- United States

- /

- Capital Markets

- /

- NasdaqGS:PSEC

How Investors May Respond To Prospect Capital (PSEC) Insider Buying Following New Healthcare Investment

Reviewed by Sasha Jovanovic

- In late September 2025, Prospect Capital’s CEO John F. Barry and COO Grier Eliasek made substantial purchases of company stock, with Barry acquiring 925,000 shares and Eliasek 370,000 shares, soon after the company completed an $18 million investment in a physician-led addiction treatment facility called The Ridge.

- This wave of insider buying came as the company discussed mixed quarterly earnings and emphasized strong net investment income and portfolio repositioning efforts.

- We'll look at how executive insider stock purchases reinforce Prospect Capital’s investment narrative amid recent performance and portfolio updates.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Prospect Capital's Investment Narrative?

For shareholders in Prospect Capital, the core thesis revolves around patient confidence in a turnaround story fueled by strong insider conviction and ongoing portfolio repositioning, even as recent results show persistent challenges. The latest insider purchases by Prospect’s CEO and COO are striking, as they put fresh, significant personal capital to work just as the stock was sitting near its 52-week low after a prolonged slide. While these visible votes of confidence may stabilize sentiment in the short term, the business still faces substantial headwinds: revenue and earnings have declined, dividend sustainability is under question, and high leverage remains a structural concern. The $18 million investment in The Ridge represents a bid to diversify and revamp the portfolio, but the broader financial picture, ongoing net losses and weaker operating metrics, remains for now. Although the insider buying might temper immediate downside risk and refocus attention on management’s strategy, it does not erase the fundamental issues set out in prior analysis, particularly around profitability and dividend coverage. On the flip side, dividend coverage remains a central issue investors should watch closely.

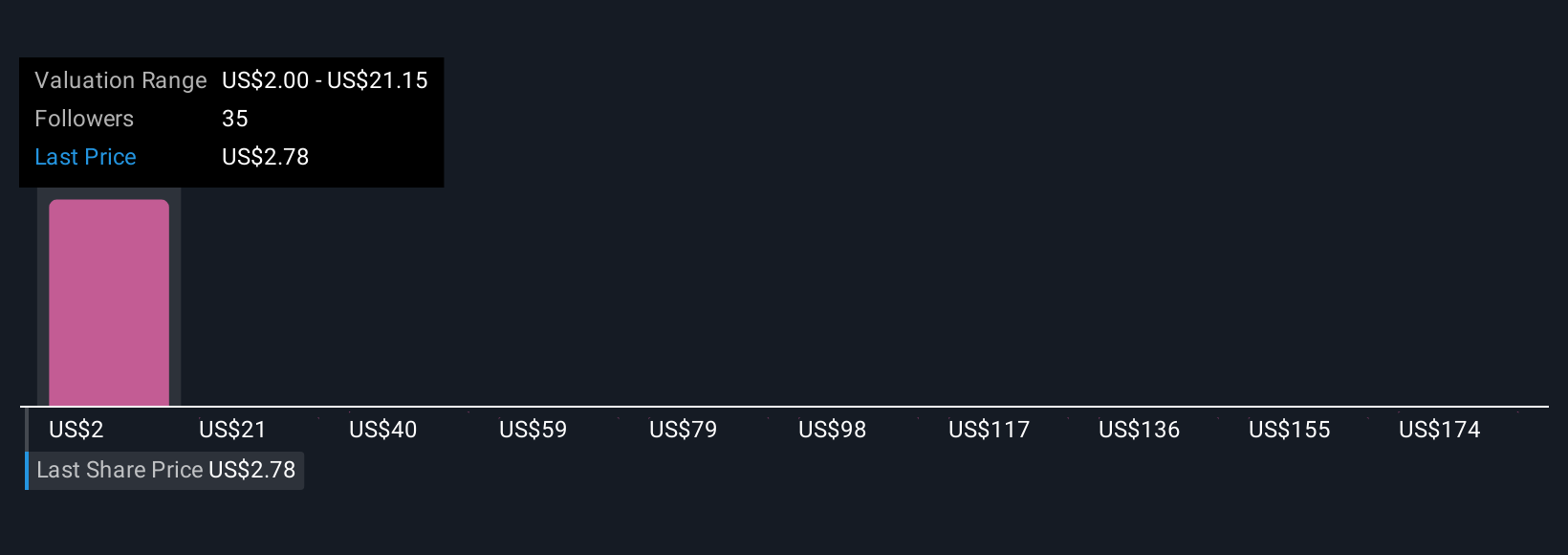

In light of our recent valuation report, it seems possible that Prospect Capital is trading beyond its estimated value.Exploring Other Perspectives

Explore 10 other fair value estimates on Prospect Capital - why the stock might be worth 28% less than the current price!

Build Your Own Prospect Capital Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Prospect Capital research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Prospect Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Prospect Capital's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 33 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PSEC

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion