- United States

- /

- Capital Markets

- /

- NasdaqGS:TROW

Does T. Rowe Price's (TROW) New Asset Reporting Approach Signal a Shift in Growth Strategy?

Reviewed by Simply Wall St

- In the past week, T. Rowe Price Group reported its second quarter 2025 earnings, with earnings per share exceeding analyst expectations even as revenues showed a slight year-over-year decline and the company experienced net client outflows of US$14.9 billion. Management continues to focus on cost efficiency and expanding its ETF and retirement business to address ongoing equity strategy challenges and evolving client preferences.

- An interesting insight is that T. Rowe Price aims to include model delivery assets in its reported assets under management beginning August 12, reflecting its efforts to more fully capture and represent the impact of newer product initiatives within its business metrics.

- We will now examine how ongoing client outflows may affect T. Rowe Price’s outlook in light of its diversified growth strategy.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

T. Rowe Price Group Investment Narrative Recap

To be a shareholder in T. Rowe Price Group, you need to believe in the company’s disciplined approach to cost management, active ETF and retirement product expansion, and its ability to offset industry headwinds such as ongoing net outflows. The recent earnings report, which showed both an earnings beat and significant net outflows, does not materially change the biggest near-term catalyst: success in attracting net inflows through new products, even as the company’s main risk remains persistent client redemptions and pressure on fee rates.

Among recent announcements, the latest share buyback program stands out. Between April and June 2025, T. Rowe Price repurchased 1.21 million shares for US$108.56 million, reinforcing its commitment to enhancing shareholder value by reducing shares outstanding, the same metric that supports earnings per share growth amid fluctuating revenues and assets under management.

Yet with ongoing net client outflows, investors should be especially mindful of how continued redemptions could limit the potential benefits of...

Read the full narrative on T. Rowe Price Group (it's free!)

T. Rowe Price Group's outlook anticipates $7.6 billion in revenue and $2.2 billion in earnings by 2028. This scenario is built on a projected annual revenue growth rate of 2.3% and an increase in earnings of $0.2 billion from the current level of $2.0 billion.

Uncover how T. Rowe Price Group's forecasts yield a $101.50 fair value, a 4% downside to its current price.

Exploring Other Perspectives

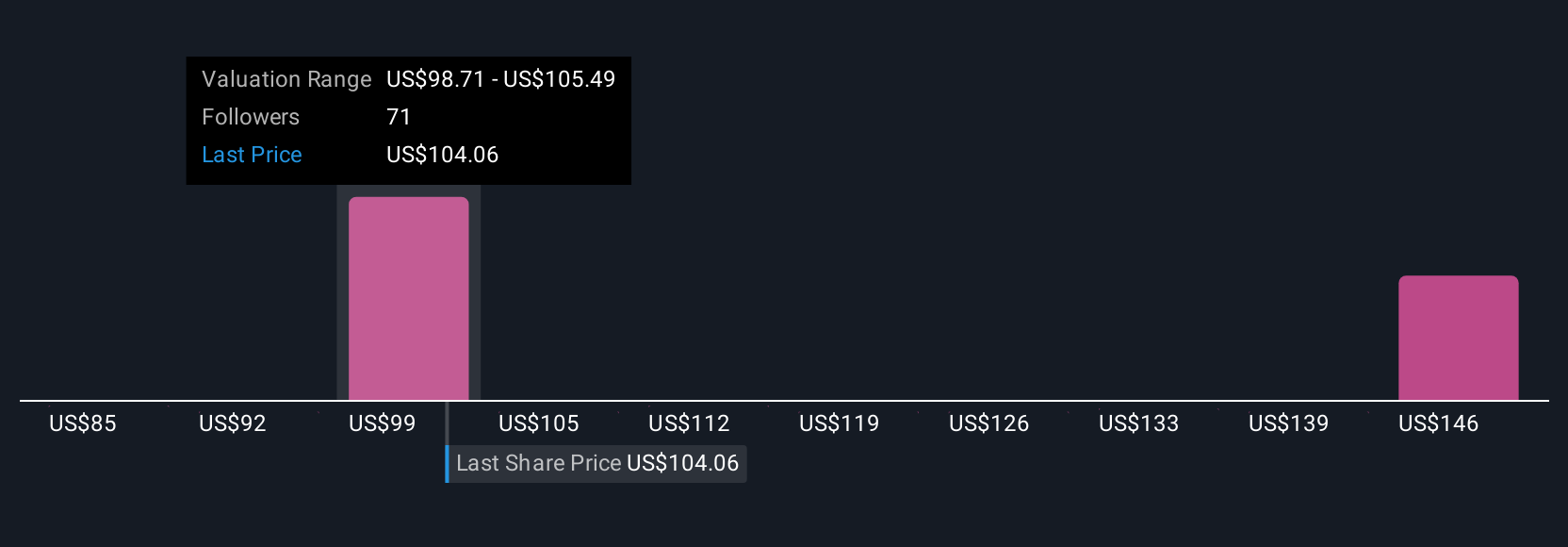

Seven fair value estimates from the Simply Wall St Community range from US$85.16 to US$165.67 per share. As participant views spread across nearly double the current share price, fee rate pressure and persistent outflows remain top-of-mind issues for anyone considering the company’s future performance.

Explore 7 other fair value estimates on T. Rowe Price Group - why the stock might be worth as much as 56% more than the current price!

Build Your Own T. Rowe Price Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your T. Rowe Price Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free T. Rowe Price Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate T. Rowe Price Group's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if T. Rowe Price Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TROW

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives