- United States

- /

- Capital Markets

- /

- NYSE:AAMI

Acadian Asset Management (AAMI) Valuation: How Analyst Downgrades and Earnings Uncertainty Are Shaping Investor Sentiment

Reviewed by Simply Wall St

Acadian Asset Management (AAMI) has caught investor attention as Weiss Ratings moved its rating from buy to hold, just days before the company’s upcoming earnings announcement. Several analysts have also revised their outlooks, highlighting changing sentiment around the stock.

See our latest analysis for Acadian Asset Management.

Acadian Asset Management’s share price has surged an impressive 92% year-to-date, reflecting growing optimism even as analyst sentiment shows signs of cooling. The company also recently paid a quarterly dividend, keeping long-term investors engaged. Short-term momentum has been particularly strong, with a 24.6% share price return over the past 90 days. Its total shareholder return has reached 87.6% over the last year and 261.8% over five years. All this suggests that although market nerves may be showing, the longer trend remains remarkably positive.

If this kind of momentum has you considering what else is out there, now is a perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With such rapid gains and shifting analyst sentiment, the key question is whether Acadian Asset Management's strong run presents a genuine buying opportunity, or if all that future growth has already been reflected in the current price.

Price-to-Earnings of 19.8x: Is it justified?

Acadian Asset Management’s price-to-earnings ratio stands at 19.8x, which places its shares at a premium to its peer group average of 16.6x. This elevated multiple signals the market is willing to pay more for each dollar of earnings compared to similar companies, but also raises the question of whether that optimism is warranted.

The price-to-earnings (P/E) ratio is a widely used metric that compares a company’s share price to its per-share earnings. It reflects how much investors are willing to pay for a dollar of the company’s current profits, and is particularly relevant for evaluating established companies in the financial sector like Acadian Asset Management.

At 19.8x, Acadian Asset Management’s P/E ratio suggests expectations for robust earnings or continued growth. It is notably higher than the peer group’s average of 16.6x; however, it is also trading below the broader US Capital Markets industry average of 26.6x. This indicates that while it commands a premium to direct peers, it remains less expensive than top performers in its space. There is insufficient data available to benchmark this against a fair ratio, but its current positioning may reflect both recent earnings strength and market enthusiasm for future performance.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 19.8x (OVERVALUED)

However, risks remain if analyst price targets prove accurate or if future earnings and revenue growth do not match market expectations.

Find out about the key risks to this Acadian Asset Management narrative.

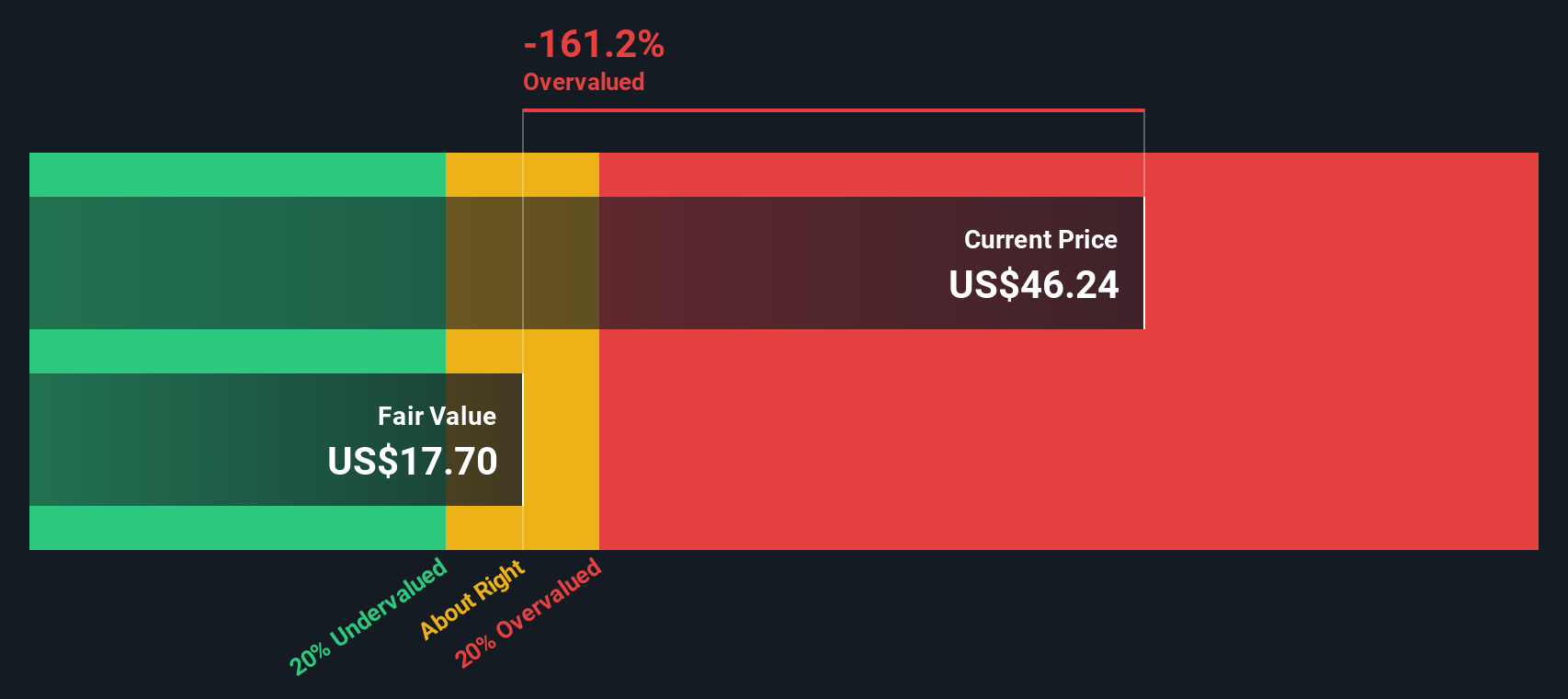

Another Perspective: Discounted Cash Flow Signals Overvaluation

While price-to-earnings shows optimism, our DCF model paints a more cautionary picture. According to the SWS DCF model, Acadian Asset Management’s shares are trading well above their estimated fair value of $17.91. This suggests the stock could be significantly overvalued. Does growth justify such a premium, or could the stock be running ahead of its fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Acadian Asset Management for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Acadian Asset Management Narrative

If you have your own perspective or want to dig deeper into the numbers yourself, it only takes a few minutes to create a personalized story. Do it your way

A great starting point for your Acadian Asset Management research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Compelling Investment Opportunities?

Don’t wait for the next winning trend to pass you by. With the Simply Wall Street Screener, you can move fast and seize fresh ideas before others catch on.

- Uncover income opportunities by scanning for high-yield companies through these 19 dividend stocks with yields > 3%, delivering solid returns and sustainable payouts.

- Get ahead of market shifts in artificial intelligence with these 27 AI penny stocks, to find the businesses redefining industries through breakthrough innovations.

- Tap into undervalued potential by using these 870 undervalued stocks based on cash flows, to spot stocks trading below intrinsic value but primed for growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AAMI

Acadian Asset Management

BrightSphere Investment Group Inc. is a publically owned asset management holding company.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives