- United States

- /

- Capital Markets

- /

- NasdaqGS:STEP

Could StepStone Group’s (STEP) Governance Updates Reflect a Shift in Management’s Long-Term Risk Priorities?

Reviewed by Simply Wall St

- StepStone Group recently proposed amendments to its certificate of incorporation, aiming to limit liability for certain officers as permitted by Delaware law and to update its bylaws by removing outdated provisions.

- This move reflects the company’s effort to modernize its governance framework and clarify internal rules, potentially increasing transparency and regulatory alignment.

- We’ll explore how modernizing governance practices, particularly limiting officer liability, could shift the longer-term investment narrative for StepStone Group.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is StepStone Group's Investment Narrative?

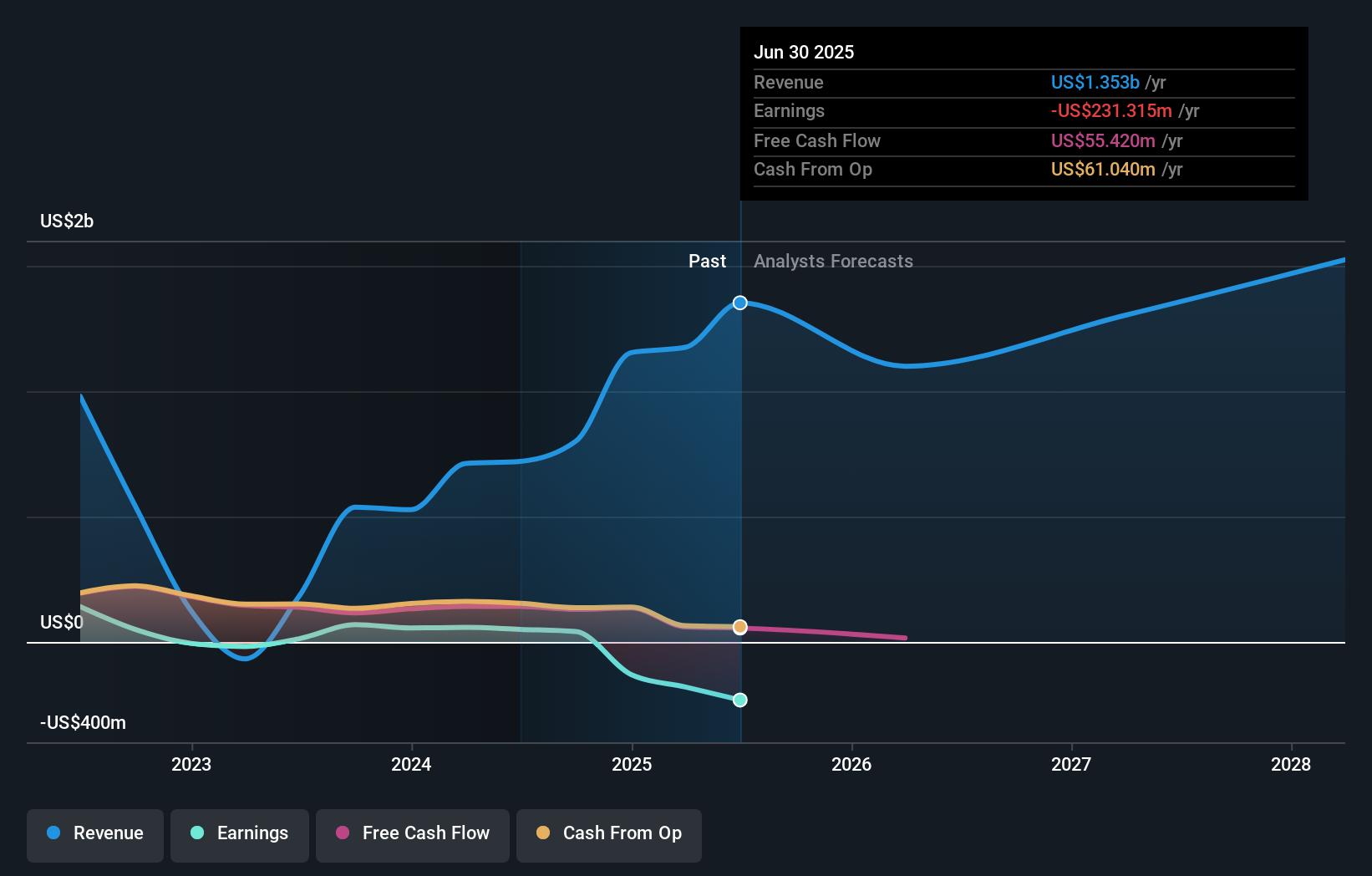

For anyone considering StepStone Group, the case to be a shareholder has always hinged on believing in the company’s position as a key player in alternative asset management, even as profitability has come under recent pressure. The group has delivered steady revenue growth, but mounting losses and a net loss of US$179.56 million last year have reaffirmed near-term concerns about earnings quality and dividend sustainability. Recent moves to modernize bylaws and limit officer liability, while a positive step for governance, are unlikely to shift the core short-term catalysts right now: achieving profitable growth, navigating index exclusions, and integrating recent leadership changes. While the company’s amendments align with regulatory best practices and may reduce future legal overhead, the share price reaction was relatively muted, suggesting little immediate impact on investor outlook or the main risks facing the business. Persistent losses and insider selling remain central watchpoints.

By contrast, insider selling could become a bigger risk than investors realise.

Exploring Other Perspectives

Explore another fair value estimate on StepStone Group - why the stock might be worth as much as $9.31!

Build Your Own StepStone Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your StepStone Group research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free StepStone Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate StepStone Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STEP

StepStone Group

A private equity and venture capital firm specializing in primary, direct, fund of funds, secondary direct, and secondary indirect investments.

Adequate balance sheet low.

Similar Companies

Market Insights

Community Narratives