- United States

- /

- Capital Markets

- /

- NasdaqCM:VALU

Exploring US Undiscovered Gems 3 Promising Stocks to Watch

Reviewed by Simply Wall St

As the U.S. stock market navigates through a period of uncertainty with fluctuating indices and concerns about trade tariffs, investors are keenly observing how these factors might impact small-cap stocks, particularly those within the S&P 600 index. In this dynamic environment, identifying promising stocks requires a focus on companies that demonstrate resilience and potential for growth despite broader economic challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| West Bancorporation | 169.96% | -1.41% | -8.52% | ★★★★★★ |

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Wilson Bank Holding | 0.00% | 7.88% | 8.09% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| Senstar Technologies | NA | -20.82% | 14.32% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

| Vantage | 6.72% | -16.62% | -15.47% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Value Line (VALU)

Simply Wall St Value Rating: ★★★★★★

Overview: Value Line, Inc. is a company that produces and sells investment periodicals and related publications, with a market cap of approximately $357.72 million.

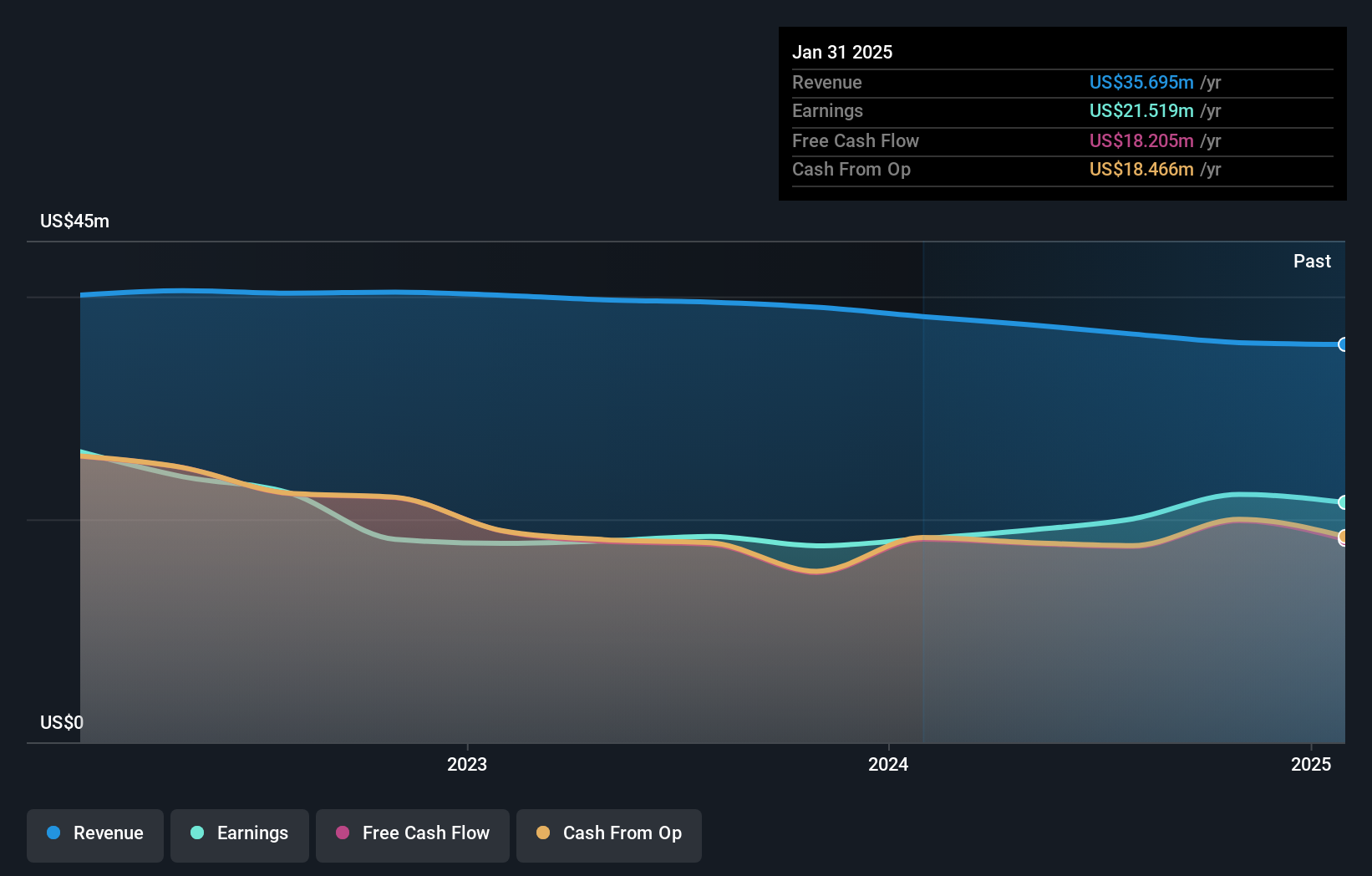

Operations: Value Line generates revenue primarily from its publishing segment, amounting to $35.70 million.

Value Line, a nimble player in the investment research space, has showcased robust performance with earnings growing 17.8% over the past year, outpacing the Capital Markets industry's 14%. The company operates debt-free, allowing it to focus on growth without financial strain. Its price-to-earnings ratio of 17.4x is attractively lower than the US market average of 18.7x, suggesting potential value for investors. Despite being dropped from the Russell 2000 Dynamic Index recently, Value Line's consistent dividend increases—11 consecutive years—reflect its commitment to shareholder returns and financial health in a competitive industry landscape.

- Click to explore a detailed breakdown of our findings in Value Line's health report.

Evaluate Value Line's historical performance by accessing our past performance report.

Shore Bancshares (SHBI)

Simply Wall St Value Rating: ★★★★★★

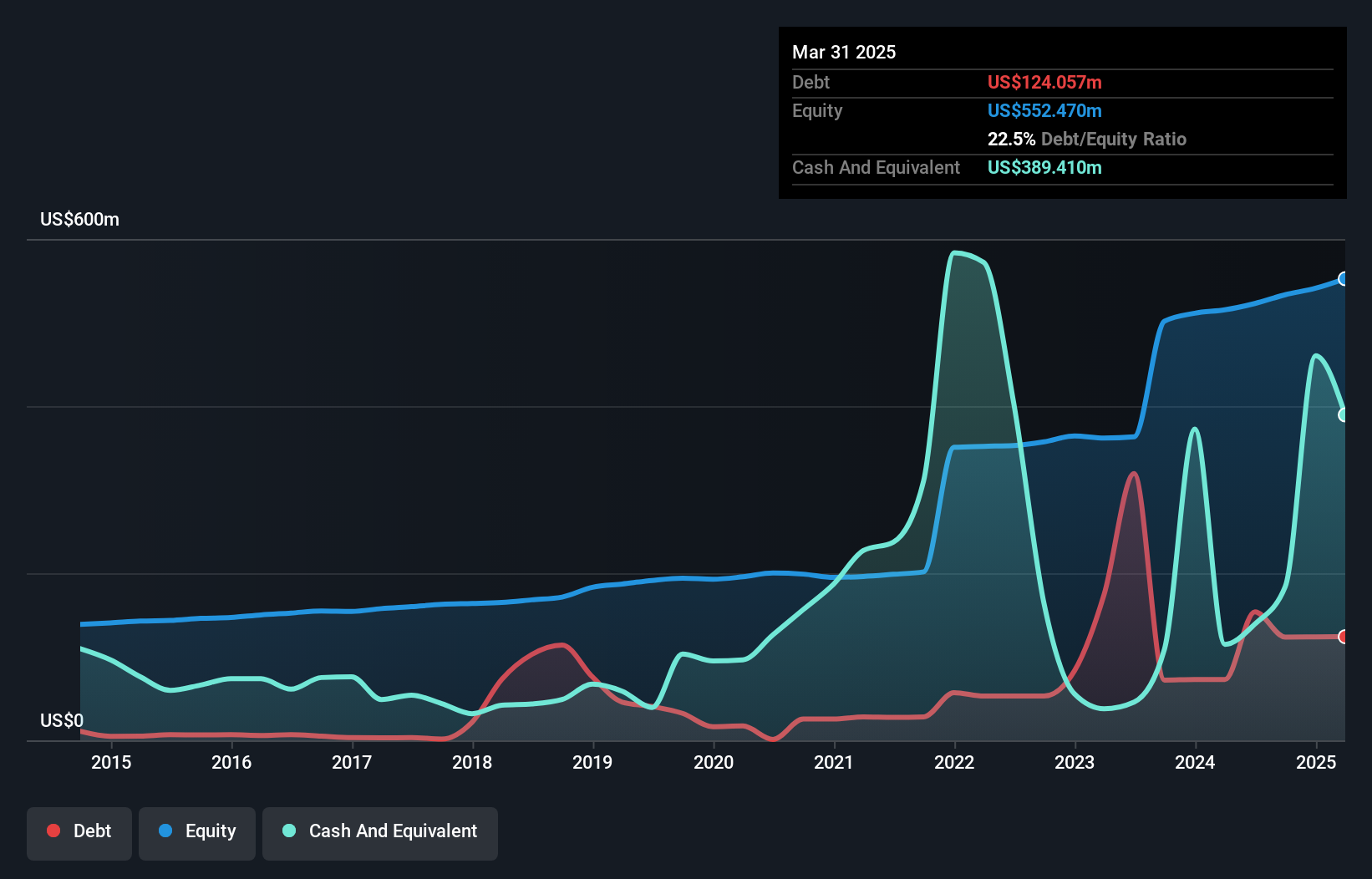

Overview: Shore Bancshares, Inc. is a bank holding company for Shore United Bank, N.A., with a market capitalization of $557.35 million.

Operations: The primary revenue stream for Shore Bancshares comes from its community banking segment, generating $201.67 million.

Shore Bancshares, with total assets of US$6.2 billion and equity of US$552.5 million, stands out for its robust financial health. The company showcases a remarkable earnings growth of 281.9% over the past year, significantly outpacing the industry average of 5.5%. It maintains a commendable bad loans ratio at just 0.3%, backed by a substantial allowance covering 356% of these loans, indicating prudent risk management practices. With total deposits at US$5.5 billion and loans amounting to US$4.7 billion, its price-to-earnings ratio is an attractive 11x compared to the broader market's 19x, suggesting potential value for investors seeking stability in banking stocks.

Associated Capital Group (AC)

Simply Wall St Value Rating: ★★★★★★

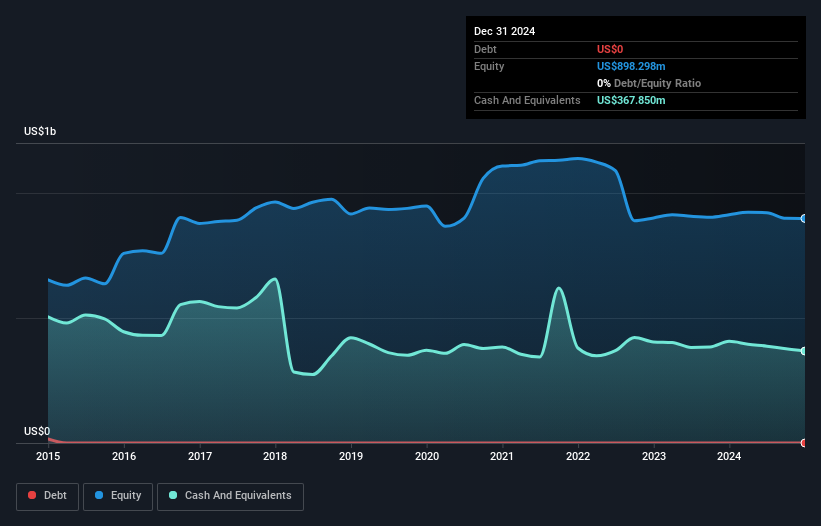

Overview: Associated Capital Group, Inc. is a company that offers investment advisory services in the United States and has a market capitalization of $791.82 million.

Operations: AC derives its revenue primarily from investment advisory and asset management services, generating $12.29 million in this segment.

Associated Capital Group, a smaller player in the capital markets, showcases a unique financial profile with no debt and an earnings growth rate of 10.7% annually over the last five years. Despite not outpacing industry growth this past year, its price-to-earnings ratio of 20.8x suggests it offers good value compared to the sector average of 28.2x. A notable one-off gain of US$36.9 million has impacted recent results, potentially skewing perceptions of ongoing performance. The company recently repurchased shares worth US$1.42 million and declared a semi-annual dividend, reflecting shareholder-friendly initiatives amidst fluctuating earnings figures.

- Navigate through the intricacies of Associated Capital Group with our comprehensive health report here.

Assess Associated Capital Group's past performance with our detailed historical performance reports.

Make It Happen

- Embark on your investment journey to our 276 US Undiscovered Gems With Strong Fundamentals selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VALU

Value Line

Engages in the production and sale of investment periodicals and related publications.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives