- United States

- /

- Capital Markets

- /

- NasdaqGS:SNEX

Assessing StoneX Group (SNEX) Valuation as Investors Await Quarterly Earnings and Guidance

Reviewed by Simply Wall St

StoneX Group (SNEX) is gearing up to report its quarterly results after markets close on November 24, 2025. Investors are closely watching for earnings to top expectations and for strong guidance.

See our latest analysis for StoneX Group.

Investor sentiment around StoneX Group has been put to the test recently, with shares pulling back 16.3% over the past month while still showing a robust year-to-date share price return of 25.3%. Despite short-term volatility, the company’s 1-year total shareholder return stands at an impressive 22.6%, supported by consistent performance over the past several years. Momentum has cooled somewhat in the period leading up to earnings, but the long-term growth story remains intact.

If the latest moves in StoneX have you wondering what other dynamic companies are out there, now's a great time to broaden your search and discover fast growing stocks with high insider ownership

The question now is whether StoneX shares are actually undervalued, or if current prices already reflect all the optimism and earnings momentum in the forecast. Does this moment mark a true buying opportunity, or has the market already priced in the company’s next phase of growth?

Price-to-Earnings of 15.2x: Is it justified?

StoneX Group is currently trading on a price-to-earnings ratio of 15.2x, which means the market appears to be placing a lower value on its expected profits relative to peers and industry averages.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each dollar of earnings. It is a widely used yardstick for assessing value in financial services, helping to gauge if the market is overpricing future growth or discounting potential risks.

For StoneX Group, this relatively modest P/E places it below the peer average of 20.7x and the US market average of 18.2x. This may indicate that investors see better value in the company’s ability to generate profits. Compared to the industry, StoneX's multiple stands out, as the broader US Capital Markets sector sits at an average of 23.6x. This figure is also slightly below the estimated fair P/E ratio of 15.5x, suggesting potential room for the valuation multiple to catch up as market sentiment evolves.

Explore the SWS fair ratio for StoneX Group

Result: Price-to-Earnings of 15.2x (UNDERVALUED)

However, a pullback in recent returns and potential headwinds in broader capital markets could challenge the bullish case for StoneX Group in the near term.

Find out about the key risks to this StoneX Group narrative.

Another View: What Does Our DCF Model Say?

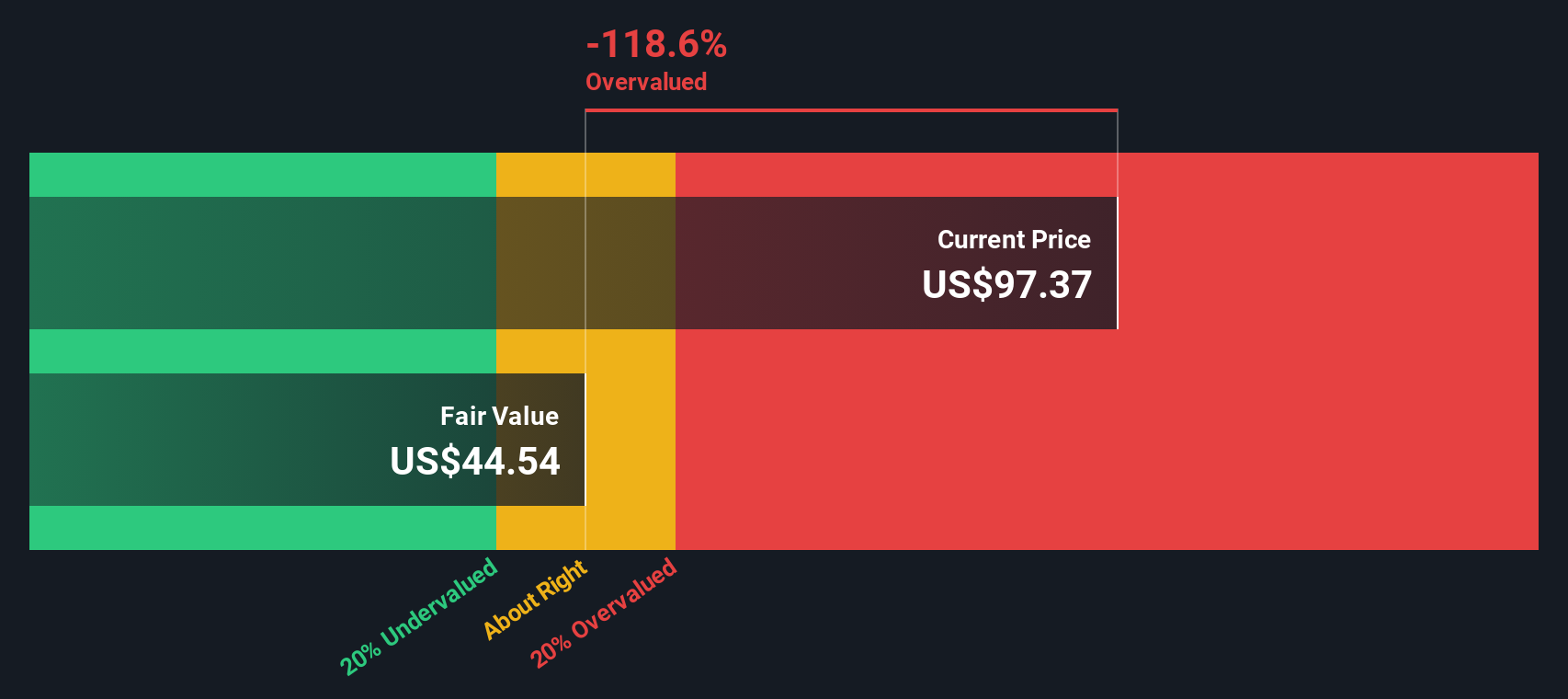

Valuation is not always straightforward. While the company’s earnings multiple suggests attractive value, our SWS DCF model offers a different perspective. According to this method, StoneX Group is trading well above its estimated fair value. This raises concerns that the current share price may be ahead of itself. Could the DCF be underestimating StoneX’s long-term prospects, or is the market simply too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out StoneX Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 927 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own StoneX Group Narrative

If you see the story differently or enjoy digging into the numbers for yourself, you can craft your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding StoneX Group.

Looking for more investment ideas?

Great investing rarely happens by accident. If you want to spot new opportunities and broaden your portfolio, check out these powerful stock ideas on Simply Wall St:

- Amplify your passive income by tapping into these 15 dividend stocks with yields > 3%, which offers robust yields above 3% and strong financials.

- Step ahead of market trends with these 26 AI penny stocks, which are powering tomorrow’s breakthroughs in artificial intelligence.

- Capitalize on market mispricing and potential growth with these 927 undervalued stocks based on cash flows, based on real cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SNEX

StoneX Group

Operates as a global financial services network that connects companies, organizations, traders, and investors to market ecosystem in the United States, Europe, South America, the Middle East, Asia, and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives