- United States

- /

- Capital Markets

- /

- NasdaqGS:SEIC

Does Recent Strategic Expansion Make SEI Investments Attractive at $83 in 2025?

Reviewed by Bailey Pemberton

Trying to figure out whether SEI Investments is worth a spot in your portfolio? You are not alone. With the stock closing at $83.07 recently, plenty of investors are recalibrating their take. Over the past week, SEI shares inched up by 1.7% after a patchy month where the price dropped 3.1%, but the story doesn't stop there. Zoom out and the one-year gain stands at 10.8%, while three- and five-year returns hit an impressive 59.3% and 79.2% respectively. This kind of growth has caught the eye of more than just casual watchers, and it has given long-term holders plenty to smile about, even if recent stretches have been choppier.

Of course, behind every number there is a narrative. Recent moves reflect optimism around strategic changes at SEI, as the company has expanded its technology offerings and forged new partnerships in the wealth management space. There has also been buzz about the company's push to innovate, building on its reputation for both operational scale and forward-thinking solutions. Even so, skepticism remains for some, especially as broader markets wrestle with changing risk appetites.

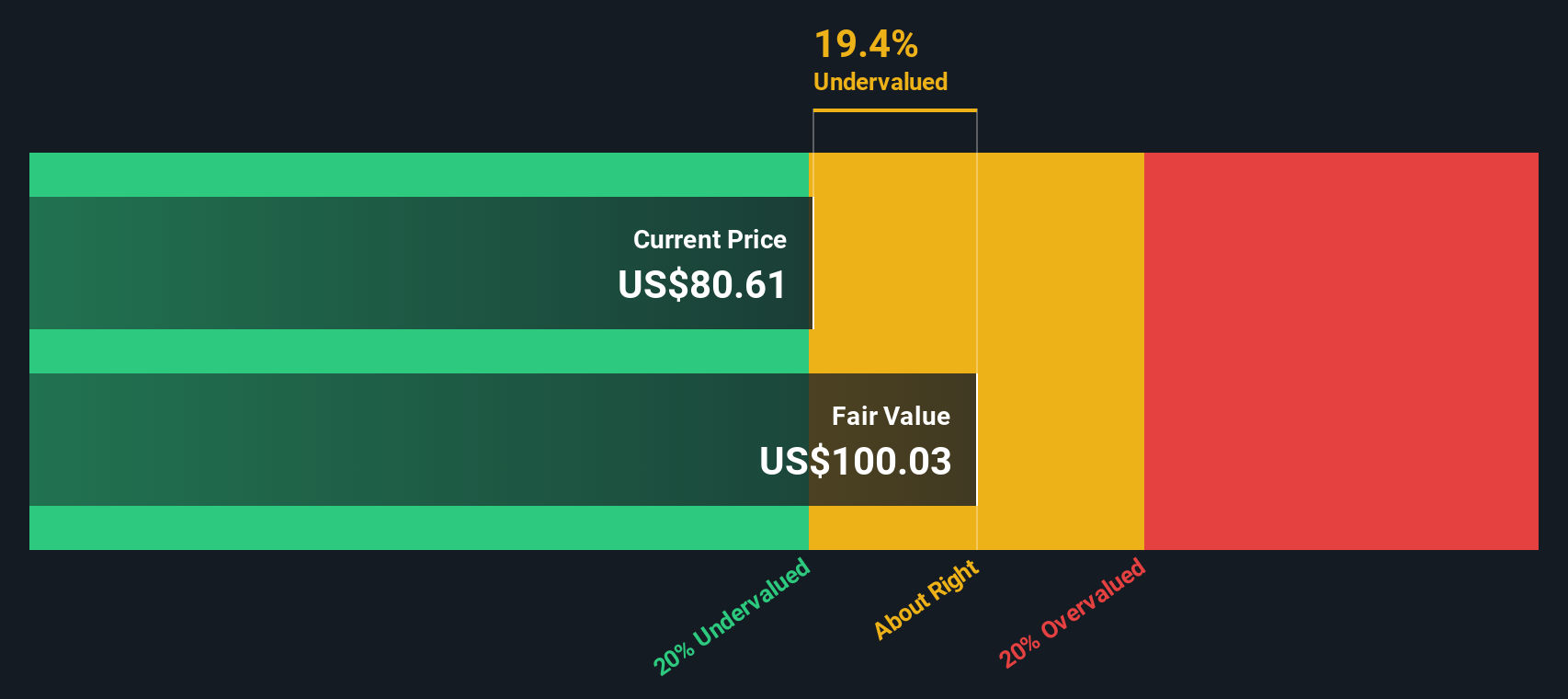

So, is SEI Investments really undervalued in today's market? A quick glance at its valuation score, 3 out of 6 based on the main industry checks, puts it right in the middle of the pack. But numbers do not tell the whole story. Next up, we will walk through the standard valuation methods to see how SEI stacks up, before diving into an alternative lens that could offer deeper insight.

Why SEI Investments is lagging behind its peers

Approach 1: SEI Investments Excess Returns Analysis

The Excess Returns valuation model focuses on how effectively SEI Investments utilizes its shareholders' capital, measuring the returns the company generates above its cost of equity. Simply put, it shows how much value the company creates for every dollar invested, after accounting for the compensation investors require for risk.

For SEI Investments, the outlook appears solid. Book value is $19.58 per share, with a steady book value over the past five years at $17.20 per share. Analysts estimate a stable EPS of $5.50 per share, indicating robust profitability. The company's cost of equity, which is the baseline return shareholders expect, is $1.38 per share, while SEI delivers an excess return of $4.12 per share on average. The firm's return on equity has averaged a strong 32.00%, significantly exceeding its cost of equity and indicating efficient capital use and a competitive edge.

Based on these figures, the Excess Returns model estimates SEI Investments' intrinsic value at $100.18 per share. With the current market price at $83.07, this suggests the stock is trading at a 17.1% discount to its underlying value. In summary, SEI appears undervalued on this basis and may offer potential for upside if the company continues to perform at this level.

Result: UNDERVALUED

Our Excess Returns analysis suggests SEI Investments is undervalued by 17.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: SEI Investments Price vs Earnings

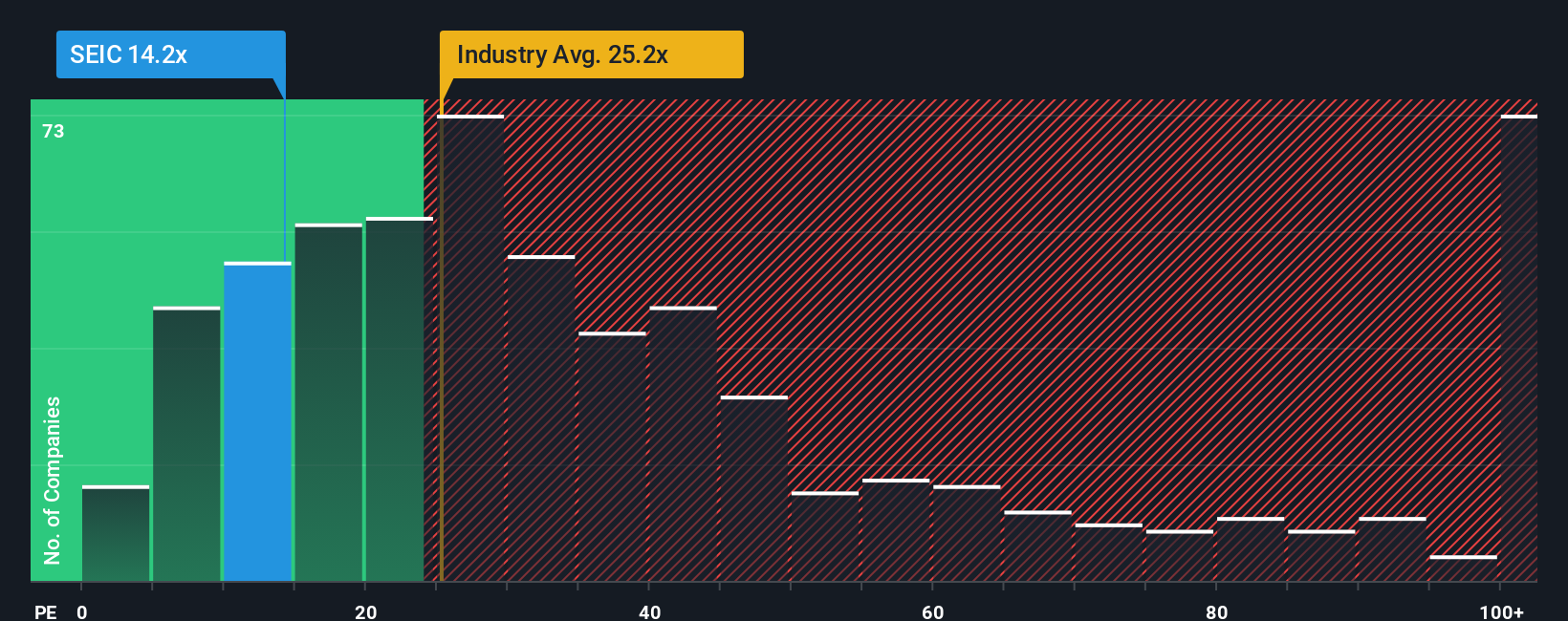

The price-to-earnings (PE) ratio is a widely used metric for valuing profitable companies like SEI Investments, as it directly connects a company’s current share price to its earnings performance. For investors, it provides a quick way to gauge whether the market is expecting high growth, stability, or carries extra risk, all of which typically factor into what’s considered a “normal” or “fair” PE ratio.

SEI Investments currently trades at a PE ratio of 14.7x, which stands in sharp contrast to the capital markets industry average of 27.0x and the peer group average of 28.0x. At first glance, this lower multiple might suggest an attractive entry point, but it is crucial to consider more than just headline numbers. Growth rates, margins, and company-specific risks all play a part in deserving a higher or lower PE than the crowd.

That is where Simply Wall St’s Fair Ratio comes in. This custom metric (14.7x for SEI) goes beyond basic comparisons by factoring in the company’s projected earnings growth, profit margins, risk profile, and relative size, providing a much more personalized benchmark for fair value. Because the Fair Ratio reflects SEI’s unique qualities and competitive environment, it is a more reliable guide than simply matching the company up against peers or the broader industry.

With SEI Investments’ current PE ratio almost identical to its Fair Ratio, the stock appears to be trading at a price in line with its true fundamentals rather than at a notable discount or premium.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your SEI Investments Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a smarter, more dynamic method for making investment decisions. A Narrative is simply your story about a company. It is where you bring together your perspective on SEI Investments, backing it up with your assumptions about future revenue, earnings, and margins, then linking these beliefs to a forecast and a resulting fair value. By combining the “why” (the business context) with “how much” (the numbers), Narratives make investing more approachable and allow you to see how your view translates directly into action.

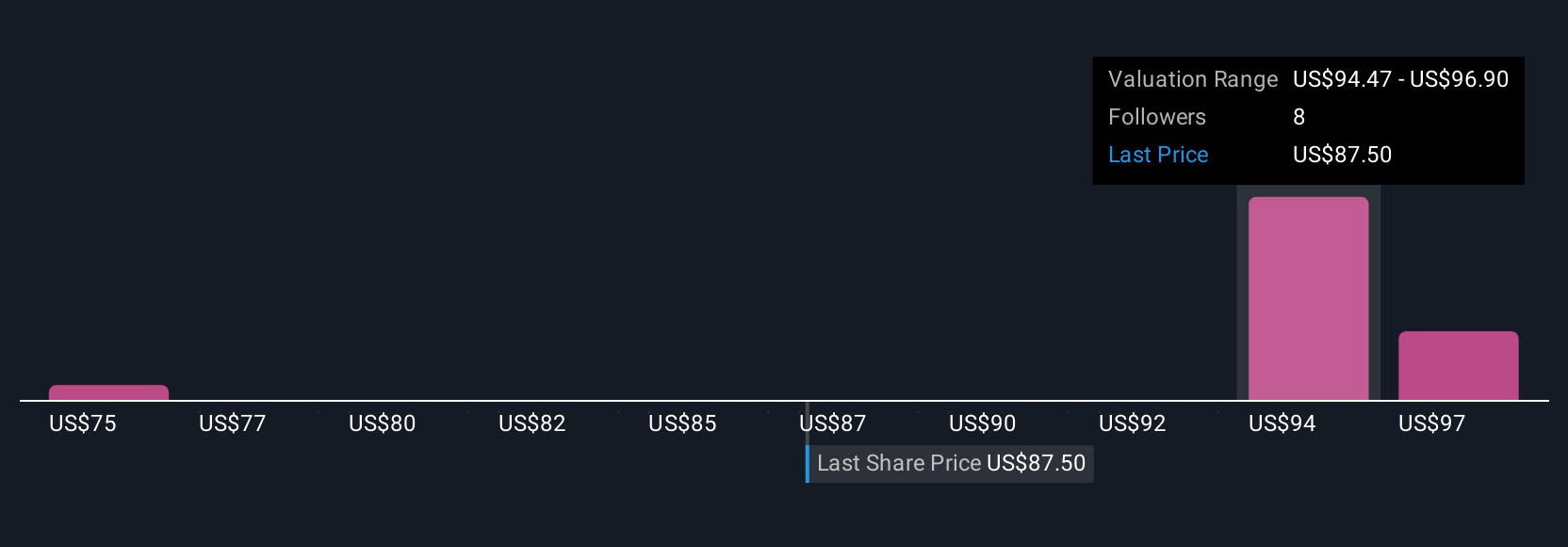

On Simply Wall St's Community page, millions of users can quickly create, compare, and update Narratives at any time. These Narratives help you decide when to buy or sell by showing you how your own fair value stacks up against the market price and adjusting instantly as new information or earnings reports emerge. For example, some investors believe SEI should be worth as much as $118 per share because of structural industry growth and successful partnerships, while others take a more cautious position at $81, citing risks around margin pressure and rising competition. Narratives ensure your investment decisions are truly grounded in your own reasoning.

Do you think there's more to the story for SEI Investments? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SEIC

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives