- United States

- /

- Capital Markets

- /

- NasdaqGS:SEIC

Is Syverson Strege’s Partnership a Pivotal Test for SEI Investments’ (SEIC) Platform Strategy?

Reviewed by Sasha Jovanovic

- Syverson Strege recently announced it has chosen SEI Investments to provide integrated custody, technology, and investment management services to further its growth objectives and enhance client experience.

- This agreement highlights SEI's growing role as a technology and services platform for independent advisory firms seeking operational efficiency and advanced client solutions.

- We'll now examine how the Syverson Strege partnership amplifies SEI's platform capabilities and could influence its investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

SEI Investments Investment Narrative Recap

To be a shareholder in SEI Investments, you need to believe in the company’s ability to scale its technology and services platform efficiently to serve financial advisory clients while managing costs. The Syverson Strege partnership highlights SEI's continued push into comprehensive technology and investment management, but does not materially shift the main short-term catalyst, accelerating client conversions, or address the biggest current risk, which remains margin pressure from high ongoing investment in technology and talent.

Among SEI’s recent announcements, the October onboarding of Clermont Trust USA to the Wealth Platform stands out. Like the Syverson Strege deal, it reinforces SEI’s operational progress in bringing large clients onto its platform, illustrating incremental wins that could slowly support more consistent revenue growth if successfully scaled across its client pipeline.

Yet, in contrast, investors should be aware that client onboarding delays and margin pressure may persist if ...

Read the full narrative on SEI Investments (it's free!)

SEI Investments' narrative projects $2.5 billion revenue and $733.0 million earnings by 2028. This requires 4.8% yearly revenue growth and a $43.7 million earnings increase from the current earnings of $689.3 million.

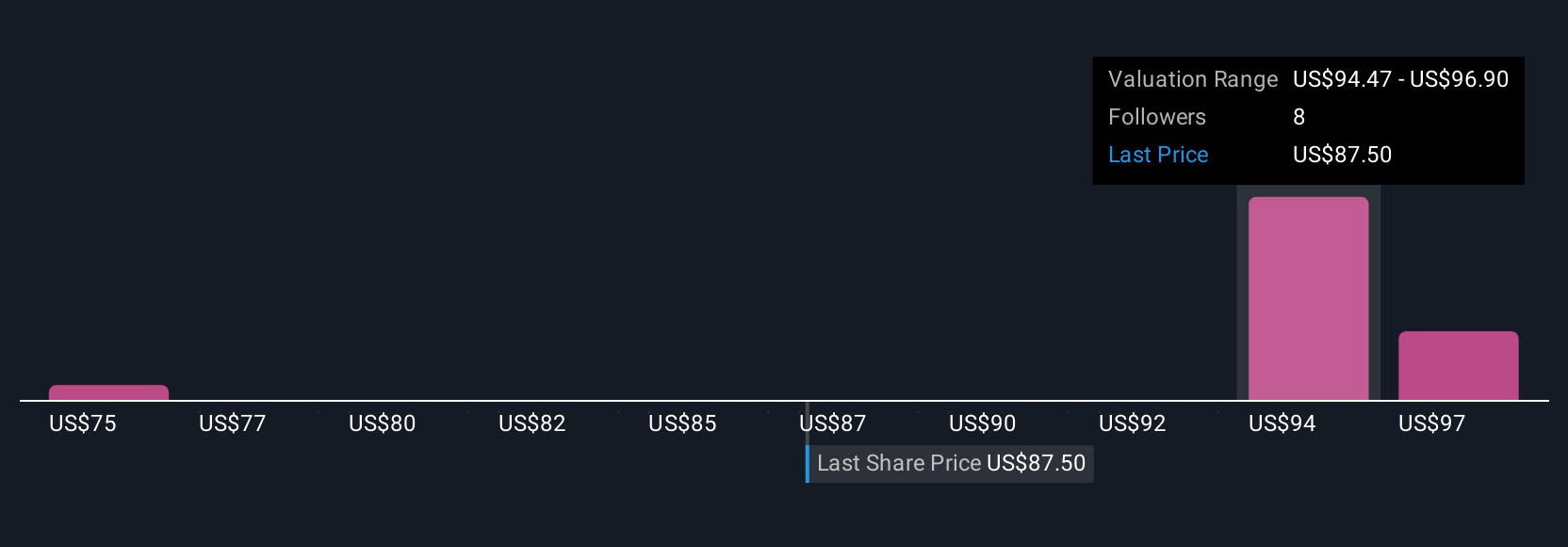

Uncover how SEI Investments' forecasts yield a $95.17 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Three member fair value estimates from the Simply Wall St Community range from US$68.68 to US$95.17 per share. While some expect stronger growth, the risk of margin compression remains a central topic and may influence performance going forward, see how other opinions compare.

Explore 3 other fair value estimates on SEI Investments - why the stock might be worth 15% less than the current price!

Build Your Own SEI Investments Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SEI Investments research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free SEI Investments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SEI Investments' overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SEIC

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026