- United States

- /

- Capital Markets

- /

- NasdaqGM:SAMG

Silvercrest (SAMG) Margin Decline Raises Questions on Profit Growth Narrative Despite Attractive Valuation

Reviewed by Simply Wall St

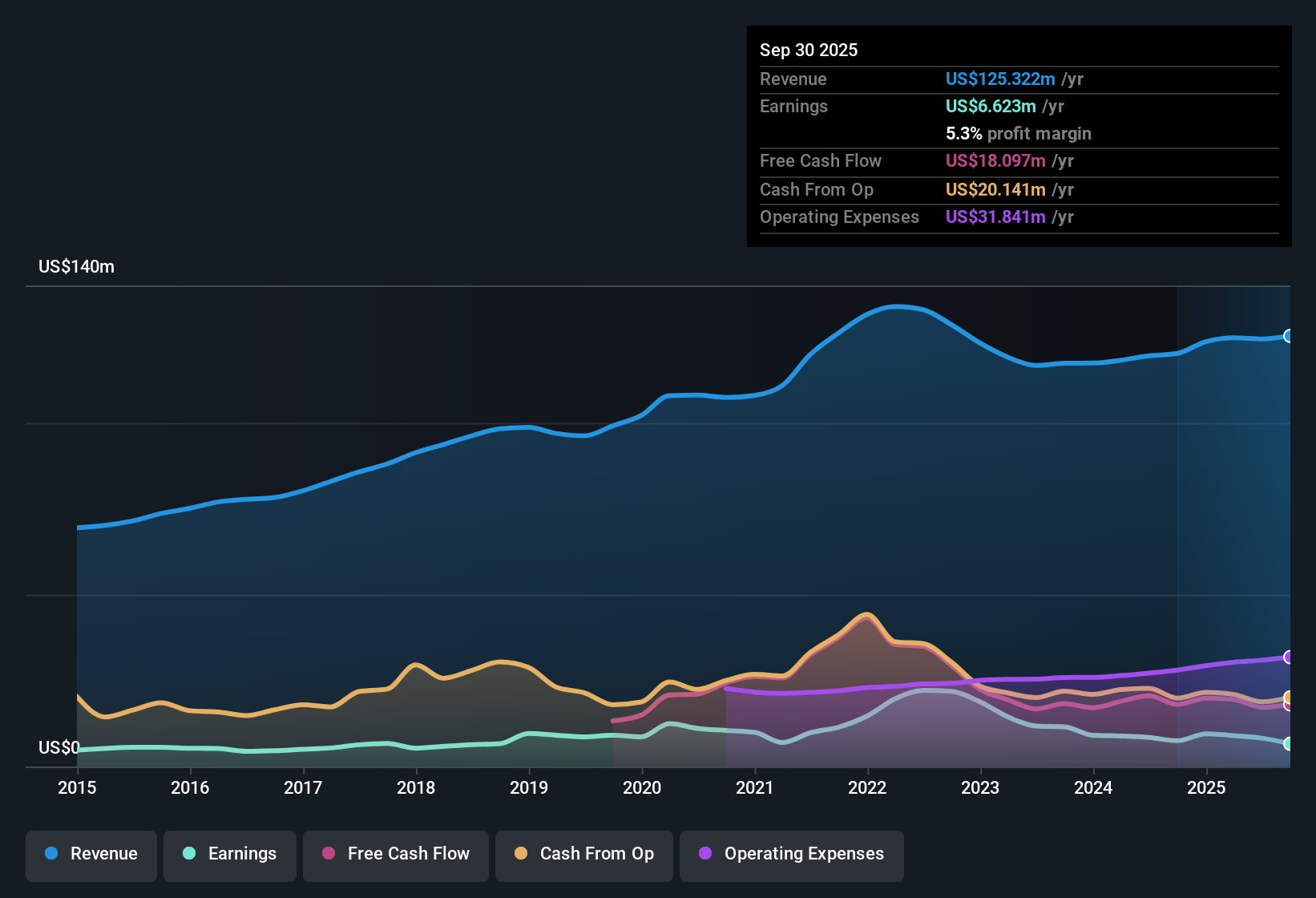

Silvercrest Asset Management Group (SAMG) delivered a mixed set of numbers this period, with earnings forecast to grow at an impressive 31.1% per year, well ahead of the US market’s projected 15.9%. However, revenue growth is expected to trail broader market trends at 6.6% per year, and net profit margins have slipped slightly to 6.6% from 7.1% last year. While the stock trades at $14.14, below its assessed fair value of $16.10 and boasts a low price-to-earnings ratio of 14.1x, investors will note that earnings have declined at a 7.3% annual rate over the last five years and have shown negative growth in the past year. The result is a picture of strong forward profit potential and value, tempered by caution over recent operational and payout trends.

See our full analysis for Silvercrest Asset Management Group.We’ll now see how these results line up with the most widely followed narratives about Silvercrest, whether they confirm market confidence or raise new questions for investors.

See what the community is saying about Silvercrest Asset Management Group

Fee Compression Limits Revenue Upside

- The most recent quarter saw a decline in year-over-year revenue, primarily driven by a decrease in average annual management fee rate as the asset mix shifted toward lower-fee institutional mandates.

- Analysts' consensus view expects that, while wealthy client and generational wealth trends should boost organic asset inflows, persistent fee compression will threaten margin expansion and slow top-line growth.

- Outflows and a shift toward institutional mandates with lower fees are already weighing on the average fee rate, challenging the view that client growth alone will deliver sustainable revenue gains.

- Consensus notes that diversified offerings and premium advisory services could help offset these headwinds. However, overall margin pressure remains a watchpoint for the next few years.

- Consistent with this balanced risk and reward picture, analysts anticipate profit margins could eventually recover from 6.6% today to 16.6% in three years, but only if these strategic investments pay off as planned.

- With operating leverage yet to materialize, near-term profitability is vulnerable to any setbacks in client growth or continued fee erosion.

- Expectations for a rebound hinge on the successful execution of expansion and a return to stronger net inflows amid industrywide margin compression.

- A 7.3% annual decline in earnings over the past five years, alongside recently negative earnings growth, underscores why consensus is closely watching for signs of a turning point.

- This trend calls into question the pace at which new market initiatives and premium service expansion will start translating into bottom-line growth.

- Consensus sees the recovery path as dependent on both stemming the decline and demonstrating that earnings can actually outpace the industry going forward.

Dividends and Share Buybacks Under Scrutiny

- Analysts expect the number of shares outstanding to decline by 7.0% annually over the next three years due to active share repurchase programs, aiming to boost earnings per share even as traditional growth levers face challenges.

- Consensus narrative emphasizes that while aggressive share buybacks and a rising dividend deliver immediate value to shareholders, there is an ongoing risk to dividend sustainability, especially with earnings under pressure and net profit margins having slipped from 7.1% to 6.6%.

- Shareholder returns are attractive today, but persistent earnings declines and rising costs could force a re-evaluation of payout ratios if margins do not recover as forecast.

- With compensation and G&A expenses rising faster than revenue, dividends and buybacks rely on management’s ability to deliver on operating leverage and margin improvement targets despite industry headwinds.

Valuation Still Offers a Margin of Safety

- Silvercrest trades at $14.14, below both the analyst consensus price target of $23.00 and the DCF fair value of $16.10, with a price-to-earnings ratio of 14.1x that is substantially lower than the US capital markets industry average of 25.6x and the peer average of 63.3x.

- According to the consensus narrative, this discount provides some cushion for investors who believe in the turnaround. It goes hand-in-hand with skepticism over the company’s ability to reverse its multi-year earnings slide.

- If management delivers on revenue, margin, and buyback targets, the current price leaves meaningful room for upside relative to both intrinsic and peer-based valuation measures.

- Conversely, investors face the risk that earnings struggles and industry-wide pressure may keep the stock from closing the gap with valuations typical of higher-growth, higher-margin peers.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Silvercrest Asset Management Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot an angle the data might not show? Transform your viewpoint into a unique narrative in just a few minutes, and Do it your way.

A great starting point for your Silvercrest Asset Management Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Silvercrest faces margin compression, declining earnings, and dividend risks as revenues struggle for momentum and expenses continue to rise faster than profits.

If stable results matter to you, focus on stable growth stocks screener (2102 results) to discover companies with track records of consistent earnings and revenue expansion, even when conditions get tough.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SAMG

Silvercrest Asset Management Group

A wealth management firm, provides financial advisory and related family office services in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives