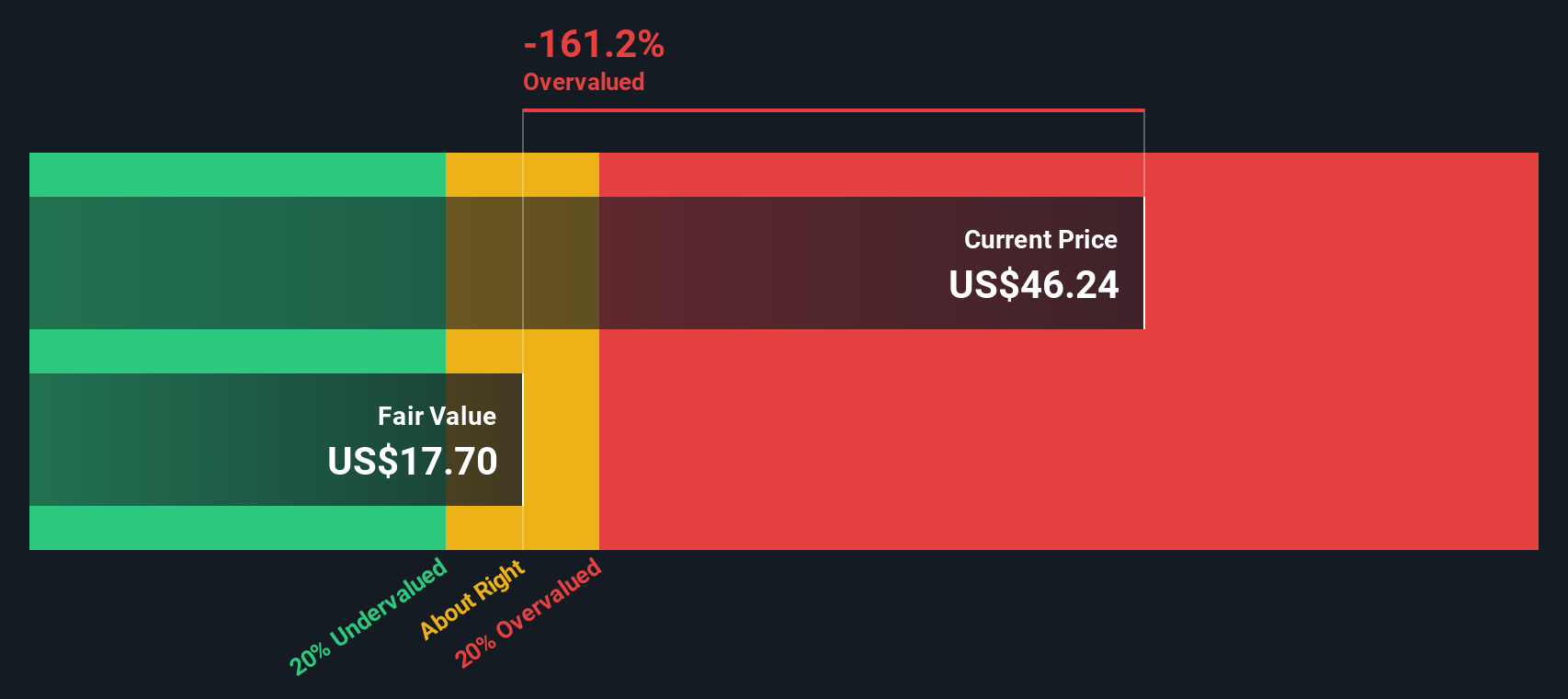

Another View: Discounted Cash Flow Says Overvalued

Looking at Acadian Asset Management through the lens of our SWS DCF model paints a very different picture. According to this approach, the stock appears significantly overvalued, with shares trading well above our intrinsic value estimate. This sharp contrast raises the question: which valuation method tells the real story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Acadian Asset Management for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Acadian Asset Management Narrative

Keep in mind, if you see things differently or want to reach your own conclusions, you can build a personalized perspective in just a few minutes. Do it your way

A great starting point for your Acadian Asset Management research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stop searching for their next edge. Broaden your opportunities and see which stocks catch your eye using these curated screens from Simply Wall Street:

- Access reliable income streams by reviewing these 16 dividend stocks with yields > 3%, which offers dividend yields above 3% and is designed for building a steady cash flow.

- Get ahead of the curve with these 25 AI penny stocks, a selection focused on game-changing progress in artificial intelligence, automation, and data analytics.

- Capitalize on emerging technologies by checking out these 26 quantum computing stocks, where companies are advancing the field of quantum computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AAMI

Acadian Asset Management

BrightSphere Investment Group Inc. is a publically owned asset management holding company.

Acceptable track record with low risk.

Similar Companies

Market Insights

Community Narratives