- United States

- /

- Capital Markets

- /

- NasdaqGS:SEIC

Is SEI’s Expanding ETF Platform and Strong Q2 Performance Shifting the Investment Case for SEIC?

Reviewed by Simply Wall St

- SEI Investments recently reported strong second quarter results, highlighted by revenue of US$559.6 million and significantly higher net income compared to the prior year, while also announcing new partnerships and service expansions, including backing GQG Partners' first ETF launch using its operational platform.

- These developments reflect SEI's ability to attract prominent asset managers with innovative fund conversions and its growing presence in the expanding ETF and alternatives space.

- We'll explore how SEI's role in launching a major client’s new ETF with significant initial assets impacts its longer-term investment outlook.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

SEI Investments Investment Narrative Recap

To be a shareholder in SEI Investments, you need to believe in its continued ability to attract and retain major asset managers through technology innovation and service scale, especially as asset flows shift into ETFs and alternatives. The new GQG Partners ETF launch underscores short-term catalysts around client wins and platform conversions, though the biggest immediate risk remains persistent margin pressure as investments in talent and technology ramp ahead of revenue, which at this stage, is not materially alleviated by recent results.

The addition of 17 new fund managers to SEI Access™ is particularly relevant, as it reinforces SEI's expansion in private and alternative markets, areas targeted for growth amid the evolving needs of wealth managers and financial advisors. This development ties closely to the catalysts of increasing recurring revenues and enhanced cross-selling, but doesn't directly address concerns over margin compression from ongoing investment requirements.

Yet, the challenge of balancing revenue growth with sustained margin improvement remains information that investors should be aware of, especially if...

Read the full narrative on SEI Investments (it's free!)

SEI Investments is projected to reach $2.5 billion in revenue and $733.0 million in earnings by 2028. This outlook assumes a 4.8% annual revenue growth rate and a $43.7 million increase in earnings from current earnings of $689.3 million.

Uncover how SEI Investments' forecasts yield a $99.33 fair value, a 12% upside to its current price.

Exploring Other Perspectives

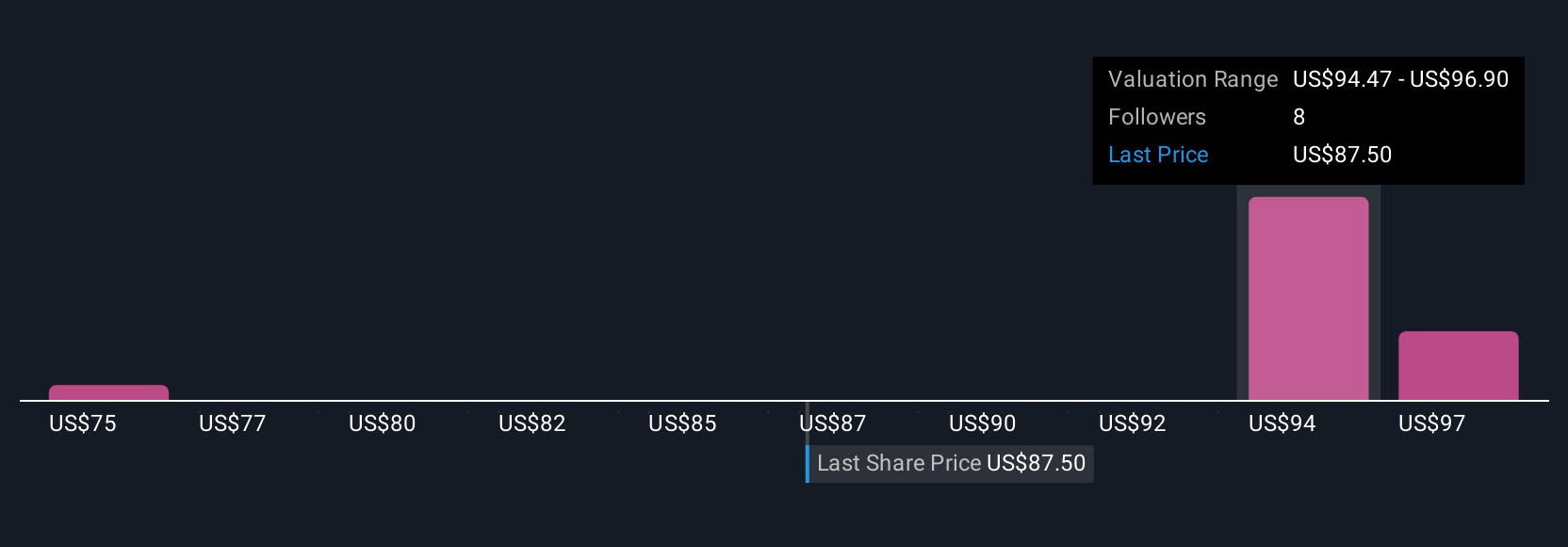

Fair value estimates from the Simply Wall St Community range from US$75 to US$102.79, based on three personal valuations. While these diverge, many agree that ongoing investment in technology and client onboarding is an important factor shaping SEI's future earnings potential.

Explore 3 other fair value estimates on SEI Investments - why the stock might be worth as much as 16% more than the current price!

Build Your Own SEI Investments Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SEI Investments research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free SEI Investments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SEI Investments' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SEIC

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives