- United States

- /

- Capital Markets

- /

- NasdaqGS:TPG

Weighing TPG’s Value After Recent Stock Dip and Alternative Investments Push

Reviewed by Bailey Pemberton

Wondering what to do with TPG stock right now? If you have been tracking this company, you have probably noticed a mix of excitement and uncertainty in recent weeks. After years where TPG surged an eye-catching 108.6% over the last three years, the stock has taken a bit of a step back as shares dipped 13.3% in the past month, with a year-to-date return sitting at -12.5%. Over the last year, TPG holders are down 16.3%, making it a moment where many investors are rethinking, repositioning, or simply watching closely for the next signal.

What’s been driving these moves? Industry chatter points to shifting sentiment around private equity, with global dealmaking dynamics changing and the wider market showing some caution. Major news for TPG includes its recent expansion into new alternative investment strategies and hints of leadership’s intent to diversify its portfolio. While not every headline has directly swayed the share price, the overall narrative seems to be that investors are recalibrating their expectations as TPG adapts to a new era of growth and renewed competition.

So, is TPG undervalued after the recent tumble? According to our multi-factor valuation system, TPG picks up a value score of 2 out of 6, meaning it shows undervaluation on 2 of the 6 key checks we use. That suggests there may be value hiding in plain sight, though not without caveats. Next, let’s break down what the main valuation approaches are telling us and why the true answer to TPG’s worth might involve a little more nuance than just the numbers.

TPG scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: TPG Excess Returns Analysis

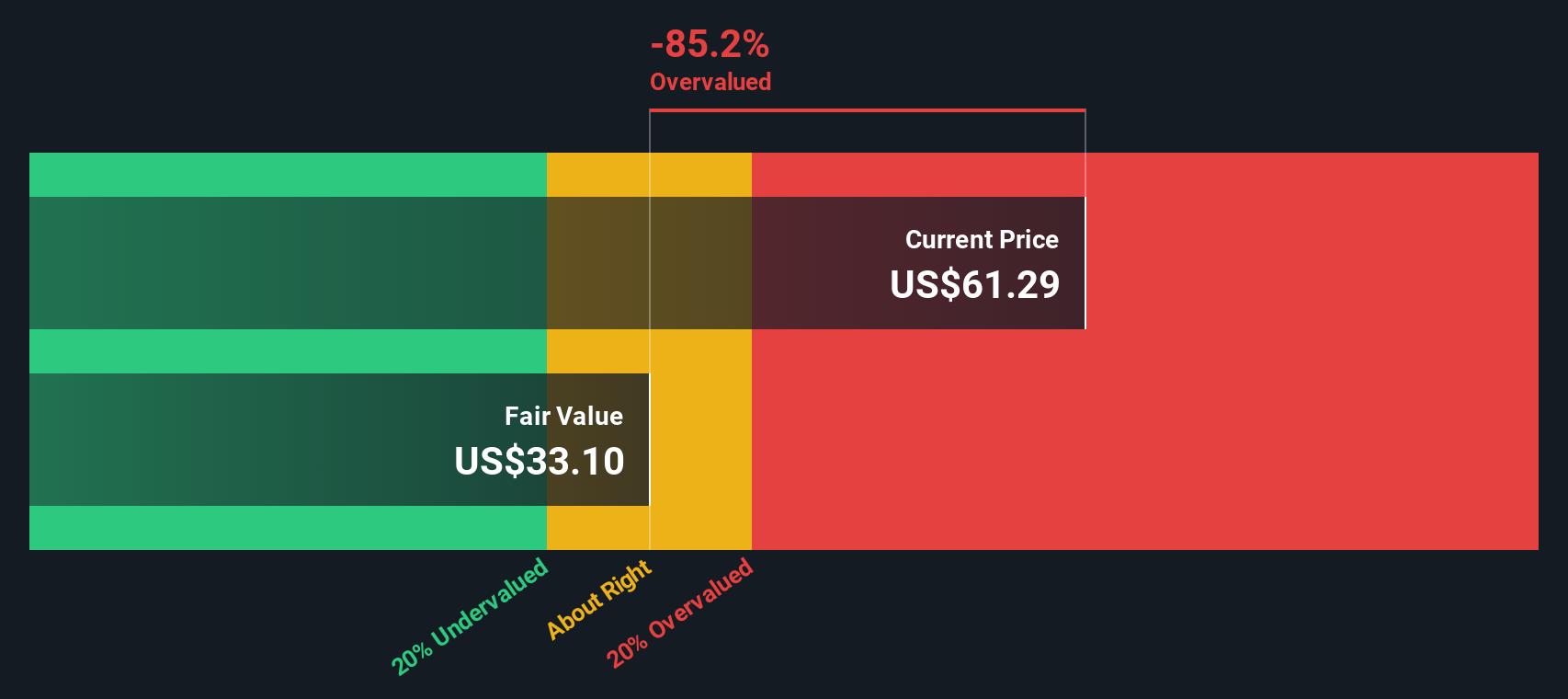

The Excess Returns model estimates a company’s value by comparing how much profit it generates above its cost of equity, after accounting for growth and the capital required to sustain the business. This approach is especially useful for assessing financial firms like TPG, as it measures how efficiently the company turns shareholder investment into real gains over time.

For TPG, the analysis begins with a Book Value of $6.86 per share and a Stable Earnings Per Share (EPS) of $1.84. The latter is based on weighted future Return on Equity estimates from four analysts. The Cost of Equity stands at $0.65 per share, resulting in a robust Excess Return of $1.19 per share and an average Return on Equity of 23.45 percent. The Stable Book Value estimate, informed by two analyst sources, is $7.84 per share.

Applying these figures, the Excess Returns model arrives at an intrinsic value for TPG that is substantially below its current market price. The stock currently shows an 82.2 percent premium compared to its underlying financial fundamentals. In other words, according to this approach, TPG shares appear significantly overvalued at present levels.

Result: OVERVALUED

Our Excess Returns analysis suggests TPG may be overvalued by 82.2%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: TPG Price vs Sales

The price-to-sales (P/S) ratio is often a preferred valuation metric for companies like TPG because it focuses on the relationship between a company’s revenue and its market value. For profitable businesses, especially those in financial services where earnings can fluctuate due to market cycles, the P/S ratio provides a more stable comparison point by using topline sales rather than earnings, which can be volatile.

In practice, investors use the P/S ratio to compare a company’s market valuation with industry norms and to understand how growth prospects and risk affect what a "normal" or "fair" multiple should be. Companies expecting faster revenue growth or enjoying safer business models might reasonably trade at higher multiples. In contrast, slower, riskier, or more challenged businesses typically trade at lower ratios.

Currently, TPG trades at a P/S ratio of 2.1x. This is below both the capital markets industry average of 4.0x and the peer average of 3.5x. However, Simply Wall St’s proprietary Fair Ratio, which blends in factors like TPG’s unique growth outlook, risk profile, profit margins, and position within the industry and market, estimates a fair P/S multiple of 2.1x for the stock. The Fair Ratio differs from simple peer or industry comparisons by accounting for specific fundamentals that may not be reflected in broad averages.

With TPG’s actual P/S matching the Fair Ratio almost exactly, this suggests the stock is priced in line with its fundamentals and offers investors a valuation that reflects a balanced view of its prospects and risks.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your TPG Narrative

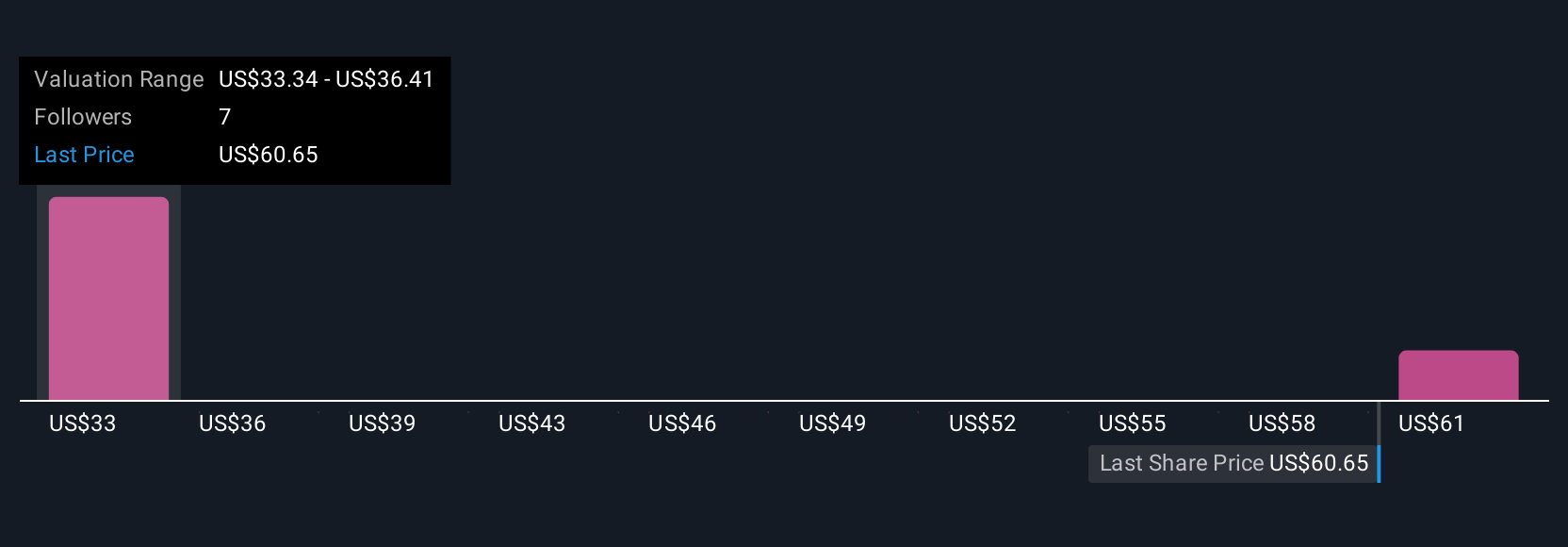

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your own story about a company, connecting your perspective on its strategy, risks, and future to a concrete financial forecast and a fair value estimate. By tying the company’s story to the actual numbers that matter, Narratives let you go beyond stock charts and anchor your buy or sell decisions in both conviction and data.

Narratives are available to all users on Simply Wall St’s Community page, relied upon by millions of investors as an accessible and interactive tool for evaluating any company. When you create or follow a Narrative, you can see not only your forecast for fair value versus the current share price, but also compare your assumptions with those of others and adjust them as new news or results arrive. Unlike static models, Narratives on Simply Wall St are dynamic and update automatically when fresh analyst estimates or significant news breaks.

For example, with TPG, some investors are optimistic, believing that robust fundraising and product expansion will unlock enduring value and assign a fair value as high as $70 per share. The most cautious investors see risks in competitive fundraising and tougher exits, valuing it as low as $58 per share. With Narratives, you can easily see these perspectives side by side and create your own, giving you clarity and confidence in every investment decision.

Do you think there's more to the story for TPG? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if TPG might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TPG

TPG

Operates as an alternative asset manager in the United States and internationally.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion