- United States

- /

- Diversified Financial

- /

- NasdaqGS:PYPL

Should You Take Another Look at PayPal After a 24% Drop This Year?

Reviewed by Bailey Pemberton

- Wondering if PayPal’s stock is actually a bargain, or if it’s still playing catch-up? You’re not alone. The real answer might be hiding in plain sight.

- The share price has slipped recently, dropping 1.4% over the past week and 5.5% in the last month. It’s down nearly 24% since the start of the year.

- Much of this volatility has played out as the market digests shifting sentiment around digital payments. Headlines have highlighted intense competition from fintech newcomers and scrutiny over PayPal's strategy to retain users. Antitrust investigations and evolving industry regulations have only added more layers for investors to consider.

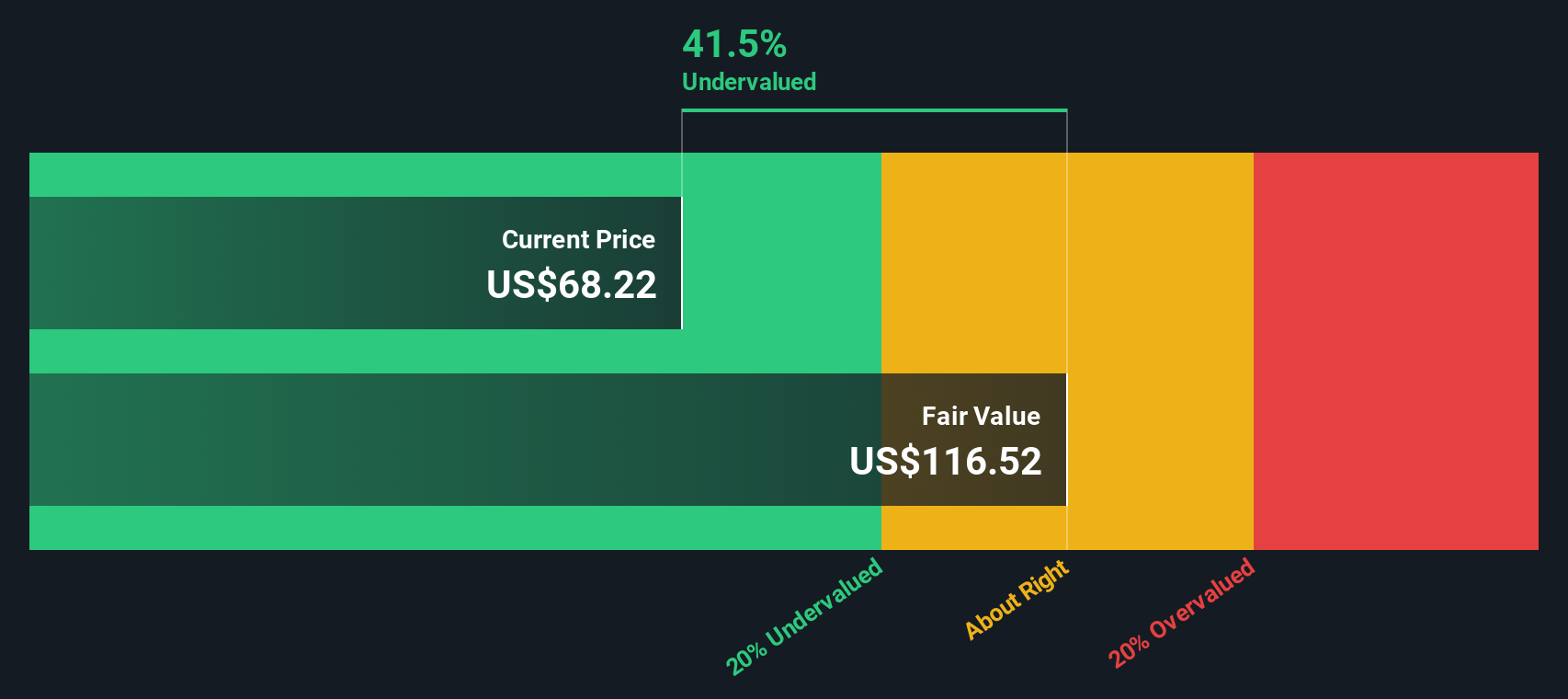

- On the surface, PayPal scores a 6 out of 6 on our undervaluation checks. However, there is more than one way to value a business. We’ll dive into the different approaches just ahead, with a potentially even smarter way to assess value at the end of this article.

Find out why PayPal Holdings's -23.8% return over the last year is lagging behind its peers.

Approach 1: PayPal Holdings Excess Returns Analysis

The Excess Returns model evaluates whether a company is generating returns on invested capital above its cost of equity. This helps investors judge value beyond simple earnings or asset comparisons. For PayPal Holdings, this approach emphasizes both profitability and prudent use of shareholder equity.

Key numbers from this analysis show the company’s book value at $21.46 per share and a stable expected EPS of $6.14 per share, based on weighted estimates from 11 analysts. With an average return on equity of 24.18%, PayPal far surpasses its cost of equity, which stands at $1.96 per share. This leads to an annual excess return of $4.18 per share. The stable book value is projected to grow to $25.40 per share, based on input from eight analysts.

The intrinsic value calculated using this method indicates PayPal’s shares are trading at a 45.1% discount to this model’s fair value. At the current price, the Excess Returns approach highlights the stock as significantly undervalued, as the company is earning considerably more than it needs to justify its equity base.

Result: UNDERVALUED

Our Excess Returns analysis suggests PayPal Holdings is undervalued by 45.1%. Track this in your watchlist or portfolio, or discover 870 more undervalued stocks based on cash flows.

Approach 2: PayPal Holdings Price vs Earnings

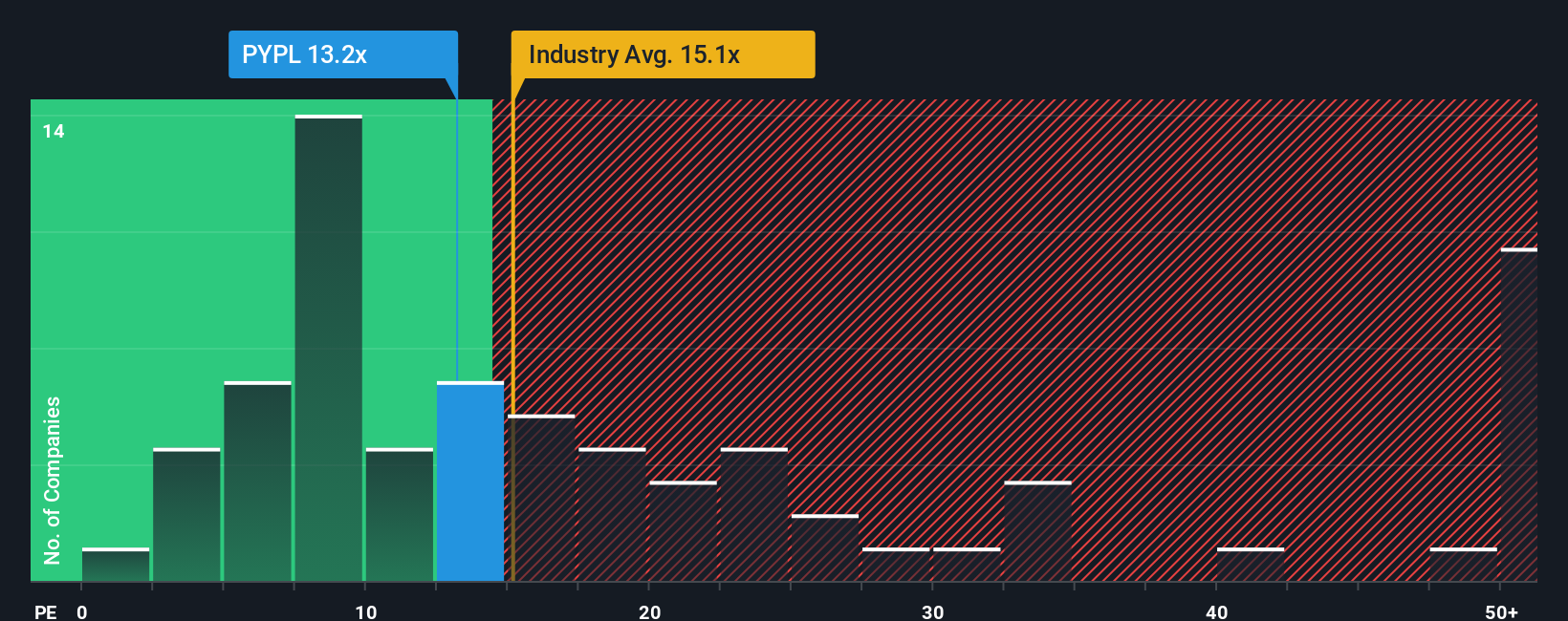

The price-to-earnings (PE) ratio is widely used to value profitable companies like PayPal Holdings, as it compares a company’s current share price to its earnings per share. For established players consistently generating profits, PE offers a straightforward snapshot of market expectations and investor sentiment.

It is important to remember that what counts as a “fair” PE ratio depends on several factors. Companies with higher earnings growth or lower perceived risk typically command a higher multiple, while those facing headwinds or uncertainty trade at lower levels. Risk tolerance, quality of earnings, and industry dynamics all play a part in shaping the market’s view.

PayPal Holdings currently trades at a PE ratio of 12.43x. This is slightly below the Diversified Financial industry average of 13.16x, and far below the average of major peers, which sits at 58.60x. To provide a more tailored benchmark, Simply Wall St’s proprietary “Fair Ratio” for PayPal is 17.49x. The Fair Ratio incorporates unique aspects of PayPal’s growth outlook, profit margins, size, and risk profile, providing a more nuanced standard than relying solely on industry or peer comparisons.

By comparing PayPal’s actual PE multiple to its Fair Ratio, the stock appears undervalued, as it is trading well below the level suggested by its fundamentals and risk-adjusted prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1398 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your PayPal Holdings Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives—an intuitive approach where you connect PayPal Holdings’s story with your own financial assumptions about its future.

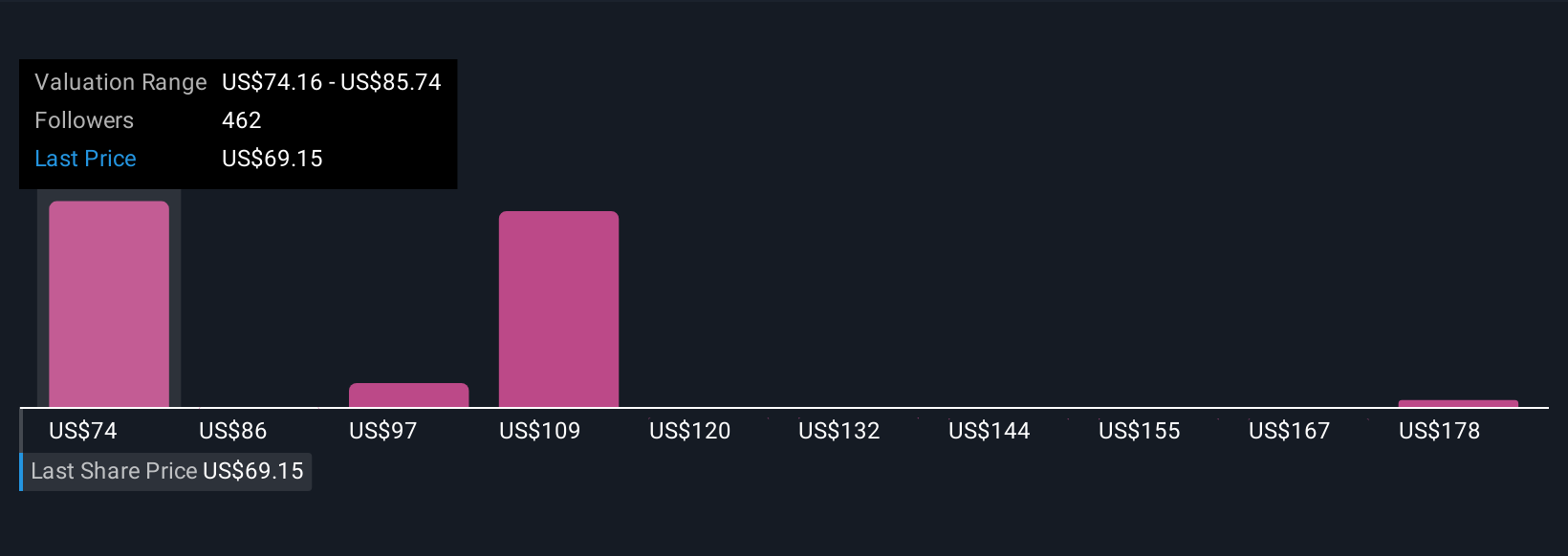

Rather than just relying on ratios and static models, a Narrative lets you define the company’s prospects in a way that is personal and forward-looking. You specify your view of future revenue, profit margins, and growth, and our platform links these assumptions directly to a fair value estimate.

Narratives on Simply Wall St make it easy and accessible for anyone to articulate their view. Millions of investors use them in our Community page, not only to see the numbers but also to explain the story and logic behind them.

This helps you decide when to buy or sell by comparing your Fair Value to the current Price. Narratives are continually updated as new data like earnings or breaking news comes in.

For PayPal Holdings, some investors see robust platform growth and project a fair value as high as $111.57, while others, factoring in market headwinds, arrive at far lower estimates around $82. Narratives empower you to compare these perspectives and decide where you sit on the spectrum, ensuring your investment decisions always match your convictions and knowledge.

Do you think there's more to the story for PayPal Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PYPL

PayPal Holdings

Operates a technology platform that enables digital payments for merchants and consumers worldwide.

Very undervalued with outstanding track record.

Similar Companies

Market Insights

Community Narratives