- United States

- /

- Diversified Financial

- /

- NasdaqGS:PYPL

PayPal Holdings (NasdaqGS:PYPL) Partners With Selfbook To Enhance Hotel Booking Experience

Reviewed by Simply Wall St

In the latest partnerships, Selfbook and PayPal Holdings (NasdaqGS:PYPL) announced a collaboration to streamline hotel payment processes, a move that could have bolstered PayPal's position in digital payments. Over the last quarter, PayPal's share price increased 8%, possibly influenced by several initiatives including their partnership with TerraPay for cross-border transactions and launching a physical PayPal Credit card. While the broader market also rose, PayPal's recent performance reflects its efforts to expand services and enhance its user experience. The company's recent financial results also showed healthy growth, adding weight to its share price performance.

The collaboration between PayPal and Selfbook has the potential to enhance PayPal's revenue streams by providing streamlined payment options for hotels. This aligns with PayPal's narrative of evolving into a commerce platform focused on personalized experiences, with the introduction of smart wallets and expanding Venmo and PayPal debit card services. Such partnerships could contribute positively to transaction volumes and support earnings growth, although macroeconomic uncertainties and regulatory challenges remain.

Over the past year, PayPal's shares saw a total return of 9.63%, despite underperforming the US market's 12.4% rise. Compared to the US Diversified Financial industry, which posted a substantial gain of 22.4%, PayPal's performance seemed modest. Analysts' forecasts suggest that the ongoing strategic partnerships and service expansions could bolster revenue and earnings in the longer term. However, external factors and competition may impact this trajectory.

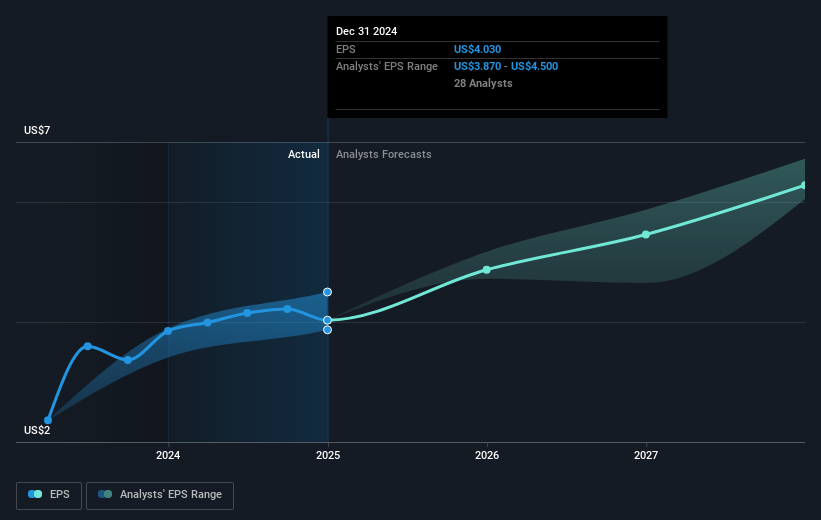

With a current share price of US$68.05 and an analyst consensus price target of US$82.32, this suggests a potential upside. Analysts estimate revenue growth to reach US$37.7 billion by 2028, alongside an expected earnings of US$5.5 billion, provided PayPal sustains its focus on higher transaction margins through optimized services. These expectations put PayPal's current pricing relatively close to its target, indicating a balanced outlook amidst ambitious growth plans.

Assess PayPal Holdings' future earnings estimates with our detailed growth reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PYPL

PayPal Holdings

Operates a technology platform that enables digital payments for merchants and consumers worldwide.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion