- United States

- /

- Capital Markets

- /

- NasdaqGS:TRIN

Does Trinity’s (TRIN) Support of Bobbie Signal a New Focus on Consumer Health Diversification?

Reviewed by Sasha Jovanovic

- Trinity Capital Inc. recently announced it provided equipment and asset financing to Bobbie, a mom-founded organic infant feeding company, to support scaling operations at its Ohio facility and accelerate nationwide growth.

- This partnership underscores Trinity Capital’s focus on expanding its presence in high-growth consumer health sectors by backing emerging brands aiming to broaden national accessibility of organic products.

- We will explore how Trinity Capital’s funding of Bobbie could influence its outlook on revenue growth and sector diversification.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Trinity Capital Investment Narrative Recap

Investors in Trinity Capital need to believe in the ongoing demand for non-bank lending and the company’s ability to diversify into new growth sectors like consumer health. The recent financing for Bobbie, while reinforcing sector diversification, is not a material short-term catalyst, nor does it significantly alter the main risk: potential credit quality challenges if the innovation and venture capital ecosystem slows.

One announcement that stands out is the recent expansion of Trinity’s credit facility to US$690 million, which directly supports greater lending capacity. This increased access to capital could prove significant if market conditions remain favorable and origination volumes continue at pace, though the risks tied to future credit quality remain closely linked to overall sector health.

By contrast, as portfolio diversification increases, investors should remain mindful that concentrated exposure to high-growth sectors also carries...

Read the full narrative on Trinity Capital (it's free!)

Trinity Capital's outlook anticipates $344.1 million in revenue and $159.5 million in earnings by 2028. This scenario is based on a projected 10.5% annual revenue growth rate and a $20.7 million increase in earnings from the current $138.8 million.

Uncover how Trinity Capital's forecasts yield a $16.44 fair value, a 9% upside to its current price.

Exploring Other Perspectives

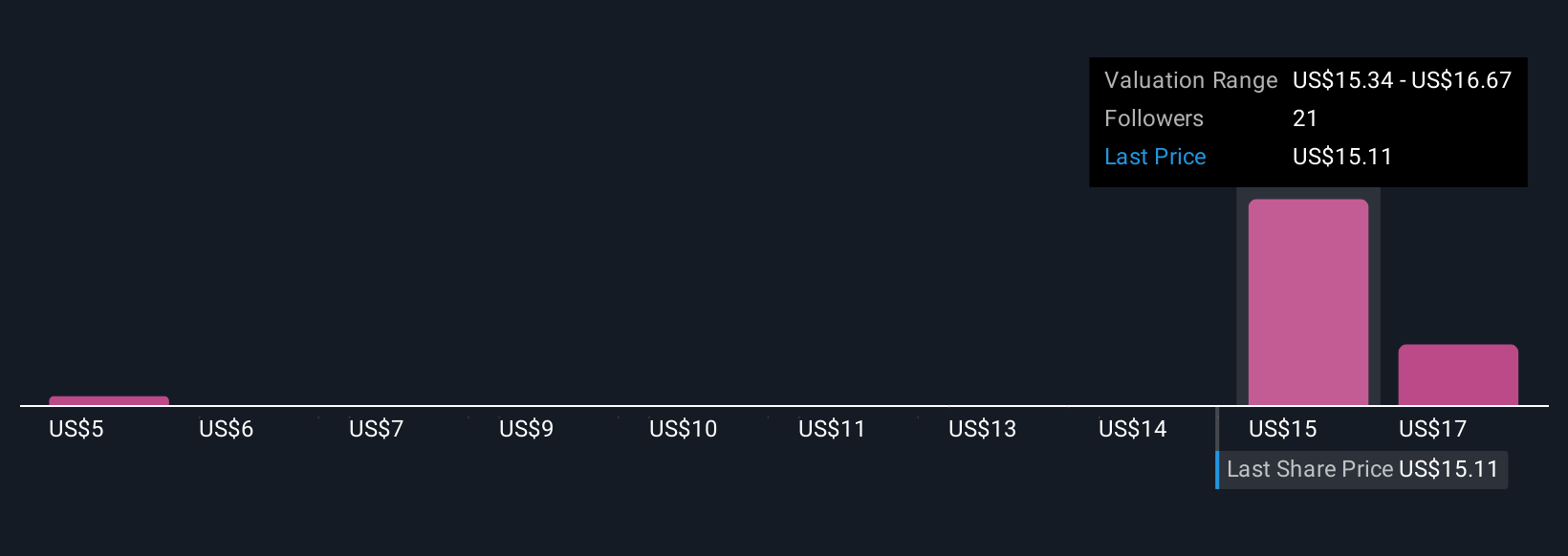

Simply Wall St Community contributors provided eight unique fair value estimates for Trinity Capital, ranging widely from US$4.71 to US$18 per share. Against this backdrop of contrasting opinions, the company’s future hinges on robust origination volumes but also faces the risk that credit quality could weaken if startup activity falters.

Explore 8 other fair value estimates on Trinity Capital - why the stock might be worth less than half the current price!

Build Your Own Trinity Capital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Trinity Capital research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Trinity Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Trinity Capital's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trinity Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TRIN

Trinity Capital

A business development company specializing in term loans, equipment financing, and private equity-related investments.

Good value with proven track record.

Market Insights

Community Narratives