- United States

- /

- Diversified Financial

- /

- NasdaqCM:SEZL

A Look at Sezzle (SEZL) Valuation Following Q3 Earnings Beat and Upgraded Guidance

Reviewed by Simply Wall St

Sezzle (SEZL) is drawing attention after posting third-quarter results that beat market expectations. Revenue and net income both climbed sharply over last year. Investors are now digesting the company’s decision to raise full-year earnings guidance.

See our latest analysis for Sezzle.

After a stellar earnings beat and upgraded profit outlook, Sezzle’s share price quickly jumped 7.76% in the latest trading session. However, momentum has been mixed recently, with the stock still down 23.26% over the last month. Even so, Sezzle’s year-to-date share price return sits at an impressive 45.72%. When factoring in total shareholder return, investors have gained 64.24% over the past year. Recent executive changes and new guidance are fueling debate, and these moves are being weighed against a longer-term rally that is attracting fresh attention to the stock’s growth narrative.

If Sezzle’s turnaround and sharp price swings have you curious, now is the perfect chance to broaden your search and discover fast growing stocks with high insider ownership

With Sezzle defying expectations and raising guidance, investors are asking whether the current share price fully reflects future growth or if there is still value left on the table for new buyers.

Most Popular Narrative: 44.4% Undervalued

Compared to Sezzle’s last close of $66.25, the most popular narrative forecasts a fair value of $119.25. This marks a significant gap that continues to fuel bullish sentiment and debate among followers.

Disciplined risk management, cost optimization, and robust merchant acceptance support stable long-term earnings and a competitive edge in the digital payments space. Heavy marketing spend, low-margin product reliance, rising credit losses, geographic concentration, and unresolved litigation collectively threaten Sezzle's future profitability and revenue stability.

Want to know which bold assumptions are powering these high expectations? The narrative turns on sustained rapid growth, ambitious margin targets, and one surprising forward-looking multiple. Unpack the full story behind these projections to see what is really driving Sezzle’s valuation jump.

Result: Fair Value of $119.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high marketing costs or ongoing litigation could quickly challenge Sezzle’s growth narrative, which may pressure both margins and future earnings.

Find out about the key risks to this Sezzle narrative.

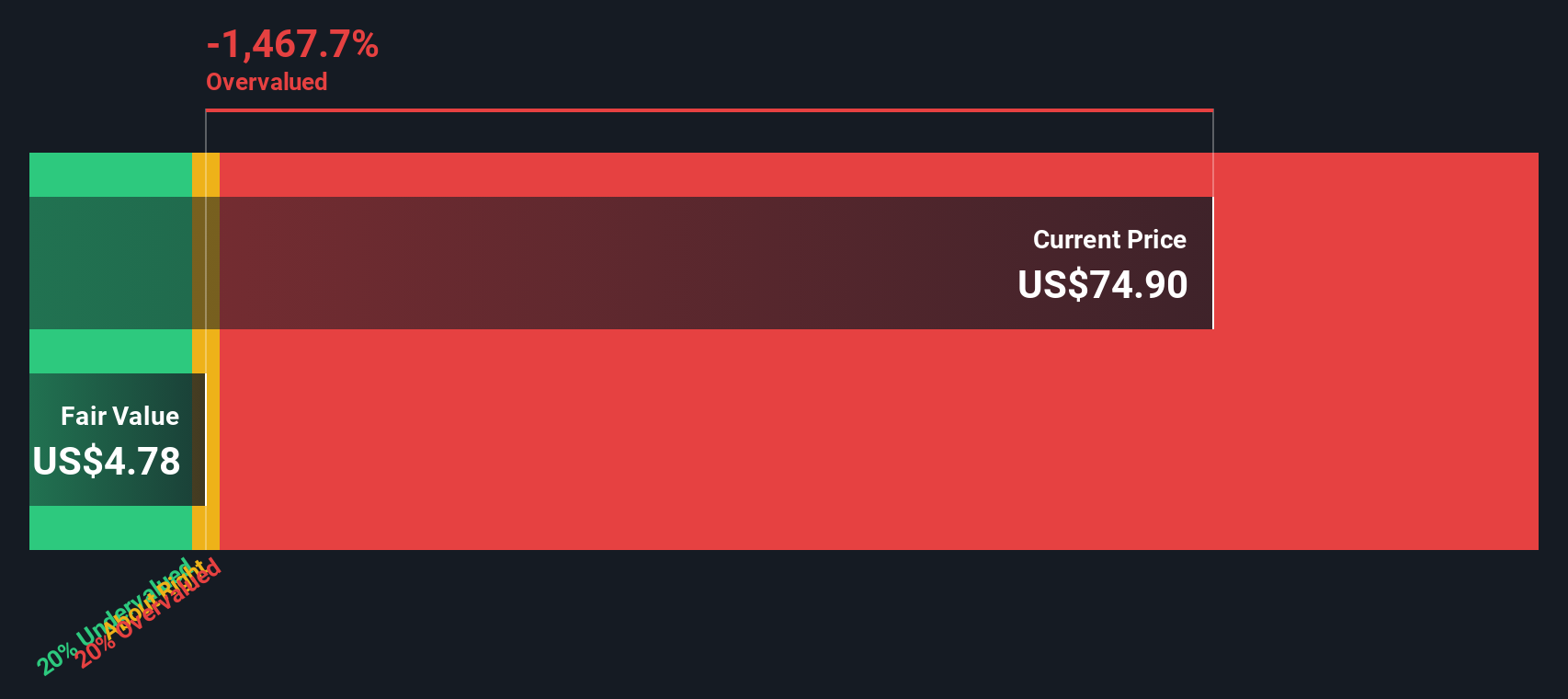

Another View: Not All Models Agree

While the popular narrative sees Sezzle as substantially undervalued, our DCF model tells a different story. Based purely on SWS DCF analysis, Sezzle may not have as much upside as many investors hope. This raises questions about whether the bullish outlook is justified.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sezzle for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 849 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sezzle Narrative

If you think the current outlook misses something, or want to dive deeper into Sezzle’s numbers yourself, crafting your own perspective takes just a few minutes. Do it your way

A great starting point for your Sezzle research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t wait for the next market move to pass you by. Instead, seize your chance to find great stocks and build a portfolio that stands out.

- Explore fresh potential by researching these 849 undervalued stocks based on cash flows with solid cash flow metrics and room to grow.

- Identify the next wave of digital transformation by following these 26 AI penny stocks making headlines in artificial intelligence innovation.

- Enhance your income strategy as you browse these 20 dividend stocks with yields > 3% featuring attractive yields and strong financial health.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SEZL

Sezzle

Operates as a technology-enabled payments company primarily in the United States and Canada.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives