- United States

- /

- Capital Markets

- /

- NasdaqGS:VCTR

Is Victory Capital’s US$110 Million Synergy Target After Amundi Deal Changing the Investment Case for VCTR?

Reviewed by Sasha Jovanovic

- Earlier this quarter, Merion Road Capital Management re-initiated a position in Victory Capital Holdings shortly after the company's acquisition of Amundi US, expanding Victory Capital’s assets under management above US$300 billion.

- A distinguishing insight from this event is Victory Capital’s upward revision of its cost synergy target to US$110 million, along with management's emphasis on future free cash flow potential and cross-selling opportunities.

- We'll examine what these expanded cost synergies and renewed investor interest could mean for Victory Capital’s investment narrative ahead.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Victory Capital Holdings Investment Narrative Recap

To be a shareholder in Victory Capital Holdings, you need to believe in the firm's ability to deliver consistent asset growth and improve earnings by integrating acquisitions and realizing meaningful cost synergies. The recent increase in Victory Capital’s cost synergy target following the Amundi US acquisition could enhance near-term cash flow, a key catalyst, but does not fundamentally lessen the ongoing risk of net client outflows, which remains significant for revenue stability.

Among recent announcements, Victory Capital’s completion of a substantial share buyback program stands out, reinforcing management’s confidence in the company’s current valuation and future cash flow potential. This move is relevant to the narrative, as it reflects an effort to balance shareholder returns while integrating the Amundi US business and pursuing broader growth initiatives.

Yet, despite these positive signals, investors should be aware that continued outflows, even amid acquisitions and buybacks, pose a challenge to...

Read the full narrative on Victory Capital Holdings (it's free!)

Victory Capital Holdings is projected to reach $1.8 billion in revenue and $735.1 million in earnings by 2028. This outlook implies a 20.4% annual revenue growth rate and an increase in earnings of $470.5 million from current earnings of $264.6 million.

Uncover how Victory Capital Holdings' forecasts yield a $74.00 fair value, a 17% upside to its current price.

Exploring Other Perspectives

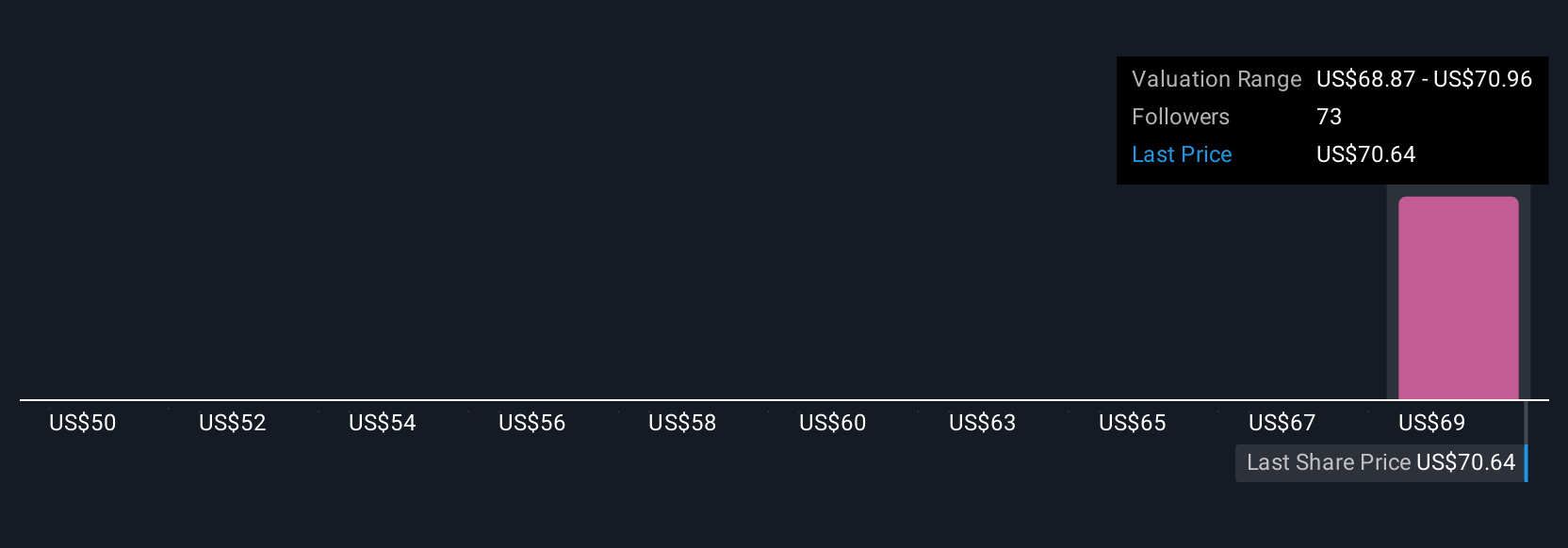

Three community-sourced fair value estimates for Victory Capital range from US$66.01 to US$74, reflecting varied expectations among Simply Wall St Community members. While you weigh these views, keep in mind the ongoing concern around net outflows and its impact on future growth.

Explore 3 other fair value estimates on Victory Capital Holdings - why the stock might be worth just $66.01!

Build Your Own Victory Capital Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Victory Capital Holdings research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Victory Capital Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Victory Capital Holdings' overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VCTR

Victory Capital Holdings

Operates as an asset management company in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success