- United States

- /

- Capital Markets

- /

- NasdaqGS:NTRS

Will Strong Q3 Results and Capital Actions Shift the Northern Trust (NTRS) Investment Narrative?

Reviewed by Sasha Jovanovic

- Northern Trust recently reported third-quarter earnings for 2025, with net income of US$457.6 million and basic earnings per share of US$2.30, both slightly higher than the prior year, while also affirming its regular dividend and completing a share buyback valued at over US$200 million.

- Despite exceeding analyst expectations for assets under management and earnings per share, the company saw only a muted investor response, indicating that the market was seeking stronger momentum given favorable market conditions.

- We'll examine how Northern Trust's combination of cost management and growth in trust fees informs its present and future investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Northern Trust Investment Narrative Recap

To be a shareholder in Northern Trust, an investor needs to have confidence in the firm’s ability to deliver sustainable fee income growth and margin expansion through its core strengths in asset servicing, wealth management, and technology-led cost efficiencies. The latest third-quarter earnings report mostly reinforced the broader investment narrative, as net income and earnings per share edged slightly above expectations, but did not prove to be a significant catalyst for the stock. The muted reaction suggests that while operational execution remains solid, the main risks, ranging from fee income pressure to competitive and regulatory threats, remain unchanged by this news.

Among recent announcements, the completion of the US$201.6 million share buyback is one of the most relevant to current shareholders. While this action can support earnings per share and signal balance sheet strength, its completion aligns with Northern Trust’s pattern of regular capital returns, rather than representing a material new catalyst for the business. Investors continue to watch for evidence that ongoing shareholder payouts can be sustained alongside the cost of necessary technology investments.

In contrast, the largest risk investors should keep an eye on is the potential for margin pressure if industry-wide technology investments start to consistently outweigh...

Read the full narrative on Northern Trust (it's free!)

Northern Trust's outlook suggests revenue of $8.2 billion and earnings of $1.4 billion by 2028. This implies a yearly revenue decline of 1.6% and a $0.7 billion decrease in earnings from the current $2.1 billion.

Uncover how Northern Trust's forecasts yield a $134.86 fair value, a 6% upside to its current price.

Exploring Other Perspectives

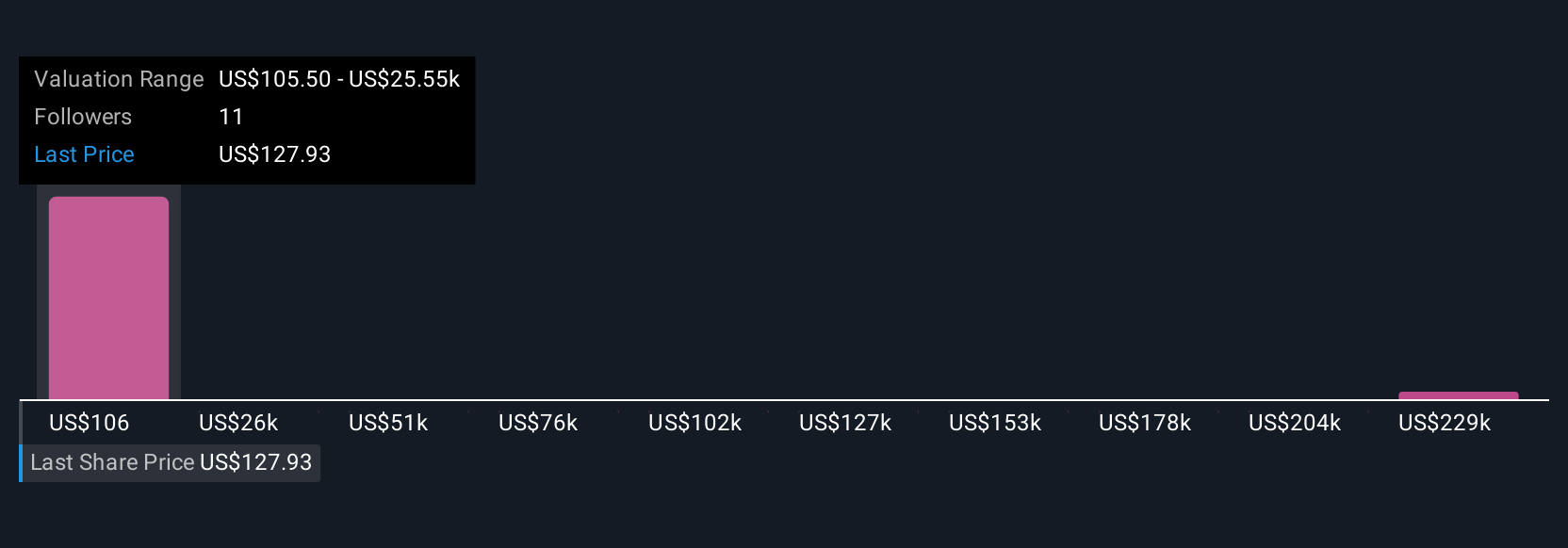

The Simply Wall St Community captured four unique fair value estimates for Northern Trust, spanning from US$114 to above US$254,500. While analysts point to cost management supporting margins, these diverse views show just how widely opinions can differ when forecasting the business’s long-term earnings potential.

Explore 4 other fair value estimates on Northern Trust - why the stock might be worth 10% less than the current price!

Build Your Own Northern Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Northern Trust research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Northern Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Northern Trust's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northern Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTRS

Northern Trust

A financial holding company, provides wealth management, asset servicing, asset management, and banking solutions for corporations, institutions, families, and individuals worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives