- United States

- /

- Capital Markets

- /

- NasdaqGS:STEP

Will StepStone Group’s (STEP) Riyadh Debut Reshape Its Competitive Edge in Private Markets?

Reviewed by Sasha Jovanovic

- StepStone Group has opened a new office in Riyadh, Saudi Arabia, marking its first physical presence in the Middle East and reinforcing its commitment to clients in the Kingdom.

- This expansion supports Saudi Arabia’s Vision 2030 and enables StepStone to deepen its investor relationships while broadening access to private market opportunities in the region.

- We'll explore how StepStone’s strengthened Middle East presence shapes its investment narrative and enhances access to regional private markets.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is StepStone Group's Investment Narrative?

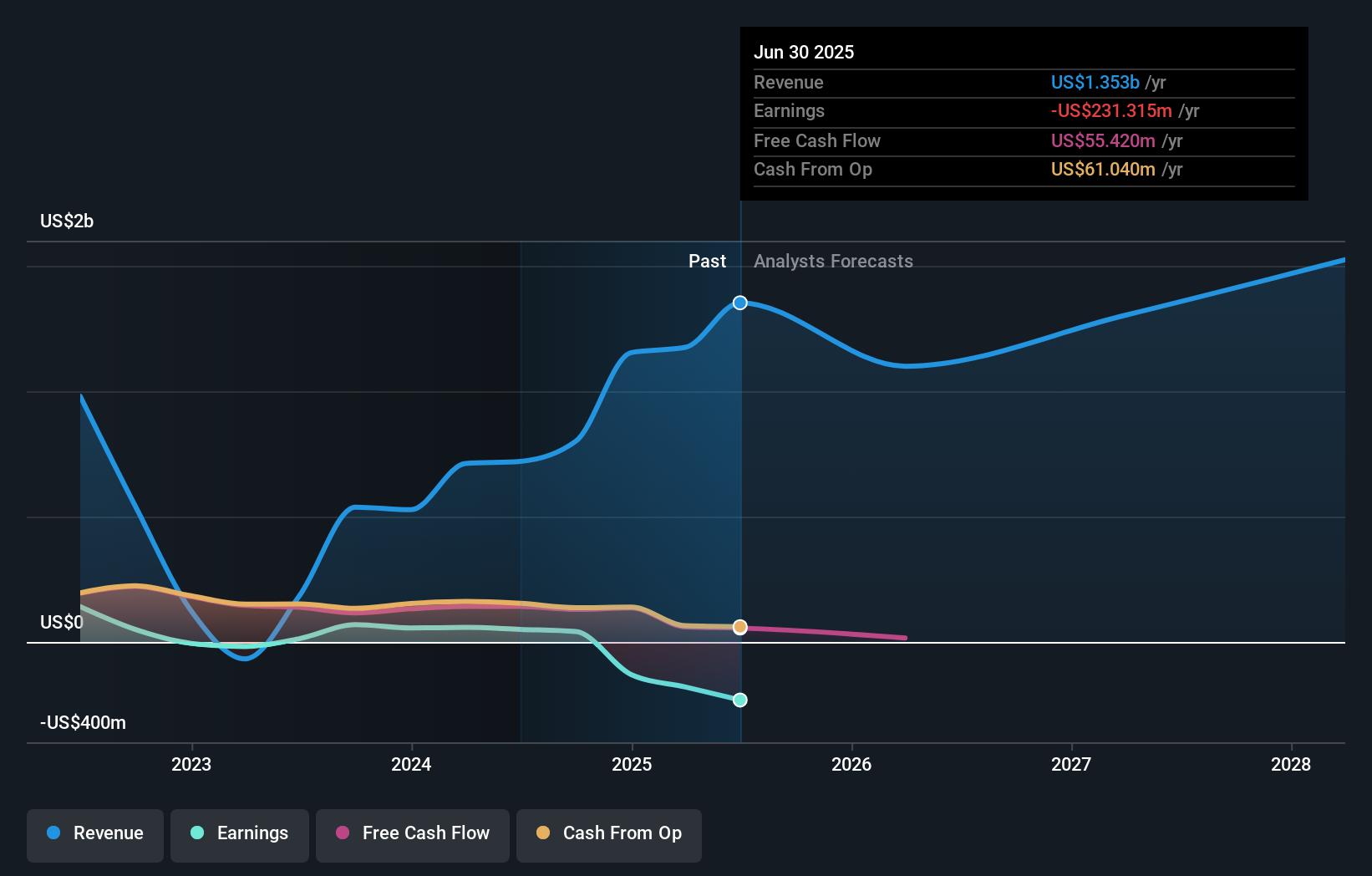

Owning StepStone Group stock comes down to believing in its ability to build lasting client relationships and expand access to global private markets, even as the company continues to operate in the red. The new Riyadh office is significant as it plants a physical flag in a region central to global capital flows and aligns with Saudi Arabia’s Vision 2030. This could help StepStone strengthen institutional partnerships, broaden its investor base, and potentially stabilize near-term revenue generation, but it may take time before these opportunities translate into material impact. Near-term catalysts like revenue growth and index inclusion must now be weighed against increased costs, ongoing unprofitability, and the persistent risk that StepStone’s expansion efforts may not lift earnings quickly enough. The recent move may alter risk perceptions, but the most immediate business challenges remain. Yet, as StepStone’s profile in Saudi Arabia rises, unprofitability and shrinking margins still stand out as key risks.

StepStone Group's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on StepStone Group - why the stock might be worth less than half the current price!

Build Your Own StepStone Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your StepStone Group research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free StepStone Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate StepStone Group's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STEP

StepStone Group

A private equity and venture capital firm specializing in primary, direct, fund of funds, secondary direct, and secondary indirect investments.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives