- United States

- /

- Capital Markets

- /

- NasdaqGS:TRIN

How Will Trinity Capital's (TRIN) Rapid Micro Investment Shape Its Innovation-Led Growth Strategy?

Reviewed by Sasha Jovanovic

- Trinity Capital recently announced a US$45 million growth capital commitment to Rapid Micro Biosystems to help scale its Growth Direct platform and support global commercial expansion.

- This investment is expected to accelerate manufacturing, reduce product costs, and improve service productivity for Rapid Micro, highlighting Trinity Capital’s continued focus on supporting innovation-driven companies and expanding its investment portfolio.

- We’ll explore how this latest funding underscores Trinity Capital’s commitment to active capital deployment and its potential effect on the broader investment narrative.

Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

Trinity Capital Investment Narrative Recap

To be a shareholder in Trinity Capital, one needs to believe in the growth of venture debt and persistent demand from innovation-focused companies. While the recent US$45 million investment in Rapid Micro Biosystems aligns with Trinity’s active capital deployment, this single transaction is not likely to materially alter the most important short-term catalyst: robust growth in assets under management. The biggest risk remains sustainability of credit quality should origination volume outpace prudent underwriting.

The newly secured US$200 million credit facility with KeyBank, announced in November 2025, stands out as directly relevant to supporting Trinity’s ongoing lending activities, including the Rapid Micro funding. This expanded borrowing capacity positions the company to pursue additional originations and manage its large pipeline, tying in closely with investors’ focus on continued portfolio expansion and corresponding revenue growth.

However, if credit quality falters as the pace of originations accelerates, investors should be aware that...

Read the full narrative on Trinity Capital (it's free!)

Trinity Capital's narrative projects $344.1 million revenue and $159.5 million earnings by 2028. This requires 10.5% yearly revenue growth and a $20.7 million earnings increase from $138.8 million.

Uncover how Trinity Capital's forecasts yield a $16.44 fair value, a 15% upside to its current price.

Exploring Other Perspectives

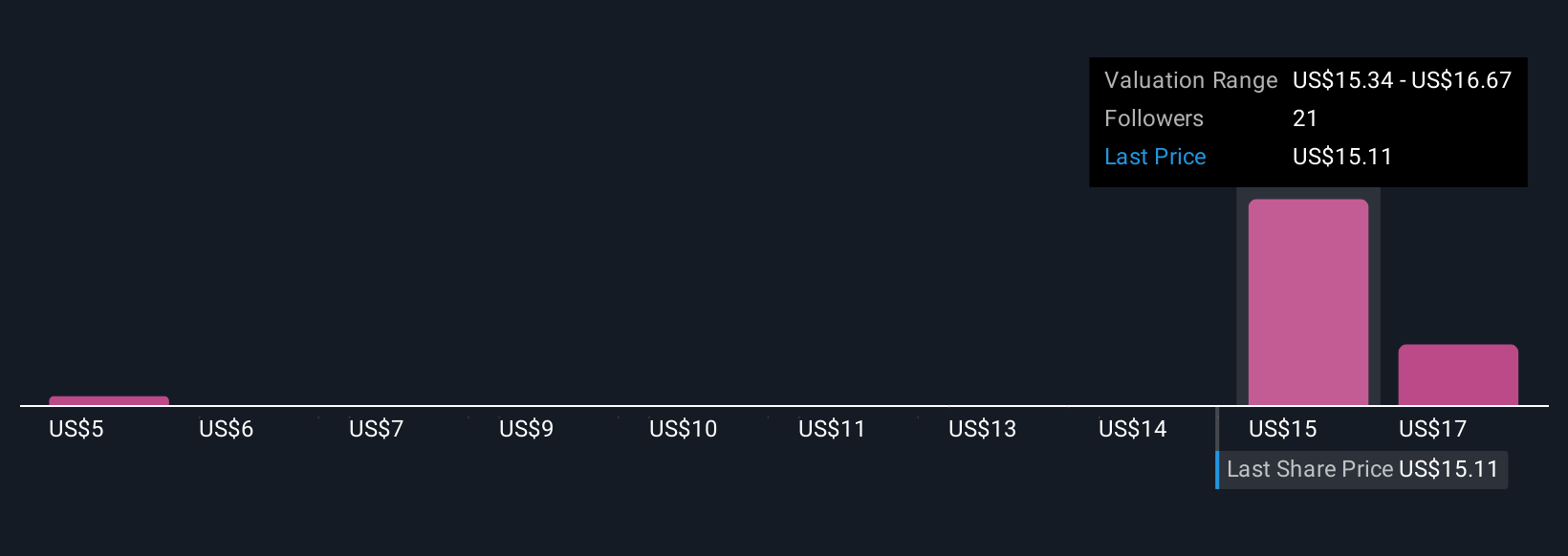

Simply Wall St Community members produced eight fair value estimates for Trinity Capital, with values ranging from US$4.71 to US$25.12 per share. This span of independent views contrasts with the analyst consensus focus on growth in managed accounts and alternative income streams, underscoring just how varied performance expectations can be depending on which drivers you emphasize.

Explore 8 other fair value estimates on Trinity Capital - why the stock might be worth as much as 76% more than the current price!

Build Your Own Trinity Capital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Trinity Capital research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Trinity Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Trinity Capital's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trinity Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TRIN

Trinity Capital

A business development company specializing in term loans, equipment financing, and private equity-related investments.

Undervalued with proven track record.

Market Insights

Community Narratives